My mid-week morning train WFH reads:

• Pulling the curtain back: what do millionaires invest in? On average, respondents hold 53% of their portfolio in equities. Home bias shows 83% of their stocks are U.S. stocks. Only 10% hold any assets in hedge funds, venture capital, or private equity, but conditional on doing so, they allocate 13% of their portfolio to these funds. (Alpha Architect)

• The Last Time the Fed Created a Recession. From 1968-1982, the annual inflation was 4% or higher in 14 out of 15 years. Prices were up 5% or more in 12 of those years; more than 6% in 3 out of every 5 years and over 10% on four separate occasions. For the current cycle, the inflation rate has been above 3% since April 2021, so we’ve been dealing with higher-than-average price increases for around 18 months. (Wealth of Common Sense) see also Why I don’t think the Fed will back off: The pushback against rate hikes is unlikely to succeed. (Noahpinion)

• Hedge Fund Managers Paid for Stockpicking Genius Aren’t Showing Much of It:The traditional strategy of mixing long and short equity bets hasn’t provided the bear market buffer that clients hoped for. (Businessweek)

• The Sages of Wall Street: Understanding where growth forecasts are accurate and where they err. (Verdad)

• New Tool Shows Just How Much Users Lost in Celsius Bankruptcy: Using data likely pulled from its bankruptcy filing, a new tool now shows exactly how much different users lost following Celsius’ collapse. (Decrypt)

• The surprisingly high stakes in a Supreme Court case about bacon: National Pork Producers Council v. Ross asks just how far one state can go to change life in the other 49 states. (Vox)

• Why U.S. Efforts to Regain Chip Dominance Are Uphill: The American semiconductor industry ceded the lead to Asian rivals long ago, and now it is scrambling to catch up. (CIO) see also Logic of the The China Chip Ban: Joe Biden Just Crushed China’s Semiconductor Industry. (Stratechery via the Triad)

• Putin might lose the war. What would that look like for Russia, Ukraine and the world? A former CIA leader on the cataclysms that may lie ahead — and how the U.S. should deal with them. (Grid)

• College-Educated Voters Are Ruining American Politics: Political hobbyism is to public affairs what watching SportsCenter is to playing football. (The Atlantic)

• How Stoicism influenced music from the French Renaissance to Pink Floyd: Emerging in the wake of the violent French Wars of Religion, Neostoics looked to Stoicism as a remedy for social and political instability. They developed a vocal music repertoire to teach the principles of the system, guiding singers and listeners to “rehearse” Stoic techniques of emotional regulation through informal musical gatherings in people’s homes. (The Conversation)

Be sure to check out our Masters in Business interview this weekend with Michael Levy, Chief Executive Officer of Crow Holdings. The firm is the largest developer of multifamily-homes in the United States. Crow is both a developer and investor in commercial real estate, specializing in multifamily, industrial, and office properties across 21 markets in the United States.

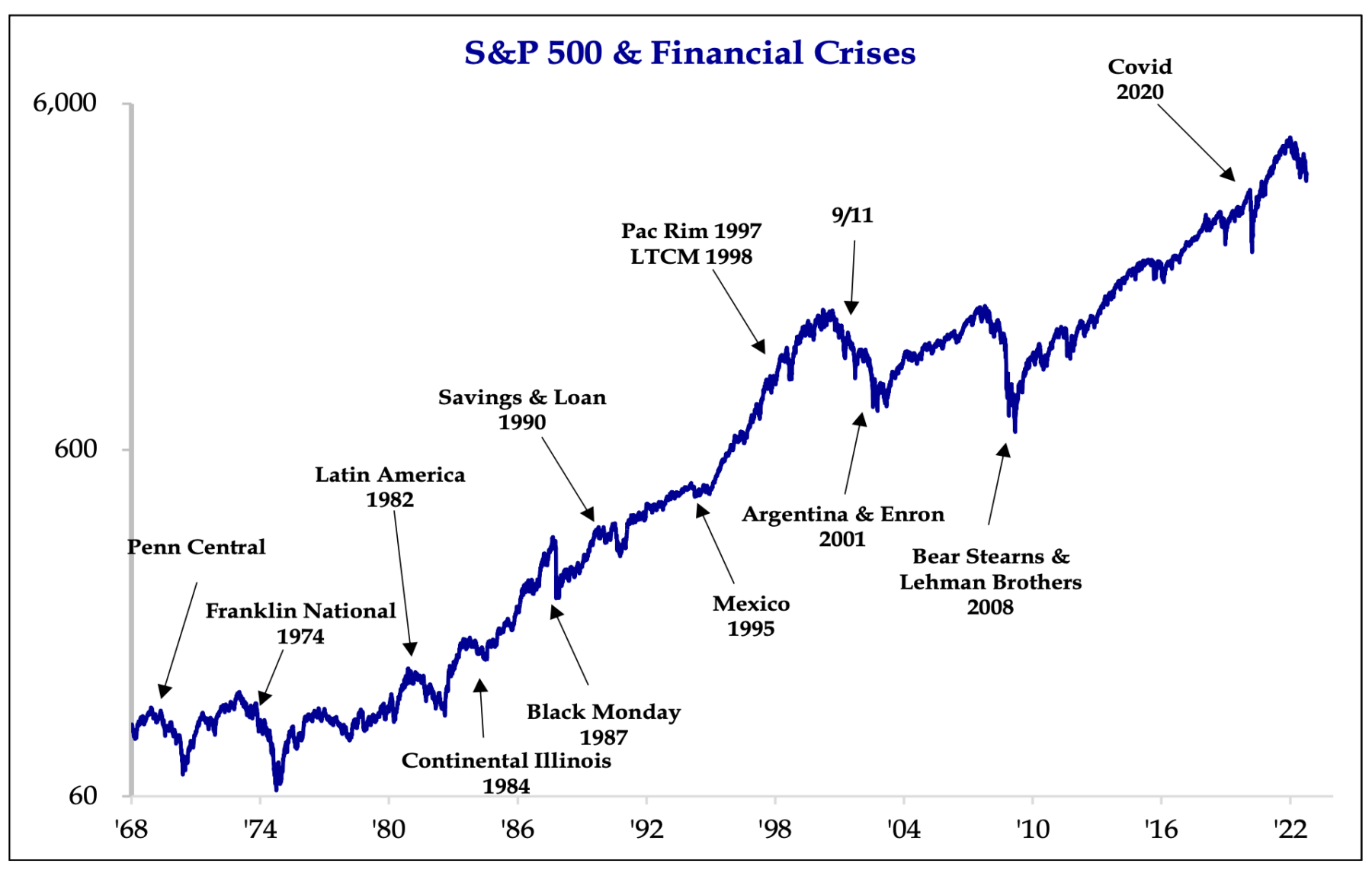

Investors have been trained to welcome financial crises

Source: Strategas

Sign up for our reads-only mailing list here.