My morning train WFH reads:

• The messy true story of the last time we beat inflation: The usual narrative about the “Volcker shock” leaves a lot out — and policymakers risk learning the wrong lessons. (Vox)

• There Has to Be a Better Way to Lose $800 Billion: Many companies change strategies because they lost money. Meta is losing money because it changed strategies. (Wall Street Journal) but see also Ways to think about a metaverse: Your boss wants a metaverse strategy, but what would that be, and what does metaverse even mean? If we strip away the noise, what can we say about this, and what can we predict? (Benedict Evans)

• How Investors Feel About ESG Initiatives A survey finds that investors’ attitudes vary widely by age, wealth and the specific ESG issue. (Wall Street Journal)

• Mortgage Rates Too High? (Blame the Fed, Wall Street and Your Neighbor) Lenders use several bits of data to set mortgage rates, including trading moves by investors. Without market volatility, the rate could be under 7 percent. (New York Times)

• Can the Fed fight inflation without triggering a meltdown? After the recent turmoil in Britain, anxiety about the stability of the financial system is rising alongside interest rates. (Washington Post)

• Twitter’s problems: a roundup. Some unsolicited thoughts for the new ownership (Noahpinion)

• A Surge of Overseas Abortion Pills Blunted the Effects of State Abortion Bans: New data suggests that abortion has declined about 2 percent in the U.S. since the end of Roe, accounting for people who traveled across state lines or ordered pills online. (New York Times)

• The right’s loudest voices have shaken off the burden of being responsible: In the Republican establishment of 2015, when Trump announced, there was still a lingering belief that elected officials shouldn’t simply peddle conspiracy theories or misrepresent reality. That belief had eroded in the post-tea-party era, certainly, but it lingered. Until Trump showed that abandoning it entirely offered a different set of rewards. (Washington Post)

• It’s not just politicians: American workers are facing a sharp spike in threats and violence: Harassment is worse for everyone from airport screeners to librarians to nurses: “That’s my Tuesday death threat.” (Grid)

• 9 Facts About Guitarist Pat Metheny as a Youngster: You don’t need to be a future guitar hero to learn from his example. (The Honest Broker)

Be sure to check out our Masters in Business interview this weekend with financial historian Edward Chancellor. He is currently a columnist for Reuters Breakingviews and an occasional contributor to the Wall Street Journal and MoneyWeek. In 2008, he received the George Polk Award for financial reporting. Chancellor is the author of “Devil Take the Hindmost: A History of Financial Speculation.” His new book “The Price of Time: The Real Story of Interest” is a nominee for FT’s 2022 Business Book of the Year.

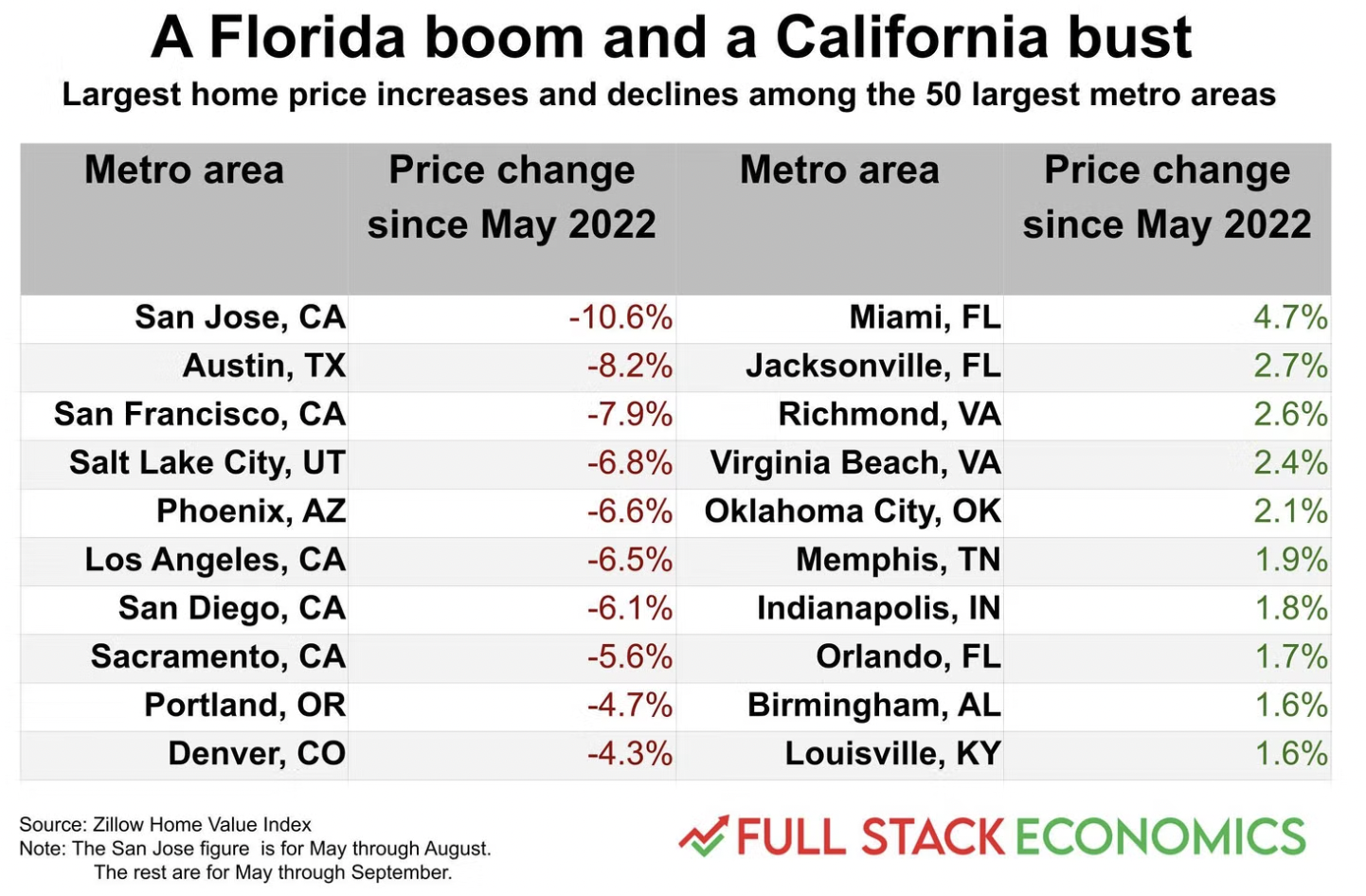

Home prices are falling faster west of the Rockies

Source: Full Stack Economics

Sign up for our reads-only mailing list here.