My back-to-work morning train WFH reads:

• ‘Inflation Fever’ Is Finally Breaking — But Central Banks Won’t Stop Hiking Rates: Slowdowns on key commodity markets signal some relief is in store after worst price shock in decades. (Bloomberg)

• The Office’s Last Stand: It’s either the end of the era of flexibility around where work takes place — or the beginning of outright rebellion. (New York Times) see also What Remote Work Debate? They’ve Been Back at the Office for a While. Cubicles are largely empty in downtown San Francisco and Midtown Manhattan, but workers in America’s midsize and small cities are back to their commutes. (New York Times)

• Will This Be the First Country Bankrupted by Crypto? It’s been a year since El Salvador adopted bitcoin as currency — things are not going well (Rolling Stone)

• 20 IRA Mistakes to Avoid: From contributions to conversions to distributions, don’t fall into these traps. (Morningstar)

• GOP Fury Over ESG Triggers Backlash With US Pensions at Risk: Politicians from Florida and Texas go on the attack against investment firms that weigh risks tied to climate change and other societal issues. (Bloomberg)

• The fabulously wealthy are fueling a booming luxury ranch market out West: Moguls are lavishing ever-larger fortunes on the rustic life, prompted in part by the pandemic. (Washington Post)

• New data shows long Covid is keeping as many as 4 million people out of work: 16.3 million people (around 8%) of working-age Americans currently have long Covid. (Brookings)

• Cities Brace for This Season’s Colliding Climate Disasters May to October has become known as the “danger season” — when the US is most at risk of experiencing back-to-back climate disasters like heat waves, wildfires, drought and storms. (CityLab)

• The Donald J. Trump Guide to Getting Away With Anything: The former president has a knack for avoiding consequences for his misbehavior. (The Atlantic)

• Everyone’s a Critic Recovering a radical tradition of cultural critique. (The Baffler)

Be sure to check out our Masters in Business next week with Eric Balchunas, Senior ETF Analyst for Bloomberg, where he is co-creator of the Bloomberg podcast Trillions, and co-host of Bloomberg TV’s ETF IQ. He has authored several books, most recently “The Bogle Effect: How John Bogle and Vanguard Turned Wall Street Inside Out and Saved Investors Trillions.”

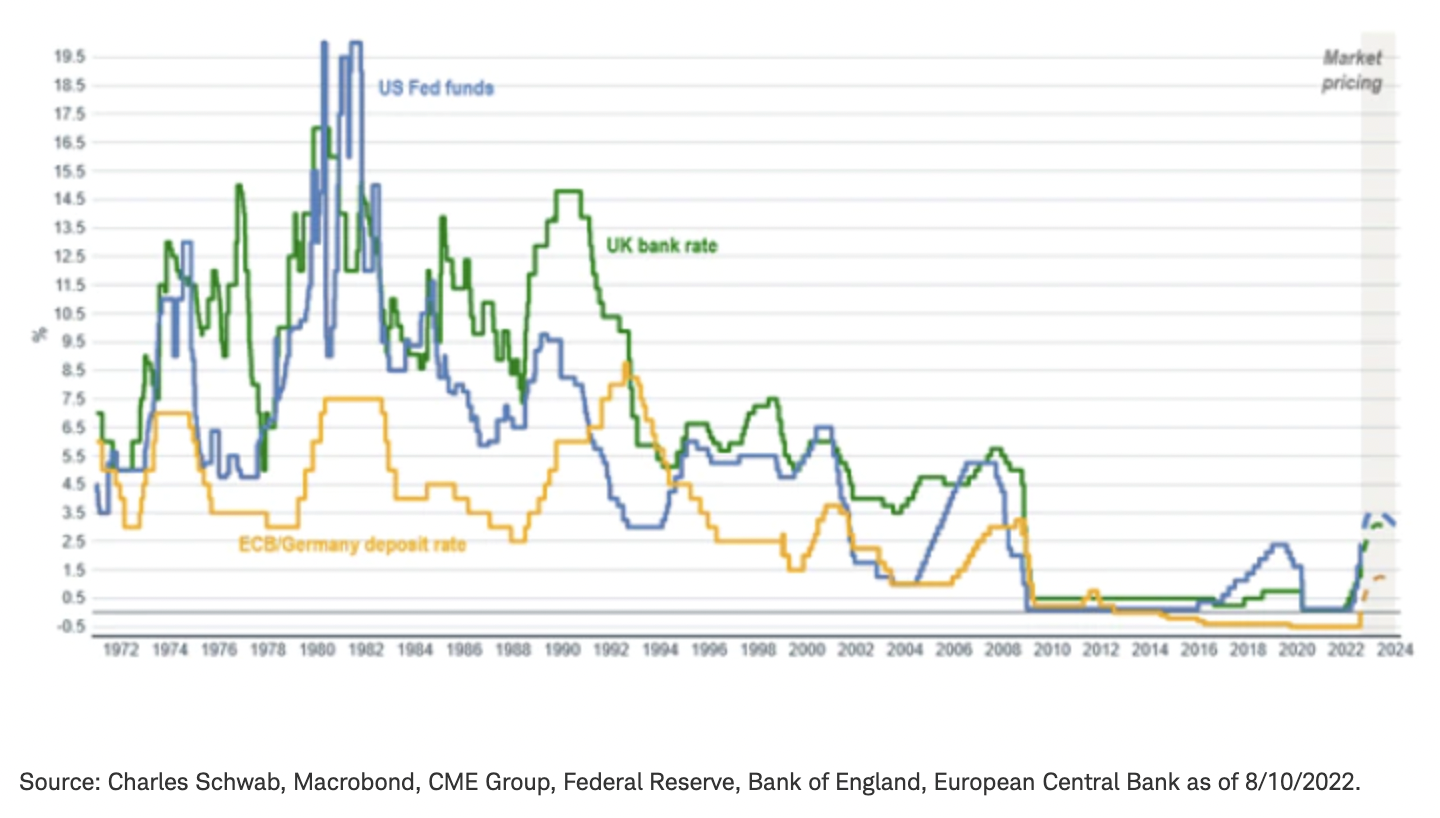

Monetary policy tended to transition quickly from hikes to cuts over the past 50 years

Source: Charles Schwab

Sign up for our reads-only mailing list here.