My Two-for-Tuesday morning train WFH reads:

• Weak Earnings Reports Aren’t Fazing Investors After Brutal Year for Stocks Shares of Bank of America, Tesla and Netflix rise after posting better-than-feared results (Wall Street Journal) see also Why You Should Be Wary of Wall Street’s Upbeat Stock Forecasts Amid rising inflation and the threat of recession, corporate earnings are coming under pressure. (New York Times)

• A Giant Distraction to the Business of Investing: The average drawdown of the top 10 stocks from last fall is a decline of 30.1%. This compares rather unfavorably with the drawdown in the S&P 500 of -17.4%. Only two stocks have a drawdown that beats the S&P 500 — Apple and Visa. Eight out of the top 10 are down more than the market itself. Many of these stocks are down in a big way. (A Wealth of Common Sense)

• Market Rout Shows Dangers of Margin Lending, Crypto Style A borrower is trapped as Celsius Networks suspends transactions. (Wall Street Journal) see also Loans Could Burn Start-Up Workers in Downturn Tech workers took out loans based on the value of their start-up stock in recent years. That may come back to haunt them. (New York Times)

• The future of remote work, according to 6 experts Make the case for working remotely — but not so much that your job gets outsourced. (Vox)

• The US Is Exporting Inflation, and Fed Hikes Will Make It Worse: Pandemic spending on goods and a supercharged dollar boost inflation elsewhere, as the US trade gap—once a boon—becomes a headache. (Businessweek) see also Inflation Is Even Worse If You Measure It the Proper Way Making a year-over-year comparison of price increases is easy to understand but inevitably backward-looking. And right now monthly core inflation is clearly accelerating. (Bloomberg)

• Incognito Mode Isn’t As Incognito As You Might Think: Private browsing (aka incognito mode) is a great way to prevent your web browser from saving what you do. But to call it privacy-focused is a stretch, and while your browser or device doesn’t log your movements in its history and cookies, that doesn’t mean the sites you visit don’t clock your behavior. Despite its name, you’re not really incognito, and you may want to dial back your confidence in what these modes really do. (Wirecutter)

• New COVID Vaccines Will Be Ready This Fall. America Won’t Be. Respiratory-virus season starts soon, and our autumn vaccine strategy is shaky at best. (The Atlantic) see also Can You Totally Avoid Catching COVID? These People Have. The “NOVIDs” share their secrets. (Slate)

• Joe Rogan Calls Trump a Drugged-Out ‘Man Baby’ The mega-popular podcaster laughed at Trump’s inability to focus on anything but himself in his latest episode. (Daily Beast)

• The Three Pillars of Happiness Being happy isn’t just about getting the details right. Here are some truths that transcend circumstance and time. (The Atlantic) see also How to admit you’re wrong: Admitting wrongdoing isn’t a failure, it’s an opportunity. (Vox)

• Can Pickleball Save America? The sport, beloved for its democratic spirit, could unite the country—if it doesn’t divide itself first. (New Yorker)

Be sure to check out our Masters in Business interview this weekend with Graham Weaver, founder of and partner of Alpine Investors, a private equity firm in San Francisco that invests in software and services and manages about $8 billion dollars. Weaver holds an MBA from Stanford GSB and a B.S. in engineering from Princeton. He started Alpine in his dorm room at Stanford’s Graduate School of Business, where he now is a lecturer, teaching courses on both management and entrepreneurship.

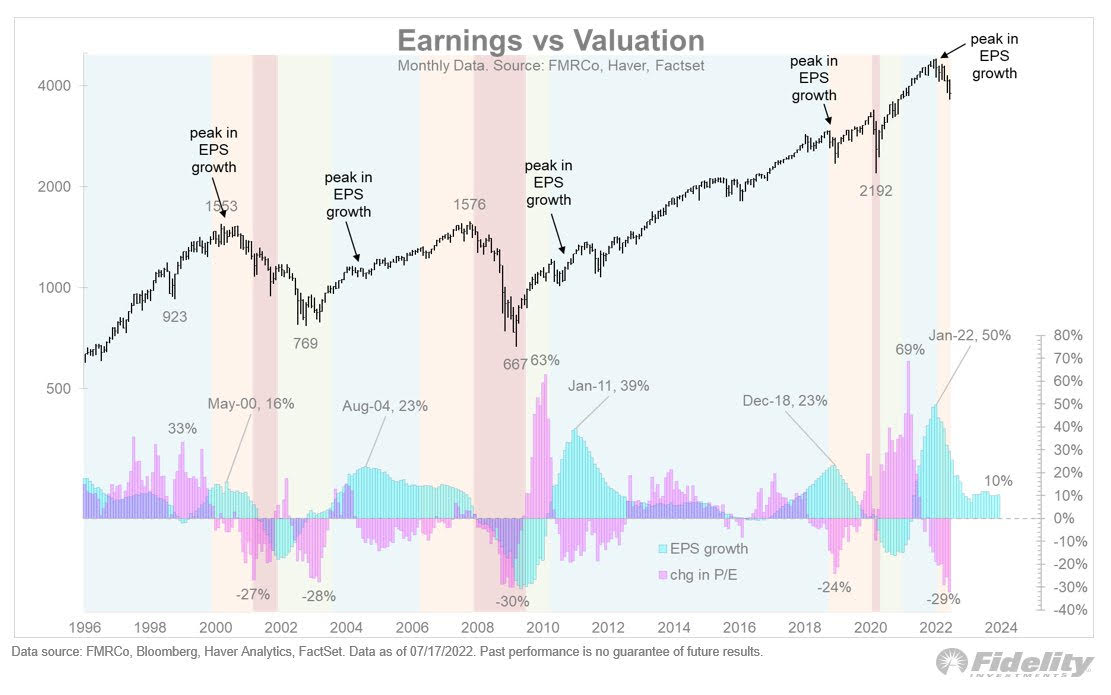

Are we witnessing the beginning of an earnings contraction, or is the rate of growth merely slowing?

Source: @TimmerFidelity