My back-to-work morning train WFH reads:

• Wall Street’s 2023 Outlook for Stocks: There’s hundreds of pages of research and analysis that come with these strategists’ forecast. The general themes: Most Wall Street firms expect the U.S. economy to go into recession some time in 2023. Many believe forecasts for 2023 earnings have more room to get cut, and some believe those downward revisions mean lots of volatility for stocks in the early part of 2023. (TKer)

• Burden of proof is on the inflation hawks now: Reality shows a “soft landing” in 2023 in the United States taking shape. We avoid a recession, we keep the job-full recovery, and inflation moves back down. Hawks, it’s time to join us in reality. (Stay-At-Home Macro) see also Meet the Man on a Mission to Expose Sneaky Price Increases: Edgar Dworsky has become the go-to expert on “shrinkflation,” when products or packaging are manipulated so people get less for their money. (New York Times)

• The Buy And Hold Mindset: When markets are in turmoil, like they have been for most of this year, I like to have a buy-and-hold mindset when it comes to making new investments. It is hard to know when you’ve reached the bottom and can start buying again, but if you think about a ten or twenty-year hold, then it becomes a bit easier. (A VC)

• Holiday Eye on the Market: the YUCs, the MUCs, FTX, the Gensler Rule and the Summers Rule Non-Fungible Trainwreck. First, I’m pleased to offer readers of the Eye on the Market a holiday gift that I commissioned for you: a one-of-a-kind “APE Innovation ETF” non-fungible token. Just copy and paste the image below and your digital journey will begin. Maybe hang it in the digital living space that you bought this year 1. (JPM Private Bank)

• Morgan Stanley’s Mike Wilson Recalls His Best Investment—His First. The often-bearish US equity strategist talks about his career year, and why he likes steering clear of the herd. (Bloomberg)

• A Big Chill Is Here for the Housing Market. Next Year Could Bring More Trouble. Affordability is still an issue, mortgage rates will remain high, and homes are sitting on the market longer. It all adds up to a stalled 2023 for real estate. (Barron’s)

• Recipe for Disaster: Reflecting on the wild volatility of the last three years in business and finance, there’s been one theme that really sticks out. It helps us all recognize a universal recipe for disaster. (KCP Group)

• Stewart Rhodes’ son: ‘How I escaped my father’s militia’. The son of militia leader Stewart Rhodes spent years plotting to help his family escape from his father’s control. Now that the elder Rhodes faces decades in prison, the rest of the family is rebuilding their lives. (BBC)

• Artemis Is Our Ticket Out Of Here: Which is why it’s so refreshing when we leave the neighborhood, if at first only for a little while. The image above is a selfie taken by the uncrewed Orion spacecraft on Monday, halfway through the 26-day Artemis I mission, from its position in orbit around the moon. In the background of the selfie are two cosmic bodies, and if you didn’t already know, you’d likely guess wrong which was the planet and which was its satellite. Get far enough away from Earth and close enough to the moon, and the Earth looks the smaller of the two. Get even farther away and the Earth will be smaller than most things. (Defector)

• Stephen Sondheim’s Lesson for Every Artist: As he worked on his final musical, the legendary composer discussed the ideas he’d abandoned, the minutiae of his technique, and the lesson that any artist must learn. (New Yorker)

Be sure to check out our Masters in Business next week with Luis Berruga, CEO of Global X. The firm manages $40 billion dollars across nearly 100 thematic ETFs.

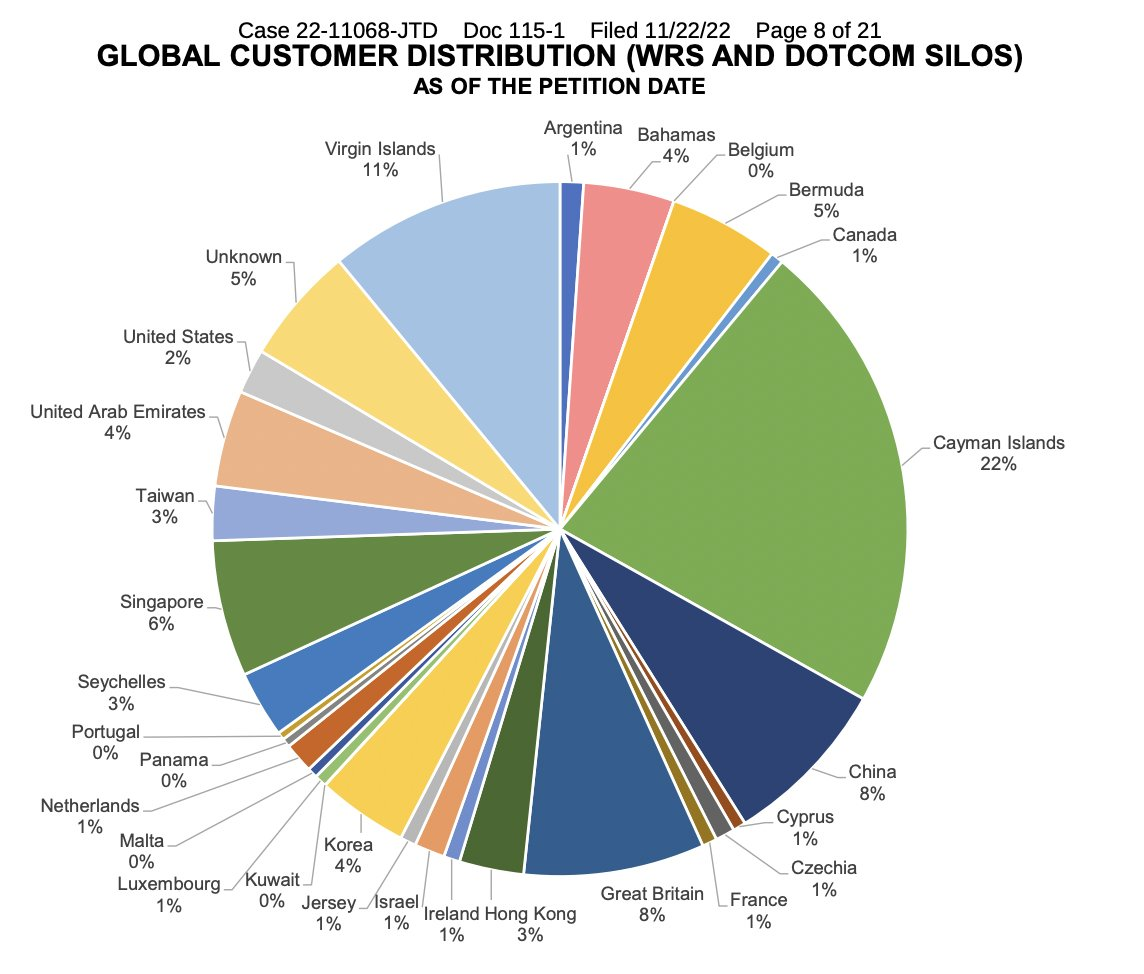

FTX customers locations (via bankruptcy proceedings)

Source: @lmatsakis

Sign up for our reads-only mailing list here.