The weekend is here! Pour yourself a mug of Bean Box coffee, grab a seat on the sofa, and get ready for our longer-form weekend reads:

• Crypto Story Where it came from, what it all means, and why it still matters by Matt Levine. There was a moment not so long ago when I thought, “What if I’ve had this crypto thing all wrong?” I’m a doubting normie who, if I’m being honest, hasn’t always understood this alternate universe that’s been percolating and expanding for more than a decade now. If you’re a disciple, this new dimension is the future. If you’re a skeptic, this upside-down world is just a modern Ponzi scheme that’s going to end badly—and the recent “crypto winter” is evidence of its long-overdue ending. But crypto has dug itself into finance, into technology, and into our heads. And if crypto isn’t going away, we’d better attempt to understand it. Its only the 2nd time in Businessweek’s 93-year history that a single author has written a cover-to-cover issue of the magazine. (Businessweek)

• Austin Builders Couldn’t Finish Homes Fast Enough. Now Their Product Is Piling Up. The pandemic-induced buying frenzy has cooled significantly, leaving new luxury homes to linger on the market. (Wall Street Journal)

• Beyond Catastrophe: A New Climate Reality Is Coming Into View: You can never really see the future, only imagine it, then try to make sense of the new world when it arrives. (New York Times)

• Billionaire investor Barry Sternlicht says Jerome Powell and ‘his merry band of lunatics’ are destroying faith in capitalism and leading us toward ‘social unrest’ “So the rich guy who loses 30%, he’s still rich, right? But the poor guy who’s working in an hourly job that loses that job, he’s going to say: ‘Capitalism is broken, it didn’t work for me. I lost my job. And this whole system has to go out the door,’” Sternlicht told Fortune. “You’re going to have social unrest,” he added. “And it’s just because of Jay Powell and his merry band of lunatics.” (Fortune)

• Why Signal won’t compromise on encryption, with president Meredith Whittaker: Signal messages are more private than iMessage and WhatsApp. Here’s how. (The Verge)

• Half the World Has a Clitoris. Why Don’t Doctors Study It? The organ is “completely ignored by pretty much everyone,” medical experts say, and that omission can be devastating to women’s sexual health. (New York Times)

• The Matter with Things by Iain McGilchrist Richard Gault reviews the magnum opus of an extraordinary thinker who lays out a detailed argument for the unity of the world. (Beshara Magazine)

• Most Americans don’t know about the omicron covid boosters: Muddled messaging and pandemic weariness may be behind the trend. (Grid)

• How Marcus Smart’s support for cancer patients transformed children’s hospitals: Smart goes about things quietly, spending one-on-one time with the patients he visits so he can establish a real connection. After his mother died in September 2018, he hosted a private dinner for families staying in Boston Children’s Hospital’s patient housing and sat down with each and every person there. (The Athletic)

• Bono Is Still Trying to Figure Out U2 and Himself: There are different Bonos to different people, including the man himself. He is, as you may know, the lead singer of U2, one of the most successful and longest-running rock bands of all time. He’s also a prominent activist, having helped lead campaigns that resulted in some of the world’s richest countries forgiving its loans to some of the world’s poorest and in procuring tens of billions of dollars in AIDS relief for African nations. “It’s not like you’re creative when you’re being a musician and when you’re an activist, you’re being an activist. That’s why I wrote the book: These different characters are all part of me.” (NYT Magazine)

Be sure to check out our Masters in Business interview this weekend with The Jeremies! Professor Jeremy Siegel of Wharton, and Jeremy Schwartz, Chief Investment Officer at the $75 billion Wisdom Tree Asset Management. Siegel is the author of Stocks For The Long Run; Schwartz is his research partner/editor. The two discuss the sixth edition of SFTLR, the latest and most widely expanded edition of the investment classic.

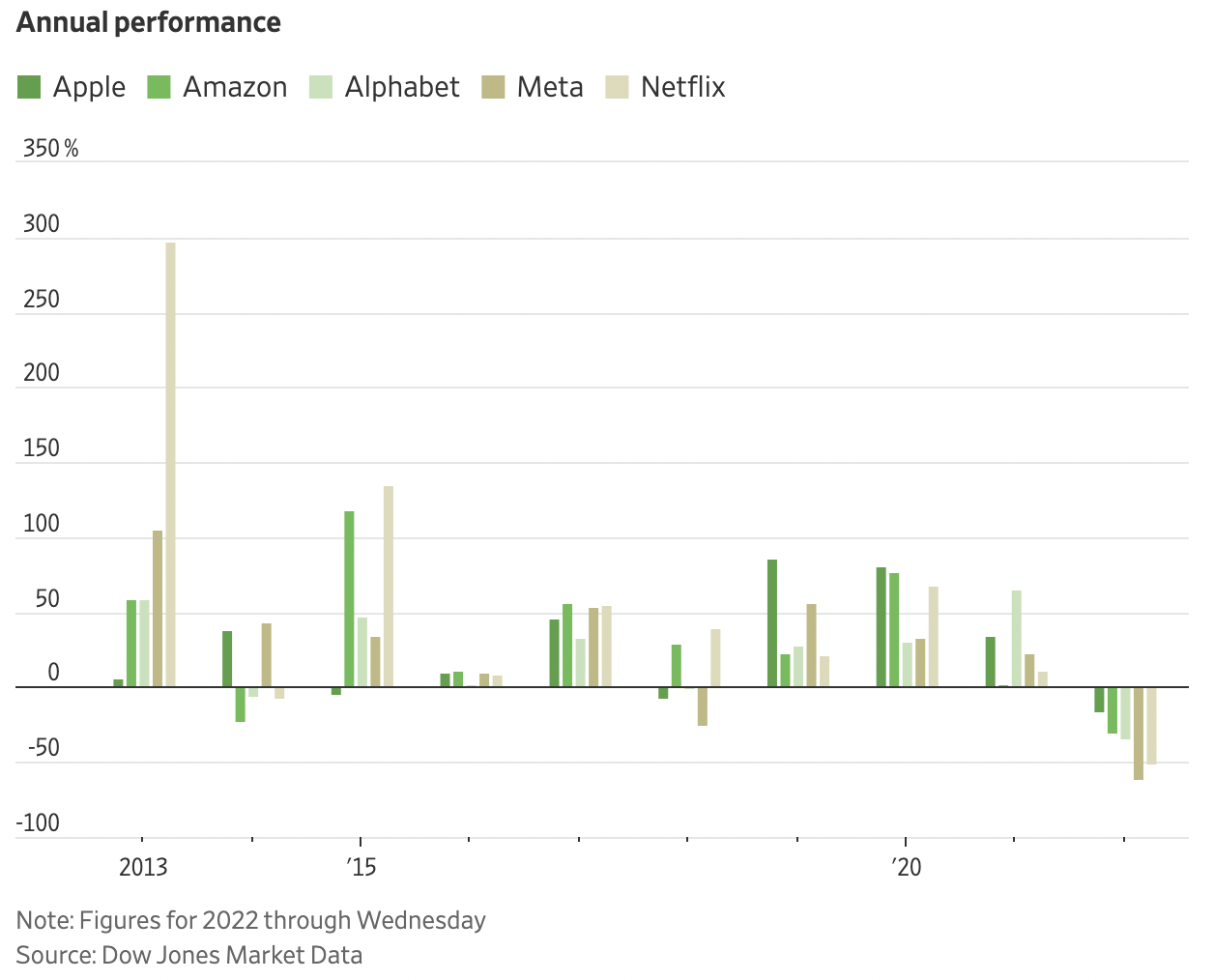

For Diving FAANG Stocks, It’s the End of an Era

Source: Wall Street Journal

Sign u p for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.