My Two-for-Tuesday morning train WFH reads:

• Here Come the Crypto Hypocrites: Don’t believe anyone who says the FTX crash was the regulators’ fault. (The Atlantic) see also Let crypto burn: Just say no to legitimacy-inferring regulation. (Financial Times Alphaville)

• Elon Musk gambled big on Twitter. Tesla is going to pay the price. So now the question becomes: How does Musk keep his new purchase afloat? Having observed Musk in action for years there is one troubling option I suspect he may pursue: raid Tesla. But siphoning cash from Tesla, Musk’s only profitable company, just as serious competition is toppling its dominance, should concern Tesla’s investors. And given his obsession with Twitter, they may well ask: How far will Elon go to save Twitter at Tesla’s expense? (Business Insider)

• The (American) age of ETFs: Rocky markets have meant that this is a bad year for fund launches in general, with only 576 open-ended funds inaugurated in 2022, according to Morningstar. That is the lowest in at least a decade. But the ETF keeps gobbling up market share. So far this year there have been 407 ETFs launched in the US compared just 169 other types of open-ended funds — smashing past the previous record. (Financial Times Alphaville) see also How a Basket of ETFs Mimicked the Performance of Top Hedge Funds: Research shows how allocators can benefit from the thinking of top managers, without the high costs and other downsides. (Institutional Investor)

• The best financial strategies for surviving a recession in 2023 from 3 top advisers: The past 12 months featured some relatively grim milestones—including the highest inflation in four decades and the first truly durable bear market since the Great Recession. That concatenation of bad news poses two challenges for investing pros. (Fortune)

• 11 Hours With Sam Bankman-Fried: Inside the Bahamian Penthouse After FTX’s Fall Billions of dollars of customer money is missing, investigators are circling, and the 30-year-old ex-CEO admits his company broke its own rules. (Businessweek) see also A forgotten banking scandal suggests FTX is the tip of the crypto iceberg: Fraud, money laundering, and corruption on a global scale, yet regulators seem asleep at the wheel. This has happened before… (Dirty Bubble Media)

• Josh Brown and Barry Ritholtz want rock-star culture and rocketing growth in one RIA so they hired Jay Tini to manage the paradox (RIABiz)

• US sees surge in children under five hospitalized for respiratory viruses: Wave of illness caused by RSV, influenza and other infections has seen more than three-quarters of pediatric hospital beds full. (The Guardian) see also Kids with long covid have trouble finding care: Kids may have lower risk, but the dozen or so dedicated long covid clinics aren’t enough to meet demand. (Grid)

• BP, HSBC and Unilever said they’d quit Russia in March, so why are they still there? British companies were quick to announce they were leaving after the invasion of Ukraine, but nine months on many are still there. The Sunday Times examines who remains and why (The Times)

• Trump’s call to suspend Constitution not a 2024 deal-breaker, leading House Republican says: Still, Rep. Dave Joyce said on “This Week” that Trump’s idea was “fantasy.” (ABC News) see also Top Republicans stay silent on Trump’s call to terminate the Constitution: Even though GOP leaders are so far staying away, the White House has strongly rebuked Trump’s comments, calling them “anathema to the soul of our nation.” (NBC News)

• ‘Planes, Trains and Automobiles’ at 35: An Oral History of One of the Most Beloved Road Movies Ever Made. Starring Steve Martin and John Candy, the John Hughes road trip comedy had a nearly four-hour runtime at one point. Hear from cast, crew, and Hughes’ family about the classic. (Vanity Fair)

Be sure to check out our Masters in Business next week with Luis Berruga, CEO of Global X. The firm manages $40 billion dollars across nearly 100 thematic ETFs.

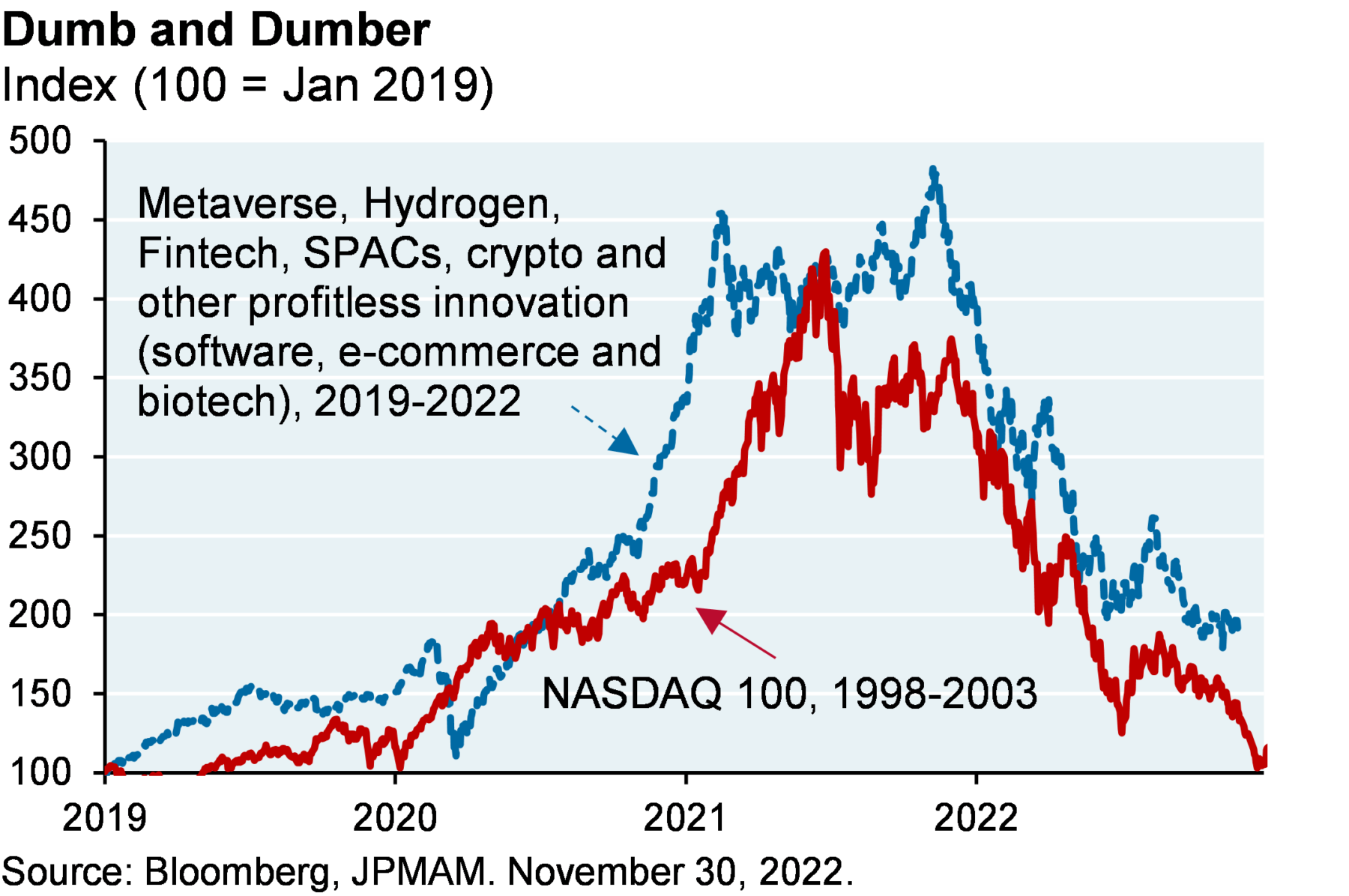

Non-Fungible Trainwreck

Source: JPM