My morning train WFH reads:

• Interest-Rate Pain From Higher Inflation Has Barely Begun: Stocks, houses, corporate borrowers and the federal Treasury may not be ready for a world of much higher real interest rates (Wall Street Journal)

• A Warren Buffett Protégée Strikes Out on Her Own: Tracy Britt Cool spent a decade working closely with the renowned investor. She is now applying those lessons to her own firm. (New York Times) see also In Times of Stress, Female Fund Managers Take Less Risk Than Men — For the Same Performance Fund investors don’t receive compensation for the higher risk that male managers take on, according to new research. (Institutional Investor)

• Good Losses, Bad Losses: All Losses Are Not Created Equal: Investors must look past simple measures of profits to understand a business’s true ability to create value. The rise of intangibles means more investments than ever are expensed immediately versus capitalized, which makes the financial statements of today appear distorted relative to those of the past. Academics distinguish between GAAP losers, companies that have losses but a high return on investment, and real losers, or those that have expenses unrelated to investment that exceed sales. Evidence from recent decades shows that GAAP losers produced attractive total shareholder returns relative to the real losers and profitable companies. (Consilient Observer)

• BofA Survey Shows Full Investor Capitulation Amid Pessimism Global growth optimism at all-time low: fund manager survey BofA says inflation seen falling but mood still stagflationary. (Bloomberg)

• Mergers destroy value. Without reform, nothing will change: The M&A playbook of warped incentives, rent extraction and creative accounting is overdue a rewrite. (Financial Times)

• Rich Chinese Worth $48 Billion Want to Leave — But Will Xi Let Them? Some 10,000 wealthy Chinese are looking to leave in the wake of punishing lockdowns and an economic slowdown. The question is whether they’ll be able to. (Bloomberg)

• A shark expert tells us to stop freaking out about shark attacks and sightings: ‘If sharks wanted to eat us, they would’ The world averages just 70 shark attacks a year. (Grid)

• The Bizarre Bird That’s Breaking the Tree of Life: Darwin thought that family trees could explain evolution. The hoatzin suggests otherwise. (New Yorker)

• As professionals flee antiabortion policies, red states face a brain drain Early indications, however, are that they may raise new obstacles to recruiting workers whose skills and qualifications allow them to choose from multiple job opportunities. (Los Angeles Times)

• Meryl Streep’s One Weird Trick: It’s stunning how often our most celebrated movie actress has built her performances on one of the form’s hackiest bits. I now follow this trend not with incredulity but with reverence. (New York Times)

Be sure to check out our Masters in Business interview this weekend with Graham Weaver, founder of and partner of Alpine Investors, a private equity firm in San Francisco that invests in software and services and manages about $8 billion dollars. Weaver holds an MBA from Stanford GSB and a B.S. in engineering from Princeton. He started Alpine in his dorm room at Stanford’s Graduate School of Business, where he now is a lecturer, teaching courses on both management and entrepreneurship.

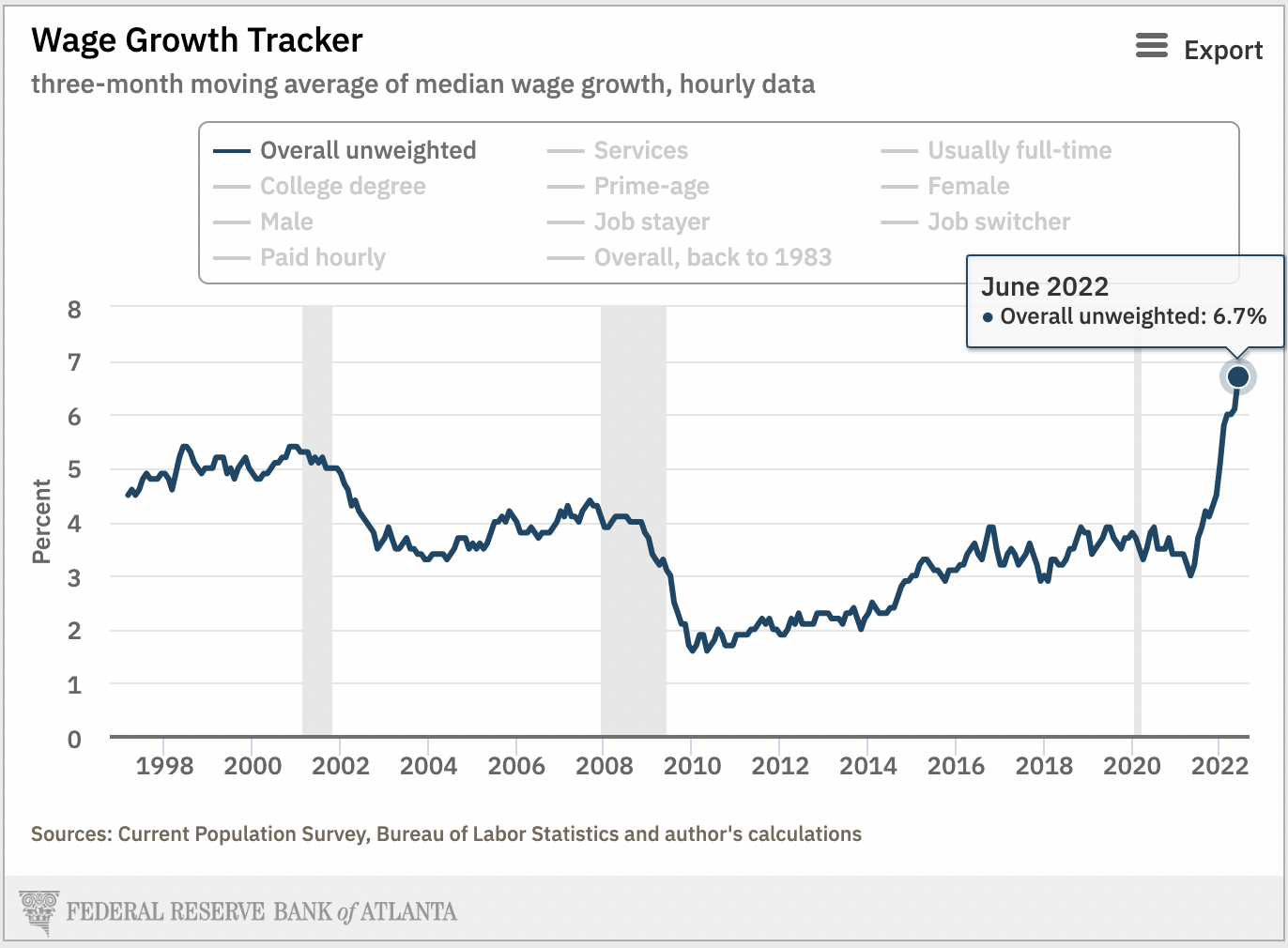

Wage Growth Tracker 6.7%

Source: Federal Reserve Bank of Atlanta

Sign up for our reads-only mailing list here.