My Two-for-Tuesday morning train WFH reads:

• Washout: If the leaders are falling, you know the rest of the bunch already got washed out. Indeed, only 8% of the Nasdaq-100 is above the 200-day moving average. (Irrelevant Investor) see also Getting Long-Term Bullish: My general investment philosophy is the more bearish things feel in the short run the more bullish I should be over the long run. If I’m taking my own advice right now I should be getting much more long run bullish. (Wealth of Common Sense)

• Wall Street’s 2022 LOL Outlook for Stocks: A roundup of 14 forecasts for 2022 of the S&P 500, including highlights from the strategists’ commentary. The targets range from 4,400 to 5,300.(S&P closed 2021 at 4,766) which implies returns between flat and +22%: (TKer)

• The bond market massacre of September 2022: We are reaching the point in the monetary tightening cycle in which things begin to break. Truss and Kwarteng are clearly counting on the Bank of England to offset the shock to markets by raising rates. And yields have certainly surged as UK bonds have sold off. (Adam Tooze)

• Office Markets Are the Real Estate Crash We Need to Worry About While a soft landing is still possible for housing and labor, it’s going to get ugly for city business districts. (Bloomberg)

• Light Fades from Sun Belt Cities as More Contracts Are Canceled: Nationally, deals fell through on 15.2% of homes that went under contract in August. (Mansion Global) see also The Boomtown That Shouldn’t Exist (2017): Cape Coral, Florida, was built on total lies. One big storm could wipe it off the map. Oh, and it’s also the fastest-growing city in the United States. (Politico)

• How the U.S. Is Making a Bottom-Up Recovery Households with the lowest incomes are bouncing back better from the Covid-19 crisis than more-affluent ones. (Wall Street Journal)

• Peak Oil Has Finally Arrived. No, Really: Those who have called a top in oil may finally be proven right as sharp global rate hikes hurt consumption. (Bloomberg) but see I come bringing good news about hydrogen: The fourth big green energy technology (Noahpinion)

• The Disappearing Art Of Maintenance: The noble but undervalued craft of maintenance could help preserve modernity’s finest achievements, from public transit systems to power grids, and serve as a useful framework for addressing climate change and other pressing planetary constraints. (NOEMA)

• The cheating scandal roiling the chess world has a new wrinkle: The cheating controversy gripping the world of elite chess was already enigmatic — but it deepened even more this week, when world champion Magnus Carlsen abruptly resigned after making a single move in his highly anticipated rematch with Hans Niemann. (NPR) see also The Question Behind the Magnus Carlsen-Hans Niemann Drama: How to Cheat at Chess? A cheating scandal has upended chess—and cast a new spotlight on how a player might possibly cheat without being detected. (Wall Street Journal)

• All of Aaron Judge’s Homers, From 1 to 61: Judge, the slugging outfielder, is having an incredible year. We have been tracking his pursuit of the all-time greats. (New York Times)

Be sure to check out our Masters in Business interview this weekend with David McRaney, science journalist, blogger, podcaster, and author. He created the podcast You Are Not So Smart based on his bestselling book of the same name. His new book is “How Minds Change: The Surprising Science of Belief, Opinion, and Persuasion.”

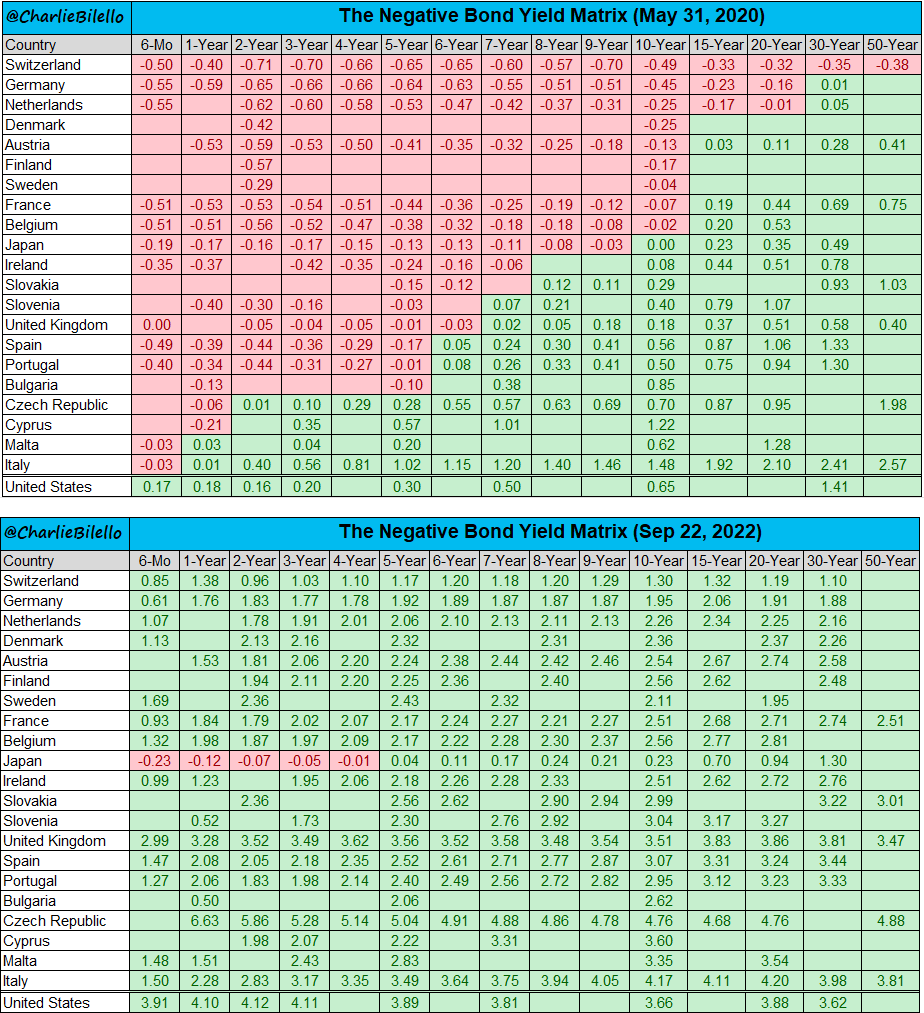

Last of the Negative Yielders

Source: Compound