Happy MLK day! Markets are closed, but the flow never stops. Contextualize the news with our 3-day weekend reads:

• The Disappearance of the Hit-Driven Business Model: As the industry changes, where do creative producers fit in? How do we make a living and provide services for the subscriber-driven companies? How do we get paid a sustainable salary, while also having healthcare and supporting the overhead of our work, which often comes out of our own pocket? How do we push projects that may not seem obvious until they are made? Projects that are controversial, unusual, or take risks? (Dear Producer)

• The Markets Are Locked in a Game of Chicken With the Fed: Investors are betting the Fed will cut interest rates as early as the second half of the year. The central bank says otherwise. (Wall Street Journal) see also The Fed: Whose Words Carry the Most Weight: The definitive guide to the Fed-verse: Who’s who at the central bank and how to decipher what they say. (Barron’s)

• What If Tesla Is…Just a Car Company? Tesla’s aura as an elite tech disrupter dims as EV competitors multiply and improve their offerings. (Wall Street Journal)

• How Dividends Juice Your Returns in the Stock Market: The price index has gone from a little less than 18 in 1928 to more than 3,800 by the end of 2022. That is good enough for a total return of more than 21,500% or an annualized 5.8% per year. (A Wealth of Common Sense)

• The Value of Corporate Pension Assets Fell Dramatically. Here’s Why That Doesn’t Matter. “It was a bit of a remarkable coincidence that both assets and liabilities fell by such a large but similar amount,” says Aon’s Joe McDonald. (Institutional Investor)

• How San Francisco Lost High Earners and Got Richer: The pandemic tech boom and a “donut effect” drove up average incomes in both expensive cities and less-pricey exurbs. (Bloomberg)

• What I learned from reading The Pmarca Blog Archive Ebook by Marc Andreessen. The opportunity to create something new — the proverbial blank sheet of paper. You have the ability — actually, the obligation— to imagine a product that does not yet exist and bring it into existence, without any of the constraints normally faced by larger companies..(Founders)

• Trying to Live a Day Without Plastic: It’s all around us, despite its adverse effects on the planet. In a 24-hour experiment, one journalist tried to go plastic free. (New York Times)

• The boring journey of Matt Yglesias: The Washington ur-blogger’s slightly contrarian, mildly annoying, somewhat influential, very lucrative path toward the political center. (Washington Post)

• Enter the conductrice: Will a new generation of women on the podium perpetuate the tyrannical charisma of their male predecessors or overturn it? (Aeon)

Be sure to check out our Masters in Business interview this weekend with Jennifer Grancio, CEO of Engine No. 1, where she guides the firm’s strategic vision. She previously was a founding member of BlackRock’s iShares business, where she led European, US, and global distribution, driving the growth of iShares and the global ETF industry.

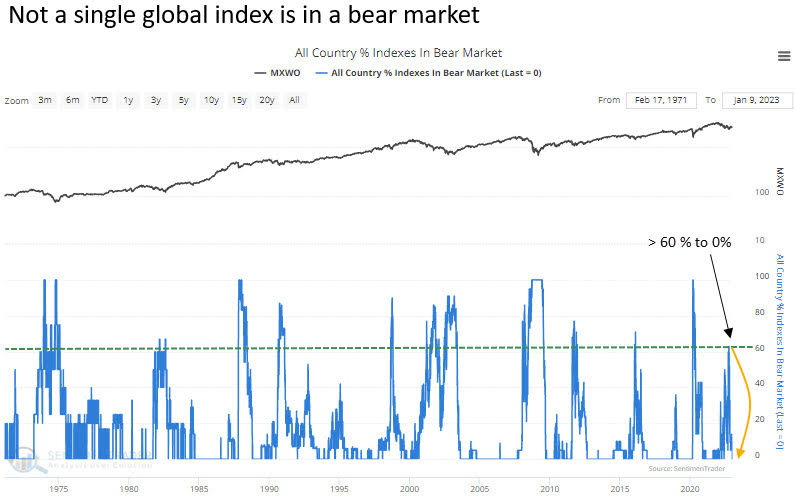

The % of global indexes in a bear market has cycled from > 60% to 0% (11th time since 1972).

Source: @DeanChristians

Sign up for our reads-only mailing list here.