My morning train reads:

• Day Traders Go Back to Their Day Jobs as Stock Market Swoons: Individual investors are placing fewer trades at Charles Schwab, Morgan Stanley and Robinhood. (Wall Street Journal)

• Americans Reclaim 60 Million Commuting Hours in Remote-Work Perk: Instead of being stuck in traffic, workers are getting more rest and spending additional time with family. (Bloomberg) see also What Have Workers Done with the Time Freed up by Commuting Less? Although individuals may have increased time working in the precise time-slot they used to commute, overall paid-work hours fell because of substitution toward other activities throughout the day. Second, we see notable increases in leisure time and sleeping. (Liberty Street Economics)

• Bear Market Opportunities For Every Generation of Investors: A powerful chart shows how much the stock market is likely to rebound over 3, 5, and 10 years. (A Wealth of Common Sense)

• The Stock Market Had a Terrible Year. These Americans Aren’t Bothered. Some say they can’t afford to put money into the market while others think there are better routes to wealth. (Wall Street Journal)

• Every Asset Manager Wants More Alts. Here’s How Wellington Is Achieving It. The firm isn’t new to alternatives, but there’s a new urgency behind its business case. (Institutional Investor)

• Bill Gross: Bond-fund taxonomist: Bond-fund classification can be an arbitrary practice. It is also very important. And Bill Gross has some thoughts on it. (Financial Times)

• Oops, we forgot to fix the supply chain: Some experts say it never really broke. (Vox)

• New Patek Philippe Nautilus Models Released in Much-Coveted Lineup: The beloved Ref. 5711A isn’t coming back, but among the many new watches announced today, there are three variations on the Nautilus theme. (Bloomberg)

• Ukraine war: Russia begins evacuation from Kherson in south: Tens of thousands of civilians and Russian-appointed officials are being moved out of Ukraine’s southern Kherson region ahead of a Ukrainian offensive, says the Russia-installed local leader. (BBC)

• This Is Uncharted Territory: If one of two major political parties no longer believes in free and fair elections, how can democracy still function? (The Atlantic) see also What Republicans Really Thought on January 6: The president turned his back on seemingly everyone. McConnell was dumbfounded. For the first time in more than two centuries, the Capitol was under siege.. (The Atlantic)

Be sure to check out our Masters in Business interview this weekend with Marta Norton, Chief Investment Officer of Morningstar Investment Management. The firm manages directly or advises on $249.4B in client funds. She began her career as BLS economist, and before her current role, she was Head of U.S. Outcome-Based Strategies for Morningstar.

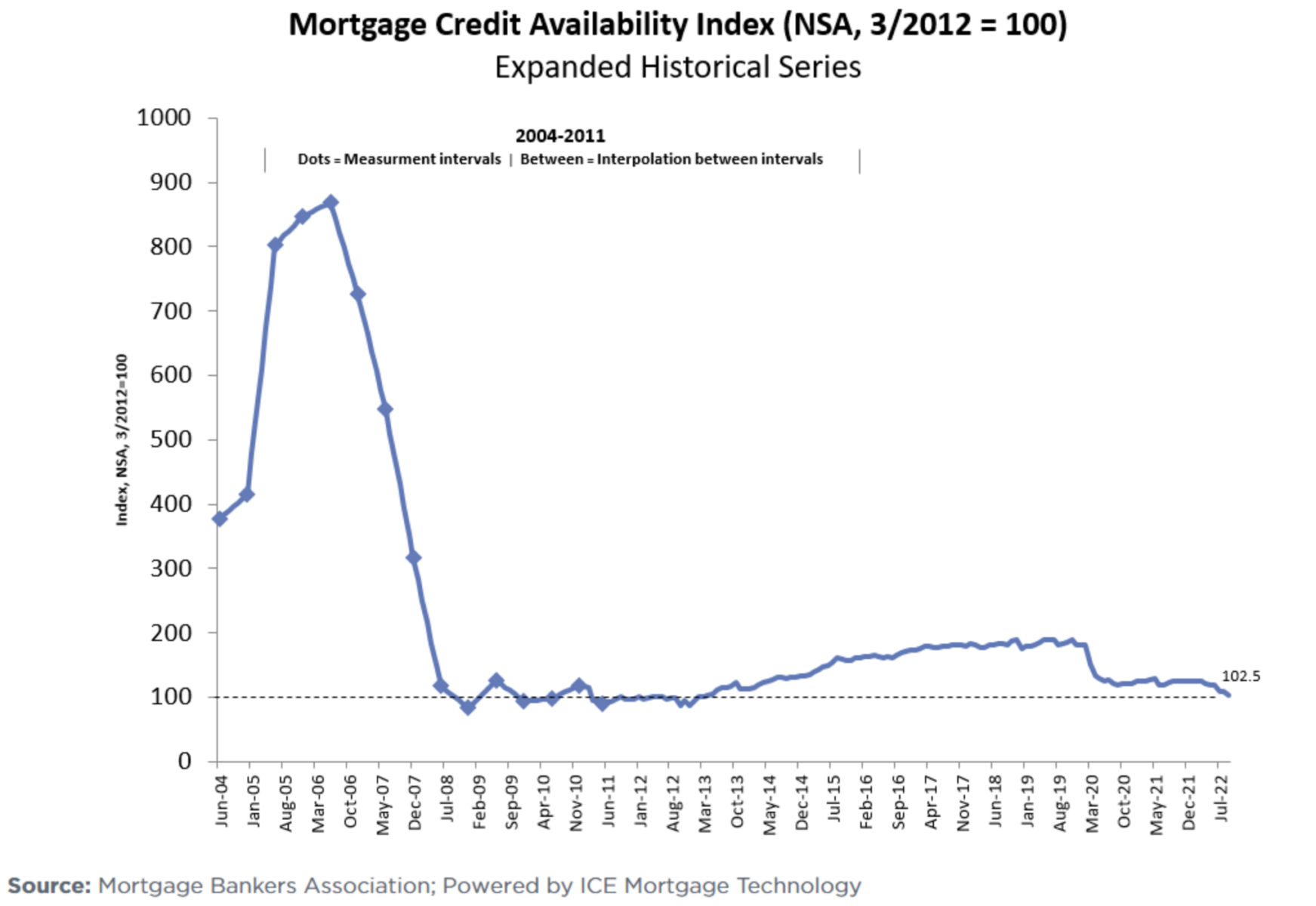

Mortgage Credit Availability was Never Excessive During the Recent Housing Boom

Source: Calculated Risk

Sign up for our reads-only mailing list here.