My back-to-work morning train WFH reads:

• Economist Says His Indicator That Predicted Eight US Recessions Is Wrong This Year: Cambell Harvey’s work showed link between curve inversion and growth Strong labor demand, risk avoidance support US economy now. (Bloomberg)

• Wall Street’s sleuth of bears is growing: Stocks kicked off the new year on a positive note, with the S&P 500 climbing 1.4% last week. The index is now up 8.9% from its October 12 closing low of 3,577.03 and down 18.8% from its January 3, 2022 closing high of 4,796.56. Meanwhile, the market’s many bears got more company. (Sam Ro) but see Everything Is Up In This Bull Market: If you’re not making money in this environment, it’s not because it’s a “bear market”. Don’t be one of those investors left holding the bag in the few remaining stocks that are not working, while almost everything else is. (All Star Charts)

• Your Investing Strategy Just Failed. It’s Time to Double Down. The standard portfolio of 60% stocks and 40% bonds just delivered one of its worst years in history. That doesn’t mean it’s a bad approach. (Wall Street Journal)

• Venture capital’s reckoning looms closer: Valuations on holdings will have to converge sooner rather than later with listed tech sector (Financial Times)

• Romer: Fed faces ‘difficult’ call to avoid overdoing rates shock: The Federal Reserve’s effort to shock the economy back to lower inflation is in its early days, making it tough for the U.S. central bank to avoid overdoing it with higher-than-needed interest rates, a top economic adviser in the Obama White House said after a fresh review of Fed policy since World War Two. (Reuters)

• Your stuff is actually worse now: How the cult of consumerism ushered in an era of badly made products. (Vox)

• What Can We Learn from Barnes & Noble’s Surprising Turnaround? Digital platforms are struggling, meanwhile a 136-year-old book retailer is growing again. But why? (Honest Broker) see also Amoeba Music asks, ‘What’s in your bag?’ and no algorithm can compete: In the long-running YouTube series, musicians divulge what they’ve bought at the legendary record store. Their answers provide an education in how to discover music. (Washington Post)

• ‘Consciousness’ in Robots Was Once Taboo. Now It’s the Last Word. The pursuit of artificial awareness may be humankind’s next moonshot. But it comes with a slurry of difficult questions. (New York Times)

• Riddle solved: Why was Roman concrete so durable? An unexpected ancient manufacturing strategy may hold the key to designing concrete that lasts for millennia. (MIT)

• Is Chelsea target Enzo Fernandez worth £105million after only 80 senior matches? Within the space of six months, the 21-year-old went his first 22 matches unbeaten with his new club, announcing himself on the European stage by shining in midfield as Benfica topped a Champions League group featuring Paris Saint-Germain and Juventus, then broke into Argentina’s starting XI during the World Cup and immediately established himself as an indispensable contributor to a historic triumph in Qatar. (The Athletic)

Be sure to check out our Masters in Business interview this weekend with John Mack, former CEO of Morgan Stanley. He was the architect of the firm’s merger with Dean Witter and then returned as CEO to lead the firm through the financial crisis. He is the author of a new autobiography, “Up Close and All In: Life Lessons from a Wall Street Warrior.”

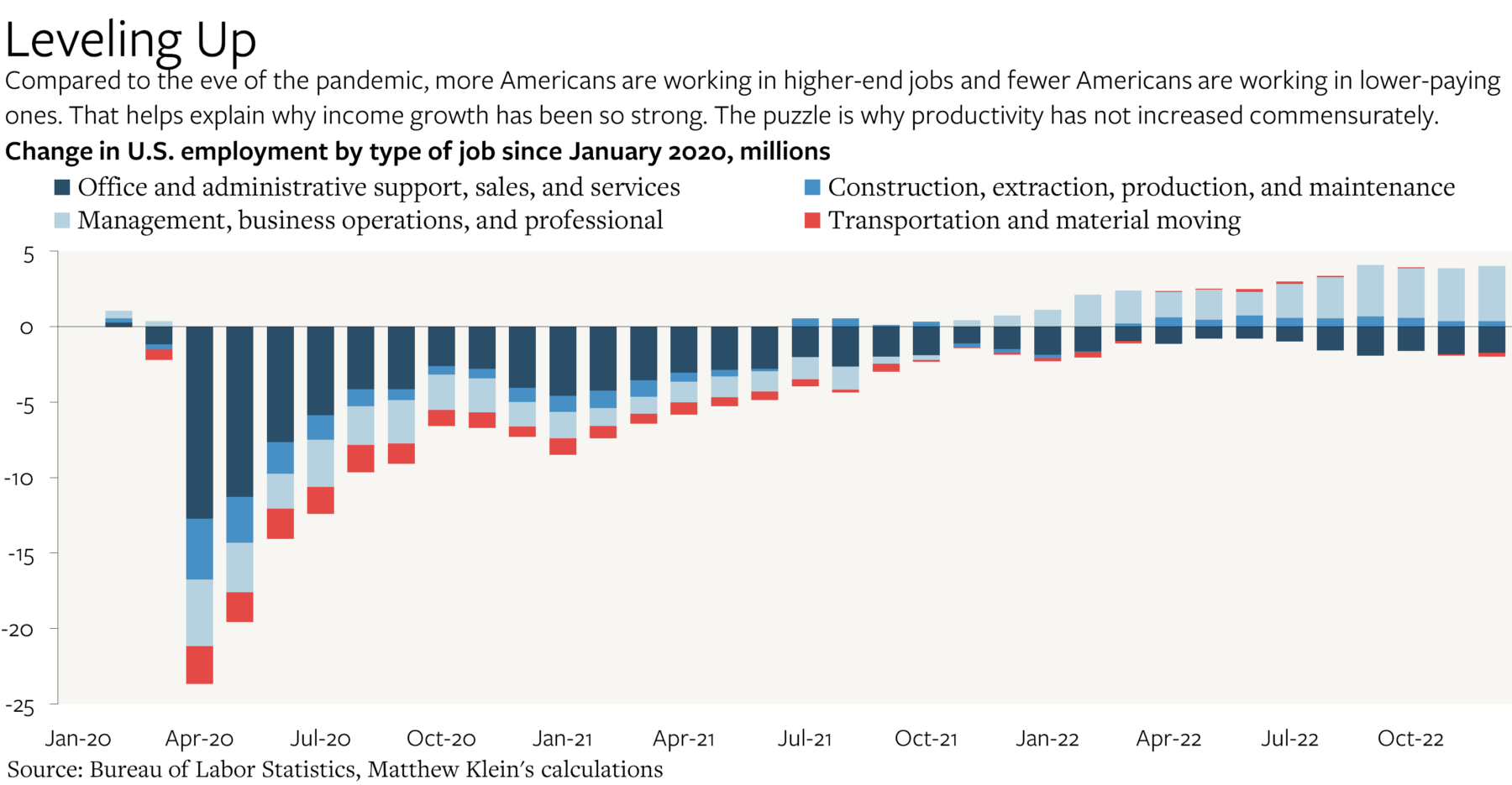

Is the U.S. Job Market Disinflationary Now?

Source: The Overshoot

Sign up for our reads-only mailing list here.