Programming note: Morning Reads will be in Dallas Thursday and Friday — we will be back on the weekend…

My mid-week morning train reads:

• Dissecting Goldman’s gory $2.25bn SVB equity issue Well that escalated quickly. (Financial Times)

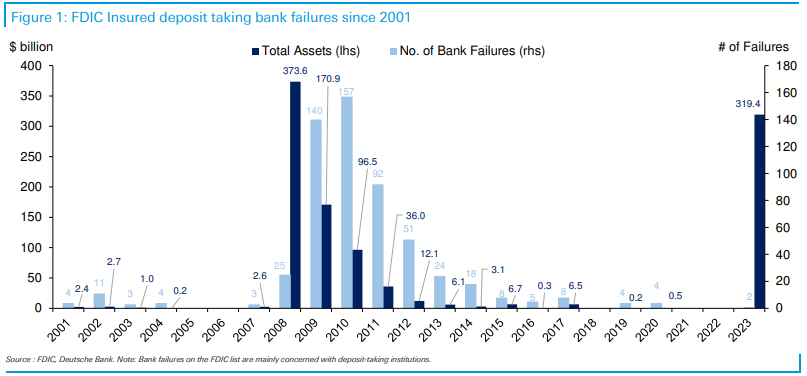

• Whose Fault is it Anyway: It has been 872 days since a bank failed in the United States. This was the longest streak on record. We’re now at day zero. Silicon Valley bank went down on Friday. Signature Bank last night. These are the second and third largest bank failures in history behind Washington Mutual during the GFC. (Irrelevant Investor)

• Three Million U.S. Households Making Over $150,000 Are Still Renters: High cost of homeownership and a tight housing market drive demand for rental properties. (Wall Street Journal)

• How Silicon Valley Turned on Silicon Valley Bank: The fallout threatens to engulf the startup world—and has exposed a new set of vulnerabilities for the banking system. (Wall Street Journal) see also The End of Silicon Valley Bank—And a Silicon Valley Myth: We are still learning exactly how much of this industry’s genius was a mere LIRP, or low-interest-rate phenomenon. (The Atlantic)

• Fiscal Justice Investing Is Changing the Municipal Bond Market: A new generation of investors is imbuing that traditional sense of purpose with an awareness of those who have been historically underserved. (Worth)

• Meta gives up on NFTs for Facebook and Instagram: Meta is moving on from more crypto projects, even though NFTs / digital collectibles were once pitched as part of its ‘metaverse’ future. (The Verge)

• How fake sugars sneak into foods and disrupt metabolic health: Artificial sweeteners and other sugar substitutes sweeten foods without extra calories. But studies show the ingredients can affect gut and heart health. (Washington Post)

• Inside the Bro-tastic Party Mansions Upending a Historic Austin Community: They have swimming pools, dozens of beds, and at least one stripper pole in a backyard school bus (you read that right). Locals say they’re turning a vulnerable community into a “theme park” for hard-partying tourists. (Texas Monthly)

• Physicists Are Searching for Signs of a Second ‘Dark’ Big Bang to Solve a Major Mystery: Dark matter in the universe might be so mysterious because it has a completely different origin to the rest of the cosmos, a new theory proposes. (Vice)

• Brett Goldstein Faces Life After ‘Lasso’ The Apple TV+ show’s breakout star is preparing to play a Marvel movie god when he’s not working on the hit streaming series “Shrinking.” But what he’s really after is human connection. (New York Times)

Be sure to check out our Masters in Business interview this weekend with Rich Bernstein of Richard Bernstein Advisors (RBA), which was founded in 2009 and is running $14.6B in assets. Previously, he was Chief Investment Strategist at Merrill Lynch, where he had worked for 21 years. Bernstein was named to the Institutional Investor’s “All-America Research Team” 18 times and has been inducted into the Institutional Investor “Hall of Fame.” He is the author of “Navigate the Noise: Investing in the New Age of Media and Hype.”

563rd US bank failure since 2001

Source: Jim Reid, DB

Sign up for our reads-only mailing list here.

Morning reads will be in Dallas Thursday and Friday — we will be back on the weekend…