My back-to-work morning train WFH reads:

• The Battle Over TikTok Is Just Starting. Here Are the Potential Outcomes—and the Most Likely Winners. Americans spent 53 billion hours on TikTok last year, according to one Wall Street estimate. If the service is banned in the U.S., much of that time could go to Meta, YouTube, and Snap. What it all means for stocks. (Barron’s)

• Silicon Valley Bank’s risk model flashed red. So its executives changed it. Focused on profits, leaders made decisions that foreshadowed the bank’s surprise failure. (Washington Post)

• The Red Hot Rubble of East New York: One of the poorest neighborhoods in Brooklyn is suddenly the focus of both private speculators and City Hall, which wants to build thousands of units of affordable housing there — and by announcing its plans is fueling a land rush. (New York Magazine)

• What Is ChatGPT Doing … and Why Does It Work? The first thing to explain is that what ChatGPT is always fundamentally trying to do is to produce a “reasonable continuation” of whatever text it’s got so far, where by “reasonable” we mean “what one might expect someone to write after seeing what people have written on billions of webpages, etc.” (Stephen Wolfram)

• ‘This is like a movie’: Ukraine’s secret plan to convince 3 Russian pilots to defect with their planes: their planes (Yahoo News)

• Your Brain Could Be Controlling How Sick You Get—And How You Recover: Scientists are deciphering how the brain choreographs immune responses, hoping to find treatments for a range of diseases. (Scientific American)

• The Twitter I Love Doesn’t Exist Anymore: At its best, the platform was a reminder that there are quick-witted and even wise people in the world with ideas to share. (The Atlantic)

• A Dumpling May Be Taiwan’s Most Potent (and Delicious) Soft Power Weapon: The restaurant chain Din Tai Fung’s founder created a global phenomenon, one serving of “xiao long bao” at a time. (Bloomberg)

• How Alvin Bragg Resurrected the Case Against Donald Trump: A year ago, the investigation into the former president appeared from the outside to be over. But a series of crucial turning points led to this week’s indictment. (New York Times)

• Dungeons & Dragons’ Epic Quest to Finally Make Money: With Honor Among Thieves soon to hit theaters, can Hasbro overcome 50 years of D&D business disasters without enraging its fan base? (Businessweek)

Be sure to check out our Masters in Business interview this weekend with Ken Kencel, founder and CEO of Churchill Asset Management. The private credit firm manages $46 billion in private capital and is an affiliate of Nuveen, the $1.1 trillion asset manager of TIAA. Churchill was the top U.S. private equity lender in 2022 and was “Lender of the Year” according to M&A Advisor. Kencel was named one of private credit’s 20 power players.

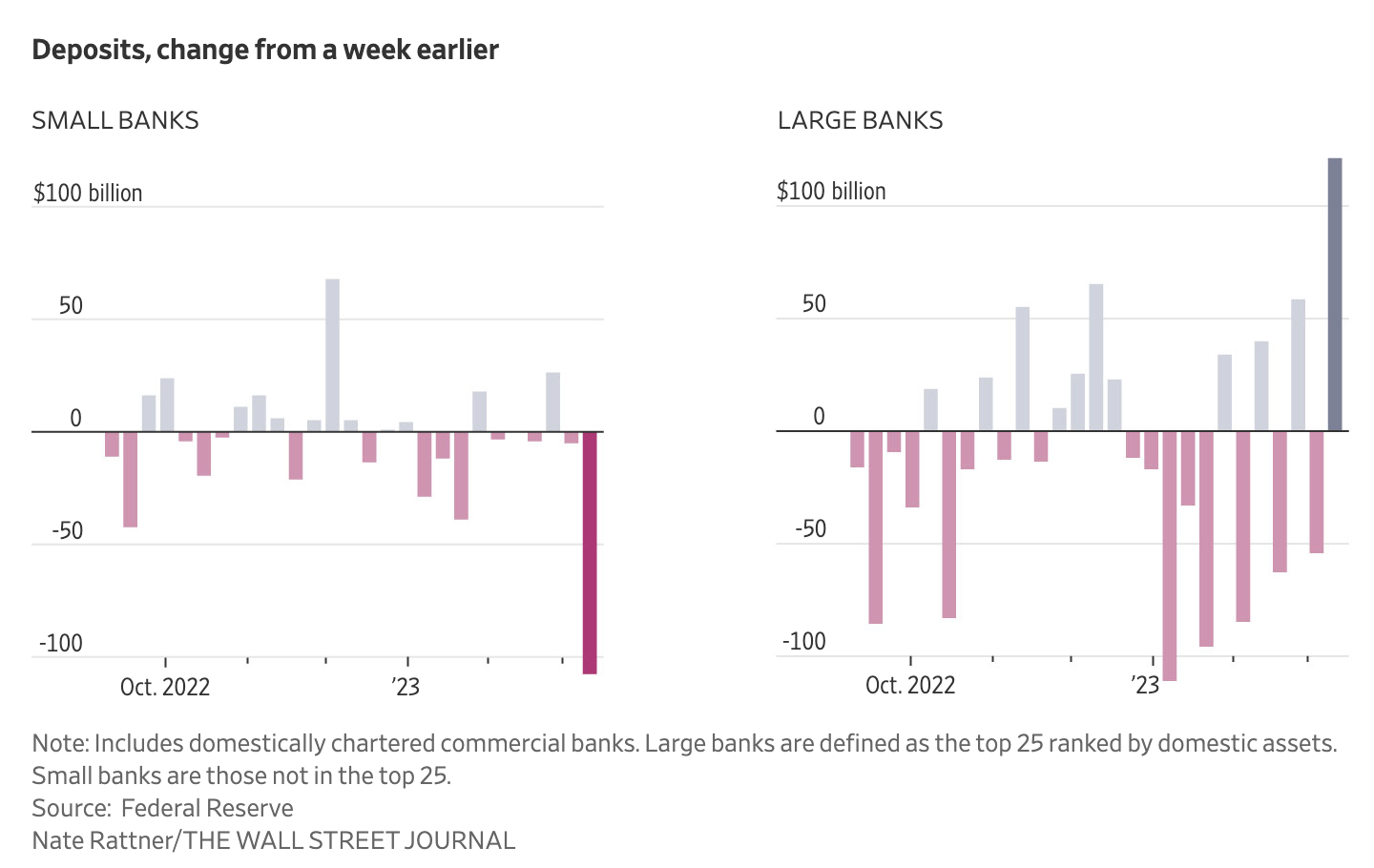

Small Banks Are Losing to Big Banks. Their Customers Are About to Feel It

Source: Wall Street Journal

Sign up for our reads-only mailing list here.