My morning train WFH reads:

• Five Clues This Isn’t Just a Bear Market Rally: The S&P 500 is up 17% from the October lows, the same magnitude as the 17% rally we saw last summer. Back then, stocks rolled back over and made new lows, something most strategists on tv are saying will happen again. Well, the facts are changing for us, and as Keynes told us in the quote above, we had better change our minds as well. So here are five clues that this rally is on firmer footing and will likely continue. (Carson)

• Don’t believe what anyone says about the economy. Including me. It’s the best of times, the worst of times, the spring of hope, the winter of despair. Everyone is looking at the same set of numbers and somehow coming to opposite conclusions. (Washington Post) but see also One plausible explanation for this too-good-to-be-true economy: The most plausible explanation of all is that the pandemic and subsequent recovery were so unusual that the normal rules of economics don’t apply. (Washington Post)

• Container Shipping Costs Plunge as Consumer Spending Declines: “The price of shipping goods on vital global trade routes has fallen 85% below its peak as the cost of living crisis hits consumer spending + pandemic-related supply chain disruption eases.” (Financial Times)

• You Could Live to 100. The Trick Is Not Running Out of Money. You Could Live to 100. The Trick Is Not Running Out of Money. (Barron’s)

• New Cars Are Only for the Rich Now as Automakers Rake In Profits: With pandemic-era chip shortages fading, manufacturers are keeping inventories low — and prices high. The shift to EVs will make things worse. (Bloomberg)

• Bosses want to pay you more but give you less: A growing number of workers are going freelance, taking higher wages over benefits and job security. (Vox)

• ‘I’ll call an Uber or 911’: Why Gen Z doesn’t want to drive. Zoomers are shunning cars and driver’s licenses. Will it last? (Washington Post) see also 10 rules of productive online communication – gen Z edition: A decade from now, this piece will most likely become outdated. I’m excited to see how it will be renovated in the future. (Many One Percents)

• Is an Arctic ‘Cold War’ coming? How climate change and the war in Ukraine are driving tensions. Melting ice and geopolitics are making for a dangerous mix at the “top of the world.” (Grid)

• Astronomers Discover Our Solar System Has a Mysterious ‘Ghostly’ Glow: After accounting for all known light sources, there’s still light leftover—equal to the glow of 10 fireflies in a dark room. Where is it coming from? (Popular Mechanics)

• The Many Ways LeBron James Can Score: The Los Angeles Lakers star’s game has evolved over the past 20 years, making him a threat from all over the court — no matter how old he gets. (New York Times)

Be sure to check out our Masters in Business interview this weekend with Tim Buckley, CEO of the Vanguard Group, which manages $7.2 trillion in assets. He began his career at Vanguard 32 years ago as an assistant to then Chairman John Bogle. He previously served roles as Chief Information Officer, as well as Chief Investment Officer.

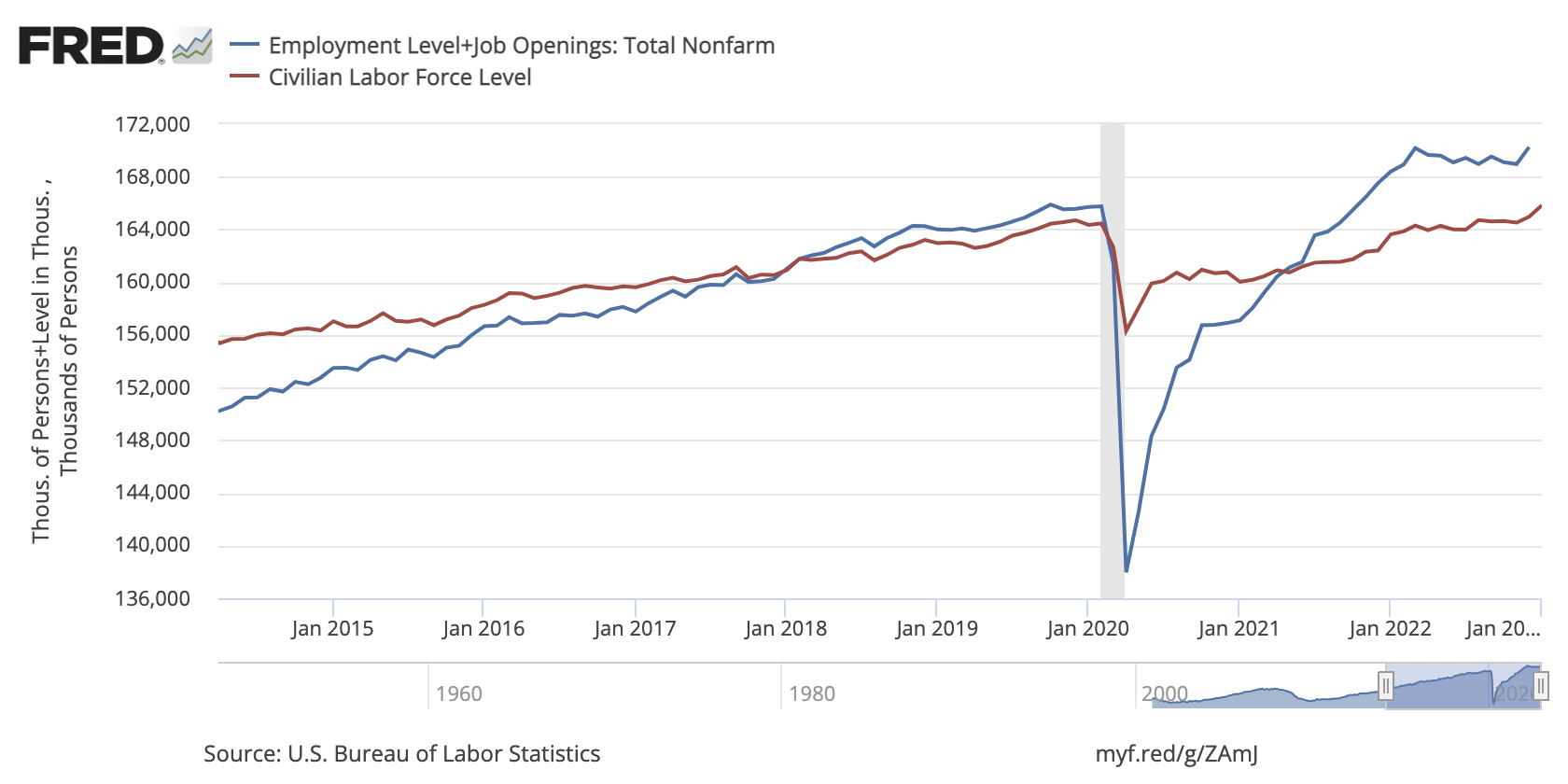

Are labor supply and labor demand out of balance?

Source: FRED

Sign up for our reads-only mailing list here.