My mid-week morning train WFH reads:

• The Death of Crypto Has Been Greatly Exaggerated, Again: Crypto’s descent into hell, rather than sending institutional investors straight for the exits, has triggered a hunt for the next big bet. (Institutional Investor)

• Why Today’s Inflation is Not a Repeat of the 1970s: I’m not a huge fan of the Federal Reserve’s current policy choices. They obviously had to do something about the persistently high inflation but I think they run the risk of overdoing it. The magnitude of their interest rate hikes increases the risk of something breaking in the financial system. (A Wealth of Common Sense) see also When Your Only Tool is a Hammer: The FOMC seems to believe that middle-class purchases of homes and automobiles are where they can best strangle inflation. This is needlessly damaging at best, and ineffective at worst. (The Big Picture)

• How job openings explain everything in the economy and the markets right now: The level and trajectory of this metric has been very telling. (TKer)

• U.S. workers have gotten way less productive. No one is sure why. Bosses and economists are troubled by the worst drop in U.S. worker output since 1947 Image without a caption. (Washington Post)

• Why Musicians & Other Creative Professionals Will Soon Get Their Revenge on the Old Guard: I finally have happy predictions about the future of arts & entertainment. (The Honest Broker)

• Elon Musk’s Twitter Faces Exodus of Advertisers and Executives: At least five Twitter executives have left in recent days, as one of the world’s largest ad companies said clients should pause spending on the social media platform. (Dealbook)

• Silicon Valley’s Unbridled Euphoria Runs Into Economic Reality: Once-buzzy start-ups had held out against the new reality that the good times are over. No longer. (New York Times)

• Can a new form of cryptography solve the internet’s privacy problem? Techniques which allow the sharing of data whilst keeping it secure may revolutionise fields from healthcare to law enforcement . (The Guardian)

• How Biden Uses His ‘Car Guy’ Persona to Burnish His Everyman Image: In the run-up to the midterm elections next month, President Biden is hoping his gearhead reputation will appeal to some parts of the Trump base. (New York Times)

• Taylor Swift Makes History as First Artist With Entire Top 10 on Billboard Hot 100, Led by ‘Anti-Hero’ at No. 1: Swift passes Drake, who claimed nine of the top 10 in September 2021. (Billboard)

Be sure to check out our Masters in Business interview this weekend with The Jeremies! Professor Jeremy Siegel of Wharton, and Jeremy Schwartz, Chief Investment Officer at the $75 billion Wisdom Tree Asset Management. Siegel is the author of Stocks For The Long Run; Schwartz is his research partner/editor. The two discuss the sixth edition of SFTLR, the latest and most widely expanded edition of the investment classic.

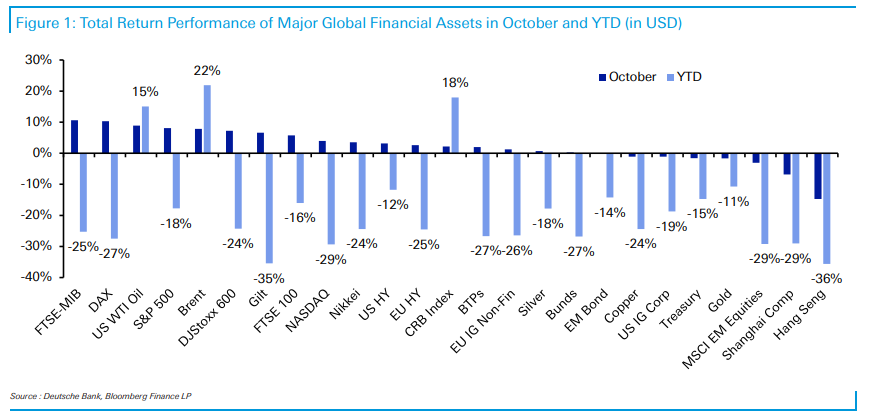

Assets performance (in USD terms) in October and YTD

Source: Deutsche Bank

Sign up for our reads-only mailing list here.