My Two-for-Tuesday morning train WFH reads:

• Chaos Is Becoming the Rational Base Case in Market Ruled by Fear: Wall Street’s highest S&P 500 target tops lowest by a rare 50%; The post-pandemic world is hard to predict for Fed, businesses (Bloomberg) see also Thirteen ‘Perfect Storms’ That Are Sweeping the World Right Now. How many times can the ‘perfect storm’ happen? Many industries have been hit by a bevy of challenges, leading to shortages, price spikes and other disruptions. On the podcast, the ‘perfect storm’ phrase has been invoked to describe everything from oil, grains, wooden pallets to coffee beans and even the shortage of bathtubs. (Bloomberg)

• The wreck of Bidenomics: Fortunately, we have a good idea of where to go from here. 15 months later, it’s looking like my optimism was unwarranted. Yes, FDR and Reagan both accomplished much less than they wanted (their policy revolutions were completed by their successors). But they accomplished something, at least — FDR the New Deal, and Reagan a giant tax cut and anti-union policies. In comparison, Biden’s two legislative achievements have been. (Noahpinion)

• China’s Economic Engine Is About to Start Shrinking: The nation’s working-age population could decline by two-thirds or more by century’s end, according to new UN projections. (Bloomberg) see also China Is Pariah for Global Investors as Xi’s Policies Backfire: ‘It’s just easier to put China aside,’ Ruffer’s Smith says Citi finds ‘surprisingly low level’ of client engagement. (Bloomberg)

• How Three Arrows Capital Blew Up and Set Off a Crypto Contagion Su Zhu and Kyle Davies turned 3AC into the most important hedge fund in crypto, but they bet everything on prices only going up. (Businessweek)

• The Last Time Inflation Was This High: There was an energy crisis back then just like there is today. The Fed was tightening monetary policy to fight inflation in the early-1980s as well. And people were increasingly unhappy about the economic state of affairs. But there are many differences between now and the early-1980s/late-1970s. (Wealth of Common Sense) see also Inflation problems persist — no thanks to consumer resilience: Good news is bad news, though some bad news is good news .(TKer)

• Tech Workers Long Got What They Wanted. That’s Over. Employees who switched jobs during the pandemic received salary bumps and permission to work remotely. Those perks are now under threat. (Wall Street Journal)

• The Case Against Elon: The depths of Musk’s legal troubles are clearly laid out in the complaint that Twitter’s attorneys filed in Delaware this week. The legal war is just starting. (Puck) see also 15 Revelations in Twitter’s Suit Against Elon Musk: What Twitter’s 62-page lawsuit does is blow open a lot of the secrecy around the deal, which has already been subject to leaks (primarily from Musk himself) and endless speculation. Here are some of the biggest revelations from the suit. (New York Magazine)

• Complaints to Government Show Americans’ Slow Descent Into Madness Over Spam Calls People at the limit of their patience with spam calls have been emailing the chairwoman of the Federal Communications Commission, Jessica Rosenworcel, in a desperate attempt to make the unwanted calls from scammers and robocallers stop. Emails paint a picture of desperate people who just want the phone to stop ringing. (Vice)

• A Gilded Age: The decline and fall of the glossy. Carter’s one innovation as editor: He supercharged Vanity Fair’s sense of exclusion, turning the magazine into a feted event. An issue devoted to new Hollywood stars, an issue that celebrated business leaders, and a party held every year in honor of the Oscars. (The Nation) see also The world’s most wonderful private libraries: Join the book club – from New York to Naples! (Financial Times)

• The rise and fall of Sad White Men: Novels about middle class male malaise are now considered passé but they were once both groundbreaking and shocking (The Critic)

Be sure to check out our Masters in Business this week with Antti Ilmanen, AQR Capital’s co-head of Portfolio Solutions Group. Ilmanen market theories and research are highly regarded, and he has won multiple awards, including the Graham and Dodd award, the Harry M. Markowitz special distinction award, multiple Bernstein Fabozzi/Jacobs Levy awards, and the CFA Institute’s Leadership in Global Investment Award. His most recent book is “Investing Amid Low Expected Returns.”

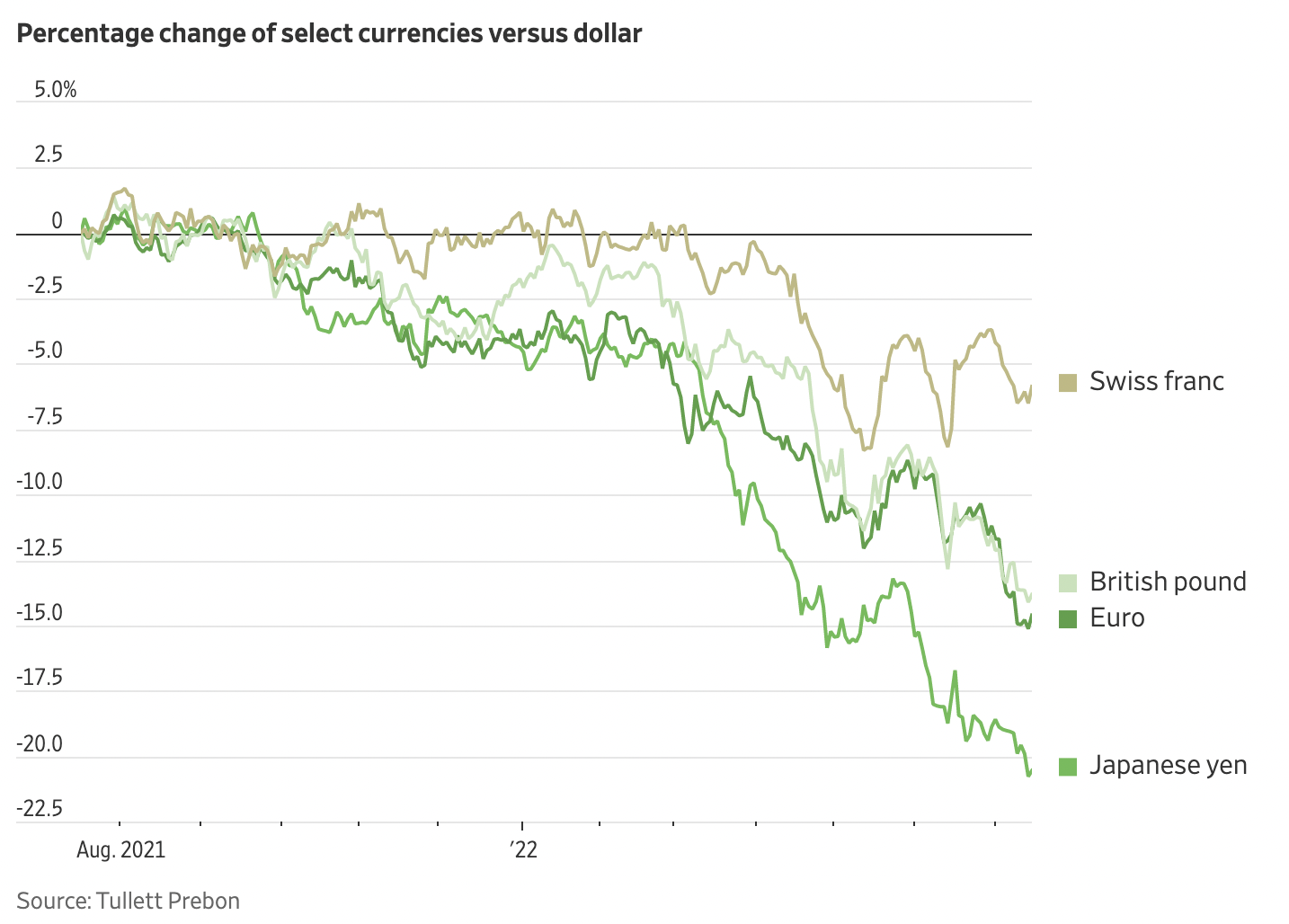

Strong Dollar Extends Gains With No End to Rally in Sight

Source: Wall Street Journal