My end-of-week morning train WFH reads:

• Will Remote Work Continue in 2023? With recession worries growing, power may shift back to employers and threaten perks gained during the pandemic. (Bloomberg)

• The billionaire vibe shift: It was the year the billionaires showed who they really are. (Vox) see also The ultrarich are getting cozy in America’s tax havens at everyone else’s expense: More states are slashing or eliminating taxes, lessening the burden mostly for the wealthy. What does that cost the rest of us? (Vox)

• The World’s Love Affair With Japanese Cars Is Souring: Brands like Toyota have been global favorites for decades. How did they get the shift to electric so wrong? (Businessweek)

• 5 ETF Predictions for 2023: 2023 marks the 30th anniversary for the US ETF industry (more on that in a moment) and I plan on going five for five this year. I can feel it. Following a highly impressive 2022, what will happen in the ETF world this year? First, a quick note: several of my predictions are more contingent than usual on financial market conditions. Obviously, forecasting markets is extremely difficult, if not impossible. (ETF Educator)

• The Nokia Risk: Small countries, big firms, and the end of the fifth Schumpetarian wave. (Phenomenal World)

• Fans Search for Coveted Film Merch—Five Decades After a Movie’s Release: Insider T-shirts and hats for long-ago films—including those that didn’t have merch to begin with—are never-hotter thanks to bootleg sites. (Wall Street Journal)

• The Strangely Beautiful Experience of Google Reviews: Glimpses of humanity in an unlikely corner of the internet. (Longreads)

• How To Speak Honeybee: Advanced technologies like A.I. are enabling scientists to learn that the world is full of intelligent creatures with sophisticated languages, like honeybees. What might they tell us? (NOEMA)

• The Secret to Ron DeSantis’s Success? Ignore Donald Trump—and Attack Business Instead: Can the Florida governor’s fight with corporate America win back the White House for Republicans? (Businessweek)

• Joel Embiid’s Process: How The 76ers Star Wants To Go ‘From Rich To Wealthy’ “From the early days, Jo was always incredibly inquisitive, asking you lots of questions, wanting to learn, trying to be a sponge to how he can grow,” says Rubin, who recalls Embiid coming to his office to observe meetings. “Different than a lot of NBA players, Jo is very financially disciplined. He may save more and invest more, and spend less, than maybe any player.” (Forbes)

Be sure to check out our Masters in Business interview this weekend with John Mack, former CEO of Morgan Stanley. He was the architect of the firm’s merger with Dean Witter and then returned as CEO to lead the firm through the financial crisis. He is the author of a new autobiography, “Up Close and All In: Life Lessons from a Wall Street Warrior.”

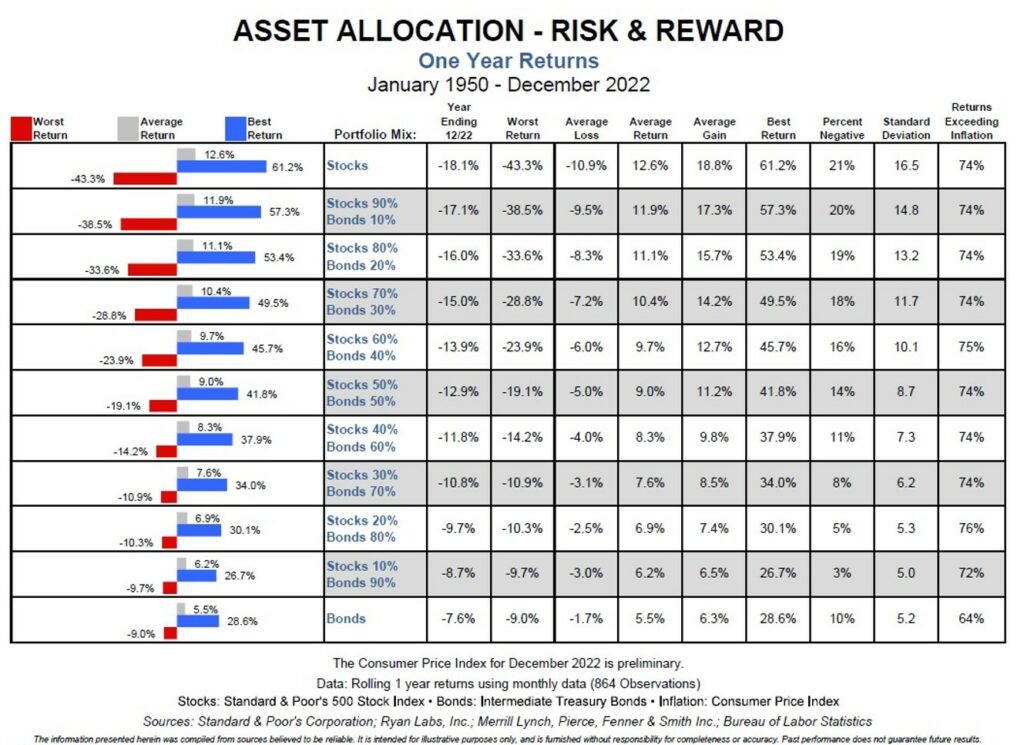

S&P 500 stocks Returns, 1950-2022, using rolling monthly data

Source: @Preston_mcswain

Sign up for our reads-only mailing list here.