My Two-for-Tuesday morning train WFH reads:

• Revenge of the Founders: A Generational Struggle on Wall Street The abrupt departure of Kewsong Lee as Carlyle Group’s chief executive followed conflicts over how to run the financial firm. (New York Times) see also A Who’s Who of Silicon Valley Lawyers Up for the Musk-Twitter Trial: More than 100 subpoenas have been issued to techies like Jack Dorsey and Marc Andreessen as Twitter tries to force Elon Musk to complete a $44 billion deal. Law firms are stoked. (New York Times)

• Is this chart going up or down? You’d be amazed at how many financial advisors, insurance brokers acting as financial advisors, financial planners, wirehouse wealth managers, financial consultants and other assorted intermediaries in this business could not for the life of them look at this chart and give you a straight answer. (Reformed Broker)

• Why Downtown Won’t Die: As the office recedes in importance, central business districts are transforming into spaces to live and socialize, not just work. It’s a process that began before Covid-19. (CityLab) see also Penn Station Plan Makes a High-Stakes Bet on the Future of Office Work: Despite near record-high office vacancies, Gov. Kathy Hochul has backed a real estate project at the New York transit hub that would be one of the largest in American history. (New York Times)

• Crypto’s Real Value Was Never $3 Trillion: The true value of the crypto market isn’t what its believers suggest, but it’s nothing to sneer at, either. (Businessweek)

• You Want an Electric Car With a 300-Mile Range? When Was the Last Time You Drove 300 Miles? “The average American motorist drives about 40 miles per day and 95 percent of our car trips are 30 miles or shorter… We haven’t so much overcome this psychological hurdle as thrown big batteries at it.” (New York Times) see also Mercedes-Maybach Has Risen Gloriously From the Dead, Again The newest offering from the Maybach brand, the vast S 580 sedan, is an opulent chariot that combines the best of Mercedes driving with a surfeit of creature comforts. (Bloomberg)

• Six months in, how are sanctions impacting Russia’s economy? Fuel embargoes and private sector divestment are further isolating Russia. (Vox)

• Inflation Reduction Act’s Real Climate Impact Is a Decade Away: Law could speed emerging technologies such as green hydrogen along the learning curve, accelerating adoption (Wall Street Journal) But see also First Solar to Invest $1.2 Billion in U.S. Plants, Spurred by Climate Law: Until recently, the solar-panel maker didn’t plan to expand further in the U.S. but pivoted after President Biden signed the climate and healthcare spending package into law. (Wall Street Journal)

• “Danger Zone” Getting through the next 10 years of U.S.-China relations: The authors don’t spend a lot of time convincing you that China’s leaders are bent on conflict — that task was already carried out by earlier authors, such as Rush Doshi’s The Long Game. It’s no longer really a question of whether China intends to displace the U.S. as the world’s leading power — it does — but rather a question of how the U.S. and its allies can resist this attempt. That’s what Brands and Beckley try to answer. (Noahpinion)

• How Long Droughts Make Flooding Worse: Parched ground is less likely to absorb water and increases the risk of dangerous flash floods. But there are ways to mitigate these conditions. (Wired) see also In America’s fastest-growing metro, a rising fear water will run out: “This seems to be some level of insanity to me that you continue to allow unabated growth at the same time you’re dealing with this unprecedented drought. Rather than trying to find all these sources of water, we ought to be controlling the growth.” (Washington Post)

• 15 Under-the-Radar TV Shows That Deserve Your Attention: A lot of great television slips through the cracks these days. (The Atlantic)

Be sure to check out our Masters in Business next week with Eric Balchunas, Senior ETF Analyst for Bloomberg, where he is co-creator of the Bloomberg podcast Trillions, and co-host of Bloomberg TV’s ETF IQ. He has authored several books, most recently “The Bogle Effect: How John Bogle and Vanguard Turned Wall Street Inside Out and Saved Investors Trillions.”

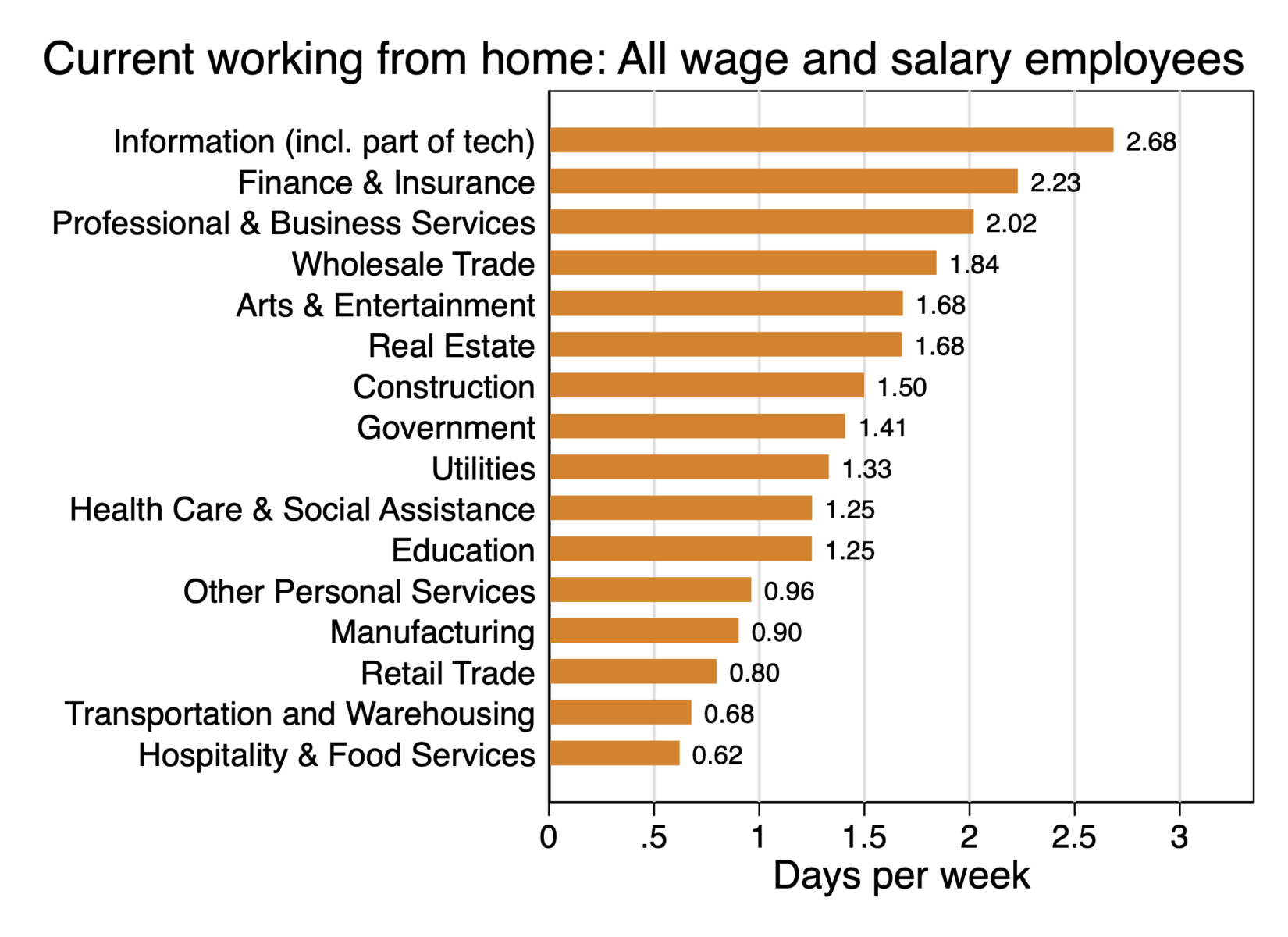

What industries have the highest levels of working from home?

Source: WFH Research

Sign up for our reads-only mailing list here.