My Two-for-Tuesday morning train reads:

• Bank Runs, Now & Then: The Panic of 1907 would probably be more famous if it wasn’t overshadowed by the Great Depression just a couple of decades later. It lasted 15 months and saw GDP decline an estimated 30% (even more than the Great Depression). Commodity prices crashed. Bankruptcies exploded. The stock market fell 50%. The unemployment rate went from 2.8% to 8%. (A Wealth of Common Sense) see also A Reverse Minsky Moment: Silicon Valley Bank’s collapse will make all the headlines, but what happened in the bond market deserves a lot of attention. The 2-year yield collapsed over the last two days to an extent only seen around historical events. Since 1990, the only other times we saw a decline of this magnitude was after the 9/11 attack, when Lehman Failed, when the TARP vote failed, and this week, when SVB failed. (Irrelevant Investor)

• How the Weekend-Long Freakout Over Silicon Valley Bank Ended: And why the worst bank failure since 2008 happened in the first place. (Slate)

• Profit margins are becoming a key controversial issue in the inflation discourse: Why are companies still charging high prices for stuff? (TKer) see also How ‘Excuseflation’ Is Keeping Prices — and Corporate Profits — High: One-off disruptions can provide cover for companies to keep prices high. (Bloomberg)

• Yale Invests This Way. Should You? Yale University’s endowment has earned spectacular returns in hedge funds, private equity and other ”alternative assets.” Investors hoping to mimic the school need to understand what has made it successful. (Wall Street Journal)

• Waluigi Effect (mega-post) In this article, I will present a mechanistic explanation of the Waluigi Effect and other bizarre “semiotic” phenomena which arise within large language models such as GPT-3/3.5/4 and their variants (ChatGPT, Sydney, etc). This article will be folklorish to some readers, and profoundly novel to others. (LessWrong).

• They Swore the Ferrari Purosangue Would Never Exist. It Does, and It Howls: Through snow and mud and mountains, the first SUV from a brand that famously said they’d never make one is a $393,000 speed machine. Here’s what it’s like to drive (Businessweek)

• The haters and conspiracy theorists back on Twitter: Hundreds of accounts that were recently allowed back on Twitter have been spreading abuse or misinformation, a BBC investigation has found. (BBC) see also Elon Musk Is Spiraling: One Elon is a visionary; the other is a troll. The more he tweets, the harder it gets to tell them apart. (The Atlantic)

• How To Fill Out Your Men’s NCAA Tournament Bracket Like A Pro (Sorry, sorry — “student-athlete.”) (fivethirtyeight)

• Physicists Are Searching for Signs of a Second ‘Dark’ Big Bang to Solve a Major Mystery: Dark matter in the universe might be so mysterious because it has a completely different origin to the rest of the cosmos, a new theory proposes. (Vice) see also Ripples in Spacetime Are Passing Through You Right Now. This Mission Will Reveal Their Secrets. At the European Space Agency’s main technology hub in the Netherlands, a futuristic space mission that will uncover cosmic mysteries is taking shape. (Vice)

• The Oscars Got This One Right: Everything Everywhere All at Once got its fairy-tale ending. (The Atlantic).

Be sure to check out our Masters in Business interview this weekend with Rich Bernstein of Richard Bernstein Advisors (RBA), which was founded in 2009 and is running $14.6B in assets. Previously, he was Chief Investment Strategist at Merrill Lynch, where he had worked for 21 years. Bernstein was named to the Institutional Investor’s “All-America Research Team” 18 times and has been inducted into the Institutional Investor “Hall of Fame.” He is the author of “Navigate the Noise: Investing in the New Age of Media and Hype.”

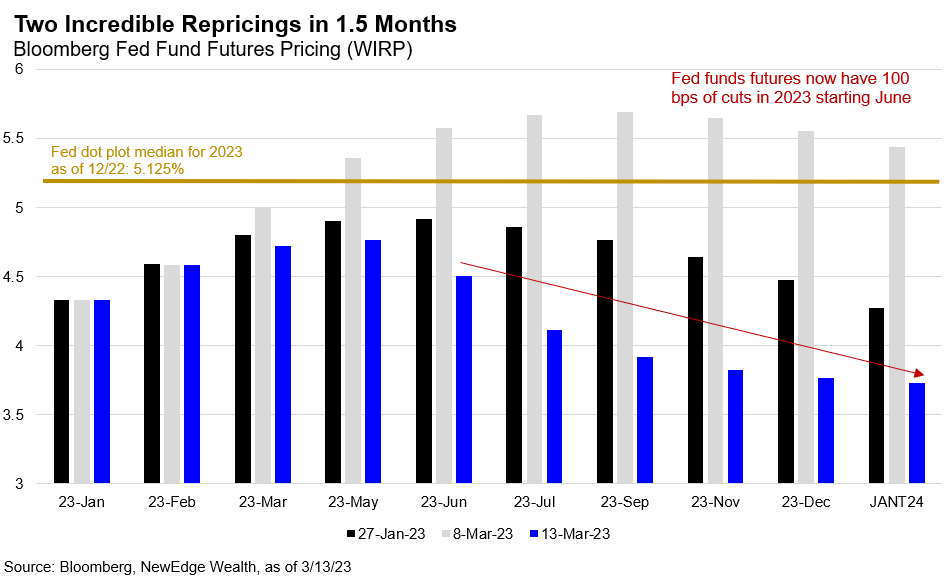

A sub 5% terminal rate and 100 bps of cuts beginning in June is priced into shifting expectations for Fed rates.

Source: Cameron Dawson