My mid-week morning train WFH reads:

• Mutual Funds That Consistently Beat the Market? Not One of 2,132. No actively managed stock or bond funds outperformed the market convincingly and regularly over the last five years. Index funds have generally been better. (New York Times)

• BlackRock Has Been Targeted by a Political Attack-Style Campaign for Being ‘Woke.’ The Asset Manager is Undeterred. Simply stated, WOKE = Marketing (Institutional Investor) see also Why the GOP Will Lose Its War on ‘Woke Wall Street’ Republicans can’t accept that they dislike modern capitalism, so they’re blaming “ESG” instead. (New York Magazine)

• Looney Tunes is not macroeconomics: Wile E. Coyote is not a serious forecast. It is not how we should think about 2023. (Stay-At-Home Macro)

• Goldman’s guide to the rest of your life:What Goldman Sachs has attempted in a new report imaginatively titled ‘The Path to 2075’. This updates long-term growth predictions made in 2003 and 2011, primarily about the prospects for the BRICs economies (a name famously coined by Jim O’Neill, Goldman’s head of economic research when the first report came out). (Financial Times Alphaville)

• Music Deal Maker With Rights to Tens of Thousands of Songs Faces Chorus of Investor Unease: Shares in Hipgnosis Songs Fund have fallen sharply below their net asset value. (Wall Street Journal)

• The Button That Could Have Changed the Internet: The “Oh, Yeah?” button, it should be noted, was not truly about verifying information or locating “truth.” Berners-Lee wasn’t suggesting that ontological certitude would arise from the web mob’s ranking of websites that distributed the most accurate information. Rather, the “Oh, Yeah?” button would suggest a more paradigmatic truth—that is, a reasonable approximation of whether something you read on the web was considered generally in the realm of credible by most people. (Slate)

• AI Homework: It happened to be Wednesday night when my daughter, in the midst of preparing for “The Trial of Napoleon” for her European history class, asked for help in her role as Thomas Hobbes, witness for the defense. I put the question to ChatGPT, which had just been announced by OpenAI a few hours earlier. (Stratechery)

• Dispatch from Kherson: Inside Ukraine’s battle to win the infrastructure war: Russia is waging a war on infrastructure. Ukrainian civilians are working 24/7 to repair the damage. (Grid) see also Why The Sanctions Against Russia Aren’t Working. Yet. But Russia has not been brought to its knees. Far from it: forecasters say Russian GDP for 2022 will likely fall, but only about 3.3−3.4 percent. Inflation, meanwhile, will likely end the year at roughly 12 percent: bad, but not close to as painful as predicted. And foreign direct investment? Estimates say it will fall by a mere 1 percent. Meanwhile, the war in Ukraine grinds on. (NPR)

• A Bad Week for Seditionists: This was a good week for the Department of Justice. It was a bad week for Trump and the seditionists. (Teri Kanefield)

• A Pizza Pilgrimage to Campania: For an Italian tour that messes nicely with tradition, head to Naples, the birthplace of pizza, where some masterful pizzaioli have elevated this humble treasure to tasting-menu status. (New York Times)

Be sure to check out our Masters in Business next week with Luis Berruga, CEO of Global X. The firm manages $40 billion dollars across nearly 100 thematic ETFs.

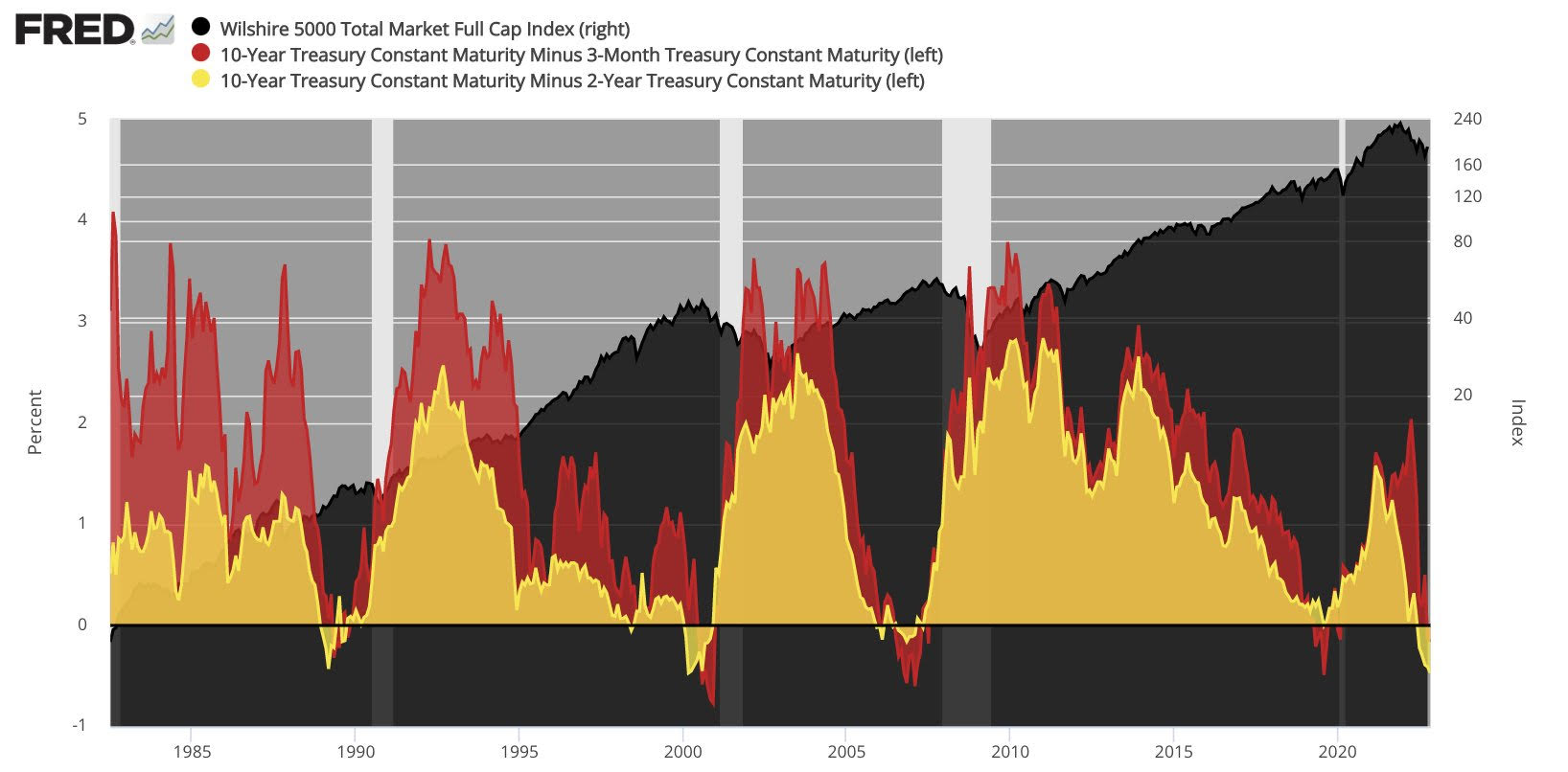

Visualization of all yield curve inversions vs. total US stock market since 1980

Source: @maxjanderson

Sign up for our reads-only mailing list here.