My Two-for-Tuesday morning train WFH reads:

• Twitter is Going Great! … and definitely does not develop features primarily to stroke Elon Musk’s delicate ego (Twitter Is Going Great) see also Two Weeks of Chaos: Inside Elon Musk’s Takeover of Twitter: Mr. Musk ordered immediate layoffs, fired executives by email and laid down product deadlines, transforming the company. (New York Times)

• Happy Talk: Pessimists seem like they’re clever and sophisticated, but—if you want to make money—take my advice: Invest like an optimist. I’m not talking wild-eyed optimists who are over-enthused about meme stocks and nonfungible tokens. Instead, I’m talking about a fundamental belief that economic setbacks are temporary and the future will be better than the past. Struggling to stay cheery amid 2022’s rotten financial markets? Here are five reasons for optimism. (HumbleDollar)

• Setting the Record Straight on Crypto, FTX and Sam Bankman-Fried, Jamie Dimon, and Financial Regulators: No one should be shocked by FTX’s demise. The fiction if not fraud of crypto and its collapse were not hard to see as long as you weren’t on the payroll of FTX/crypto directly or indirectly and didn’t let FOMO and greed cloud your judgment. (Better Markets) see also Speechless: I asked a question on Twitter a few days ago wondering who would be the Lehman Brothers of this crypto credit cycle. Many said it would be FTX, and I honestly laughed it off. I never believed they would go down — and yet, here we are. The catalyst for their downfall is the same as it always is — a good business overextending themselves by gorging on cheap credit collateralised by high and rising valuations of assets on their balance sheet. And as money became more expensive and the cycle turned, their nakedness was exposed for all to see. (Entrepreneur’s Handbook)

• Have We Been Measuring Housing Inflation All Wrong? Focusing on rents on new leases, as commercial indexes do, gives a better read on price pressures than existing government gauges like CPI. (Bloomberg)

• ‘I Finally Had Enough.’ Real-Estate Agents Reveal Why They Canned a Client. A ghost, an over-the-top character and unwanted advances led these three pros to cut ties with their clients. (Wall Street Journal) see also Housing Industry Braces for a Downturn, but Investors Are Piling In: Beaten-down shares get a boost from reports of softening inflation (Wall Street Journal)

• This School Took Away Smartphones. The Kids Don’t Mind. Here’s what happened when a Massachusetts school decided smartphones were splintering its community. (Wall Street Journal)

• Inside the billion-dollar meeting for the mega-rich who want to live forever: Hope, hype, and self-experimentation collided at an exclusive conference for ultra-rich investors who want to extend their lives past 100. I went along for the ride. (MIT Technology Review) see also 8 billion and counting: This week, the world’s population ticks over a historic milestone. But in the next century, society will be reshaped dramatically — and soon we’ll hit a decline we’ll never reverse (ABC)

• The Decade in Fame: It engulfed everything, and look where we are now. (Slate)

• Why Ron DeSantis’s post-midterms glow up may fade: Republicans are rallying around Ron DeSantis. Will it be enough in 2024? (Vox) see also Does running for president protect Trump from legal charges? The former president wants to depict a mounting series of legal challenges as a politically motivated “witch hunt.” (Grid)

• Qatar vs. Ecuador, opening ceremony makes clear this is a World Cup like no other: Billions of dollars bought Qatar a World Cup, but not loyal fans: There was the tainted bid vote. The convoluted date shift. The endless (and tragic) construction. The allegations of alarming human rights abuses. The fear from LGBTQ fans. The climate concerns over air-conditioned outdoor stadiums. The last-minute flip-flop on beer sales. The disturbing rant from the FIFA president in what was supposed to be his greeting. (ESPN)

Be sure to check out our Masters in Business interview this weekend with Marcus Shaw CEO of AltFinance, which seeks to increase diversity across alternative asset management. The firm was co-founded by Apollo, Ares, and Oaktree with a $90 Million seed funding for initiatives to recruit students at Historically Black Colleges and Universities.

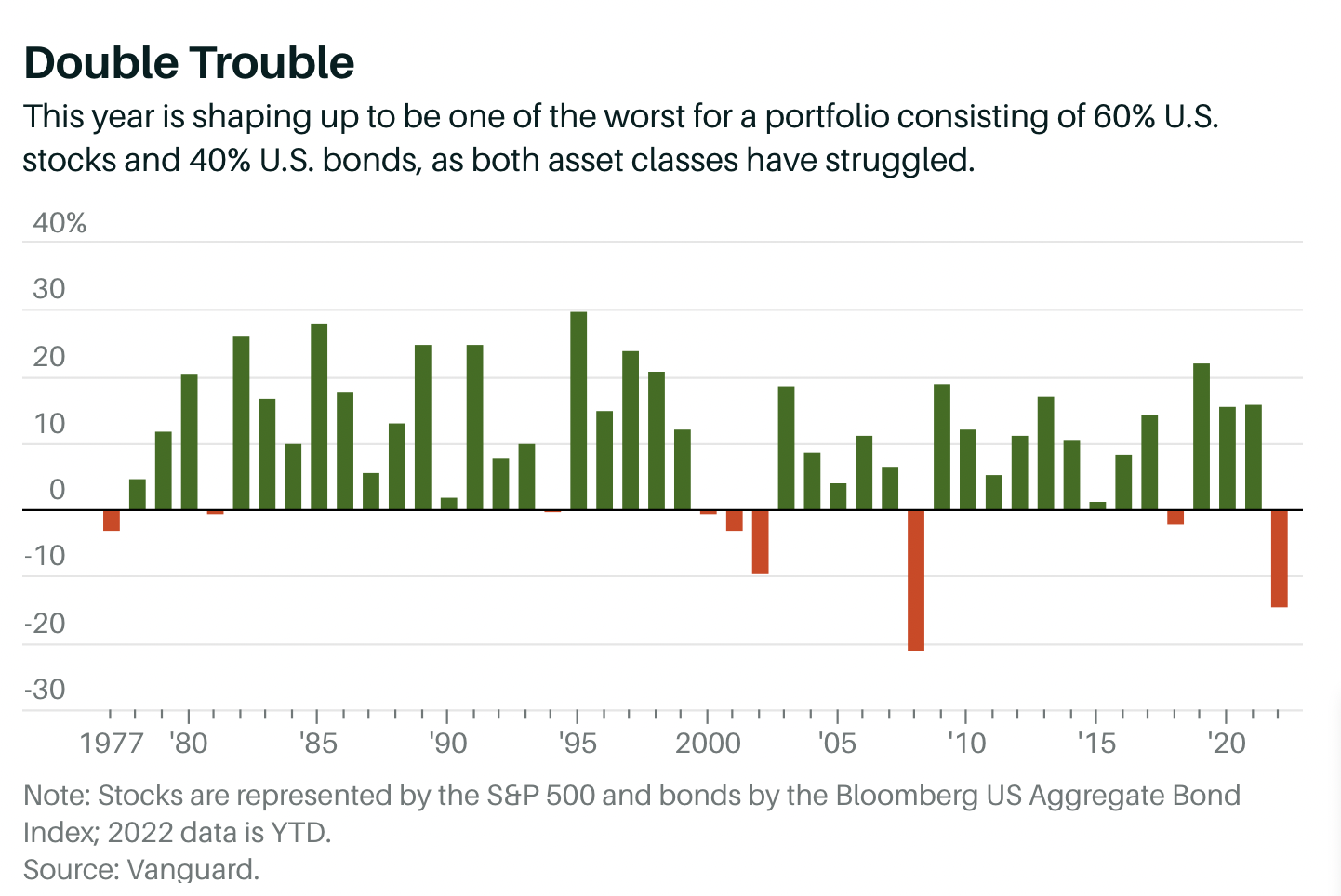

Don’t Abandon the 60/40 Investing Strategy Yet. You’ll Miss Out on Gains.

Source: Barron’s