My morning train WFH reads:

• Volcker Slayed Inflation. Bernanke Saved the Banks. Can Powell Do Both? In 140 years, American policymakers have never faced a banking crisis quite like this. (Bloomberg)

• A Tale of Two Housing Markets: Prices Fall in the West: While the East Booms In an unusual pattern, the 12 major housing markets west of Texas, plus Austin, saw home prices fall in January, while the opposite happened in the rest of the country. (Wall Street Journal) see also How Wall Street Became a Fancy Residential Neighborhood: The effort to repopulate downtown Manhattan has been a big success, but not for everyone. (Bloomberg)

• Why Investment Complexity Is Not Your Friend: When it comes to investing, keep it simple instead. (Morningstar)

• This Analyst Bootcamp Wants to Transform Training at Hedge Funds: Inspired by the Point72 Academy, Fundamental Edge aims to better prepare junior employees and career-changers for the demanding industry. (Institutional Investor)

• Traders Go Long Treasuries After Hedge Funds Unwind Short Bets: Citigroup model shows some positioning has flipped long Speculators covered SOFR, two-year shorts from record level. (Bloomberg)

• How Microsoft became tech’s top dog again: After a lost decade in which it flailed and lost its prominence in the world of tech, Microsoft is again on the rise — thanks to ChatGPT and the company’s focus on AI. (Computerworld)

• Why are young people driving less? Evidence points to economics, not preferences: Research indicates that it is changes in the circumstances of young adults that explains most of these trends. Neither better urban policy nor generational change is likely responsible for these changes—at least not yet. (Brookings)

• China Takes Its Climate Fight to the Rooftops: One in five solar panels installed worldwide last year were mounted on a Chinese roof, putting households at the forefront of efforts to decarbonize a top emitter. (Bloomberg)

• Pundit of venom and division: Newt Gingrich has not changed: Some reporters are too young to remember that Gingrich, a very effective guerrilla warrior, was a failed Speaker a quarter century ago. Facile, glib, demagogic, he always has an observation, usually more inflammatory than insightful. (The Hill)

• Steve Cohen’s Amazin’, Maddening, Money-Losing Bid to Own New York: Once a symbol of Wall Street excess, Cohen has invested lavishly in the Mets, becoming the most beloved billionaire in Queens. Is that enough to reverse team history? (New York Times)

Be sure to check out our Masters in Business interview this weekend with Ken Kencel, founder and CEO of Churchill Asset Management. The private credit firm manages $46 billion in private capital and is an affiliate of Nuveen, the $1.1 trillion asset manager of TIAA. Churchill was the top U.S. private equity lender in 2022 and was “Lender of the Year” according to M&A Advisor. Kencel was named one of private credit’s 20 power players.

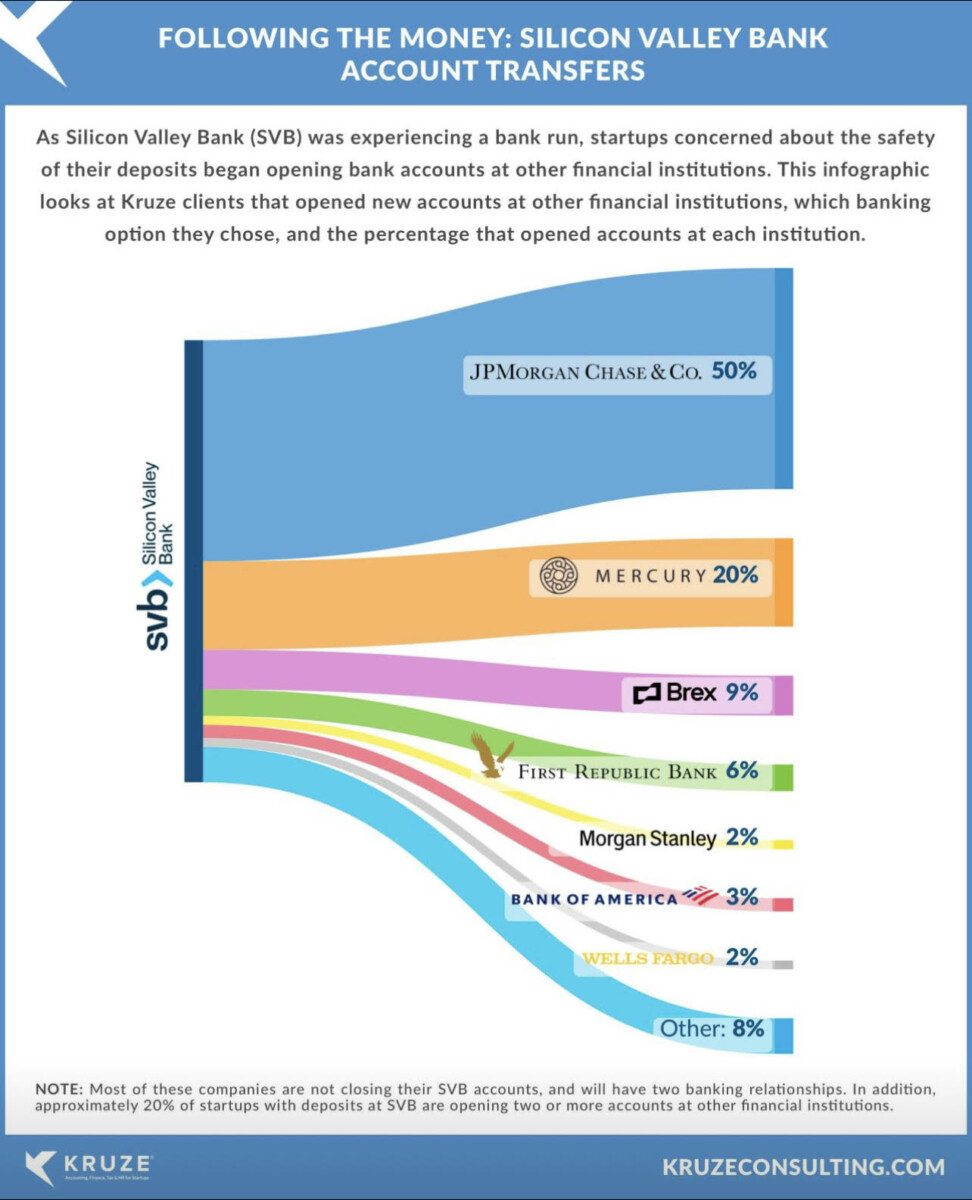

Where did SVB deposits go?

Source: The Basis Point

Sign up for our reads-only mailing list here.