My Two-for-Tuesday morning train WFH reads:

• Fed’s Brainard Says Rate-Rise Pace Can Slow Soon: Central bank’s No. 2 official argues that previous and anticipated rate increases will slow the economy in ways that can’t be observed yet. (Wall Street Journal) but see also No, That’s Not What Jerome Powell Just Told You! JPMorgan’s Bill Eigen Warns Investors Not to Jump Back Into Fixed Income. “All I do is just listen to the Fed, and I believe them,” says the manager of the Strategic Income Opportunities Fund. (Institutional Investor)

• KPMG: The Pandemic Housing Bubble is bursting—U.S. home prices falling 15% looks ‘conservative’ It was a pandemic-induced bubble, which was stoked by work-from-home migration trends: High-wage workers going to lower second tier middle markets for more space. We went to an extreme on WFH-spurred housing demand, but it abruptly ended. Part of the reason you’re seeing housing prices fall is the local incomes don’t support these home values.” (Fortune)

• As Watch Sales Boom, Watch Flippers Face a Bust: Although sales of brand-new watches are still healthy, speculative purchases for profit in the secondhand market are becoming less attractive. (Wall Street Journal) but see The Richest Art Auction Season in History Continues This Week: New York’s marquee November sales pick up where the Paul Allen sale left off, with a $3 billion-plus tally likely after all the hammers fall. (Bloomberg)

• The Death of a Wrecking Ball: Sentiment, volatility, and momentum thrusts have each suggested an end to the US dollar wrecking ball. (All Star Charts)

• H’wood FTX Frenzy as Michael Lewis Reveals He Spent 6 Months with Founder Author compares Sam Bankman-Fried: Binance’s CZ to ‘Luke Skywalker and Darth Vader’ in email sent by CAA (Ankler) see also How Sam Bankman-Fried’s Crypto Empire Collapsed: Mr. Bankman-Fried said in an interview that he had expanded too fast and failed to see warning signs. But he shared few details about his handling of FTX customers’ funds. (New York Times)

• Everyone’s Retirement Ends The Same Way: We’re all corpses in waiting. Unlike financial salespeople, the Grim Reaper doesn’t care if you’re an HNW individual. Spending decades planning for retirement while ignoring the inevitable makes little sense. We believe putting the thought of death out of sight and mind will protect us from it. It won’t. (A Teachable Moment)

• A Verifiable Mess: Twitter Users Create Havoc by Impersonating Brands: The social media service, which is undergoing changes from its new owner Elon Musk, has descended into a messy swirl of spoof messages and parody accounts. (New York Times) see also The Twitter Worker Who Captured Elon Musk’s Takeover in All Its Cartoonish Glory: Cornet’s time at Twitter was brief but well illustrated. With dozens of cartoons, Cornet depicted the feeling inside as Musk acquired the company. As the person behind some of the tech world’s best-known cartoons—including an all-timer on Big Tech org charts—Cornet was perfectly placed to document the wild 2022 Twitter experience. (Slate)

• What does long covid treatment look like for kids? Too few clinics are trying to figure it out. Kids may have lower risk, but the dozen or so dedicated long covid clinics aren’t enough to meet demand. (Grid)

• America Has an Anti-MAGA Majority The election results show that although a sizable minority of Americans will never defect from Trump, an even larger group seems equally determined to stop Trumpism. (The Atlantic) see also The Midterms Message for Republicans Voters to GOP: We don’t like your MAGA candidates and their agenda. (The Atlantic)

• Rupert Murdoch Knees Trump in the Balls While He’s Doubled Over Coughing Up Blood. The message from the Murdoch-owned New York Post, Wall Street Journal, and Fox News is clear: Pack your bags, bitch. You’re done. (Vanity Fair)

Be sure to check out our Masters in Business interview this weekend with Dave Nadig, Financial Futurist at VettaFi. The ETF industry pioneer has over 25 years of ETF experience. As Managing Director of ETF.com, he was a key participant in the rise of the passive and ETF industry. Previously, he was Was Managing Director at Barclays Global Investors. He co-authored the definitive book on ETFs, “A Comprehensive Guide To Exchange-Traded Funds,” for the CFA Institute.

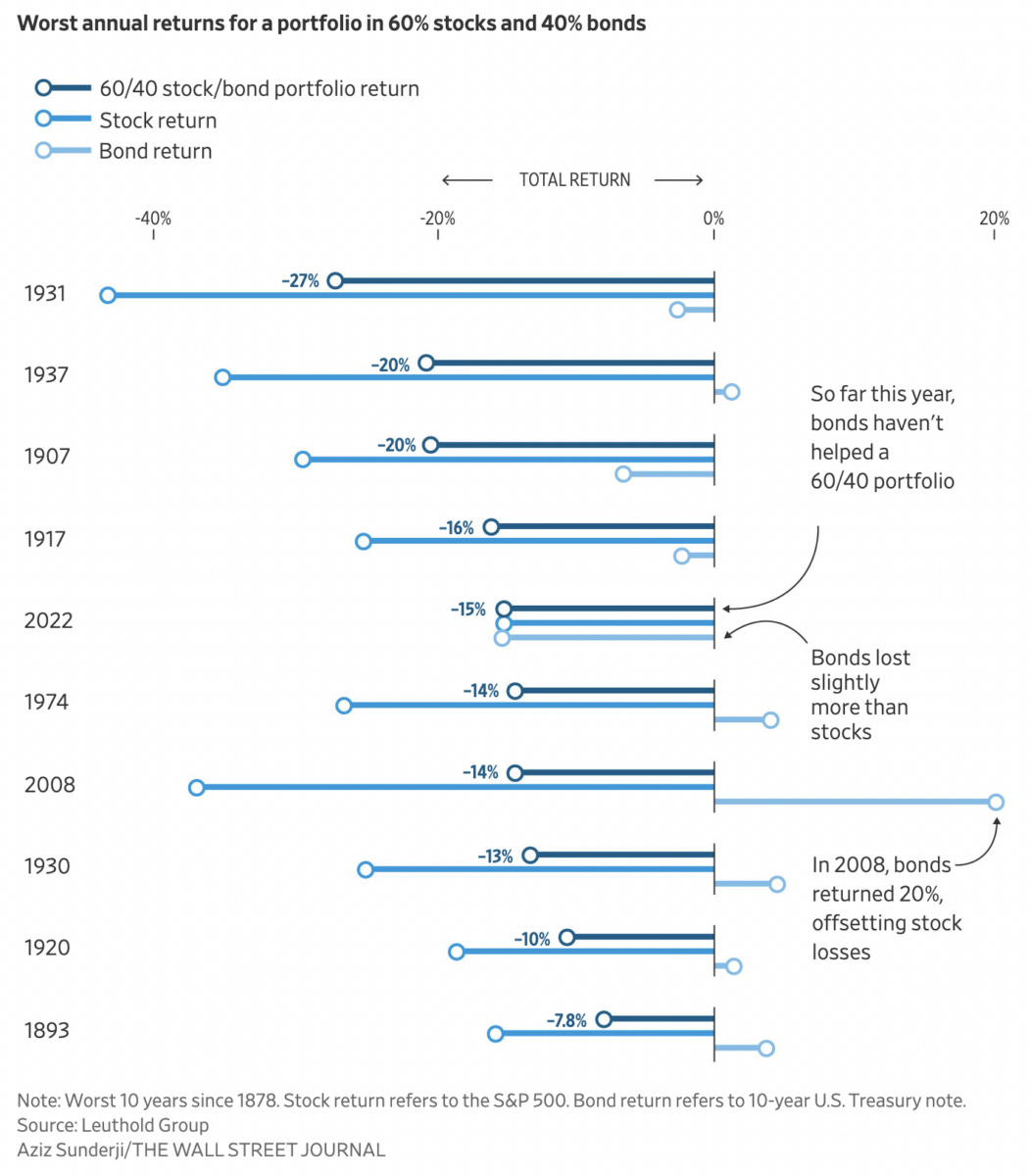

In 2022, Even The Classic 60-40 Investment Strategy Offered No Place to Hide

Source: Wall Street Journal