My mid-week morning train WFH reads:

• A Fed-induced recession is a medicine worse than the disease: Action to tackle inflation and protect workers should not be based on outdated economic thinking (Financial Times)

• Why Your House Was So Expensive: Material-cost inflation, anti-building rules, NIMBY attitudes, and barriers to innovation have created a housing-affordability crisis (The Atlantic) see also Low-Cost Cities With Strong Economies Remain Attractive as Housing Market Slows Remote workers willing to relocate help push small, affordable areas to the top of the latest WSJ/Realtor.com index. (Wall Street Journal)

• I Beg to Differ Howard Marks’s latest memo argues that investors seeking superior performance must have the courage to depart from the pack, even though doing so means accepting the risk of being wrong. Thinking differently and better than others is key to outperformance because in investing, it’s not enough to be right. You have to be more right than most. This means being able to tell when the investment crowd is focused on all the wrong things. (Oaktree Capital)

• What If Inflation Really Is Transitory? The Case For A Return Of Disinflation/Deflation (The Capital Spectator)

• Myth of ‘Free’ Checking Costs Consumers Over $8 Billion a Year: US consumers who frequently overdraft drive more than half of the profitability of mass-market checking accounts. (Bloomberg)

• The Spectacular Comeback of the American Farmers Market: Once ubiquitous, farmers markets nearly vanished in the mid 20th century — until an array of forces converged to bring about their modern-day renaissance. (Reasons To Be Cheerful)

• Spreadsheets Are Hot—and Cranking Out Complex Code: The venerable (and yes, super dull) piece of officeware is getting reinvented as a tool for non-coders to automate and simplify their lives. (Wired)

• Elder Millennials Have Less Time for Fun: A new report on how Americans spend their days shows 35- to 44-year-olds have fewer leisure hours than anybody else, and less than two decades ago. (Bloomberg)

• The Claremont Institute triumphed in the Trump years. Then came Jan. 6. After Trump helped revolutionize Claremont from a minor academic outfit to a key Washington player, the think tank is facing blowback for standing by lawyer John Eastman after he counseled Trump on overturning the 2020 election. (Washington Post)

• Richard Lewis on his sports bond with Larry David and life as an Ohio State fan: The comedian long known as the “Prince of Pain” does experience joy, especially when it’s THE Ohio State University beating Michigan in football. Or any sport. (The Athletic)

Be sure to check out our Masters in Business interview this weekend with Graham Weaver, founder of and partner of Alpine Investors, a private equity firm in San Francisco that invests in software and services and manages about $8 billion dollars. Weaver holds an MBA from Stanford GSB and a B.S. in engineering from Princeton. He started Alpine in his dorm room at Stanford’s Graduate School of Business, where he now is a lecturer, teaching courses on both management and entrepreneurship.

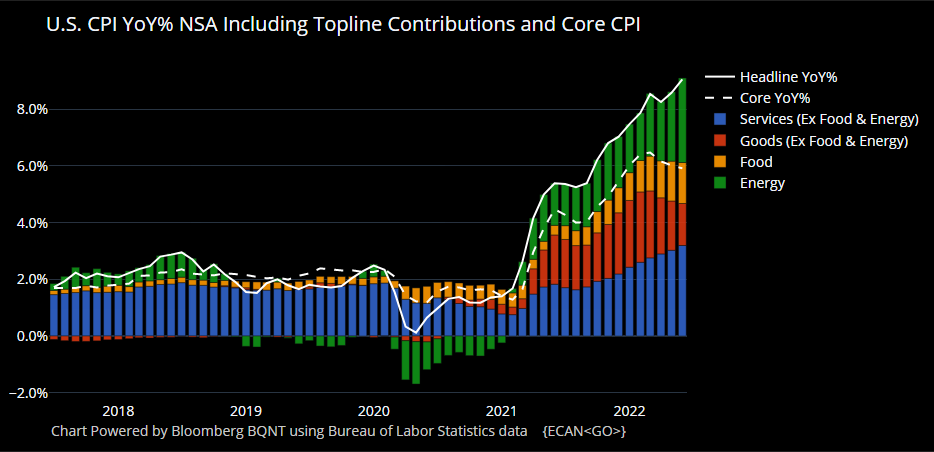

Fed to Inflict More Pain on Economy as It Readies Big Rate Hike

Source: Bloomberg

Sign up for our reads-only mailing list here.