My morning train WFH reads:

• Thursdays really are the new Fridays.Work patterns we thought might fade as Covid rules eased are actually intensifying. (Financial Times)

• Big Oil’s Message to Investors: You’re Too Pessimistic: Despite the recent rally, crude prices are down for August, and data suggests investors have reduced their involvement in commodity markets. (Wall Street Journal) see also Saudi Arabia’s EV Battery Bets Are a Warning Apart from China, no country has managed to achieve manufacturing scale. That may be about to change. (Bloomberg)

• How Value Investing Has Changed: Some growth stocks are now in the bargain category. Hare, welcome to tortoise-hood. (Chief Investment Officer)

• The 30-Year-Old Spending $1 Billion to Save Crypto: Sam Bankman-Fried, owner of an expanding crypto empire, is trying to bail out the industry after a sharp downturn. (Wall Street Journal)

• The casualties of California legalizing pot: Growers who went legal A blue state’s taxes and regulation have boosted corporate producers, leading to the near-death of the small cannabis farmer. (Washington Post)

• What Happened When Minneapolis Ended Single-Family Zoning:The city’s path-breaking shift has brought a lot of national attention and, so far, fewer than 100 new housing units. Still, it’s a step. (Bloomberg)

• Newfound Brain Switch Labels Experiences as Good or Bad: A molecule tells the brain whether to put a positive or negative spin on events. Mental disorders may result when the up/down labeling goes awry. (Scientific American)

• 1 million square feet of L.A. roads are being covered with solar-reflective paint: The initiative covers roads, playgrounds, and parking lots, and it has already cooled the surface by 10 to 12 degrees. (Fast Company) see also Expansion of Clean Energy Loans Is ‘Sleeping Giant’ of Climate Bill: The bill President Biden signed into law recently will greatly expand government loans and loan guarantees for clean energy and automotive projects and businesses. (New York Times)

• Critics said nothing would change after Sandy Hook. Actually, a lot has: How Moms Demand Action has pushed the conversation on guns forward over the last decade. (Vox)

• An illustrated guide to all 6,887 deaths in ‘Game of Thrones’ After years of frame-by-frame analysis, here it is: a complete database to every on-screen death from “Game of Thrones,” including who, how, why and where. And after eight seasons of continually rising body counts, we can definitively confirm — “Valar Morghulis” — all men must indeed die. (Washington Post)

Be sure to check out our Masters in Business next week with Eric Balchunas, Senior ETF Analyst for Bloomberg, where he is co-creator of the Bloomberg podcast Trillions, and co-host of Bloomberg TV’s ETF IQ. He has authored several books, most recently “The Bogle Effect: How John Bogle and Vanguard Turned Wall Street Inside Out and Saved Investors Trillions.”

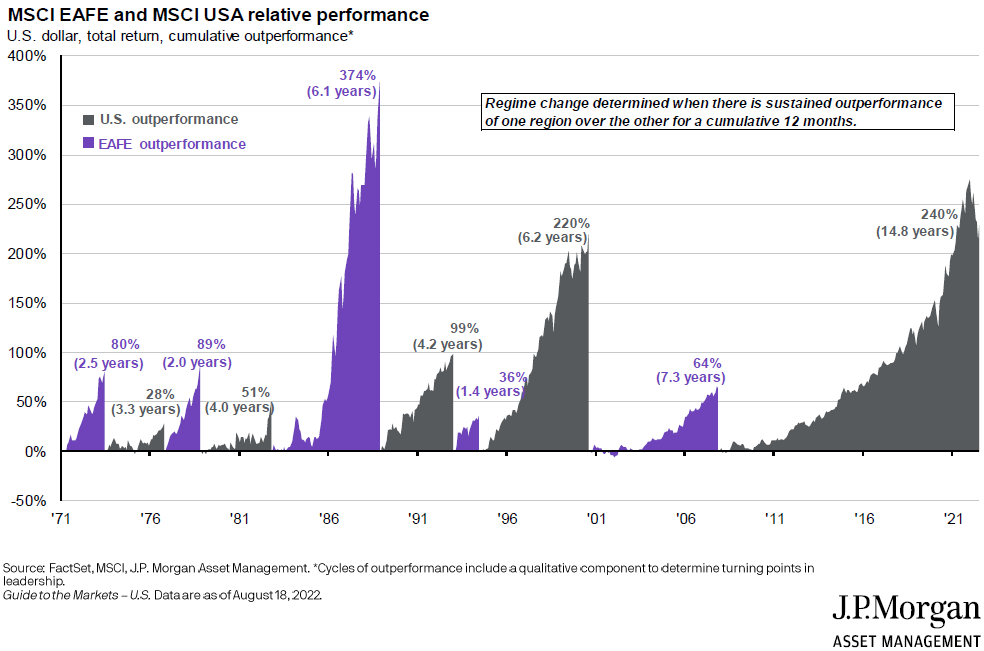

Underperformance of international stocks now approaching *15 years*…

Source: @NateGeraci

Sign up for our reads-only mailing list here.