My Two-for-Tuesday morning train WFH reads:

• Why One Firm’s 3,612% Return Is Drawing the Ire of Hedge Funds: Portfolio protection faces scrutiny just as market fears rise Taleb-advised Universa under fire for performance claims. (Bloomberg)

• AQR: Emerging Market Stocks Have Best Return Profile in 20 Years: “Emerging risks aren’t what they used to be,” according to AQR’s Michele Aghassi and Dan Villalon. (Institutional Investor) see also Reimagining index funds: Can classic cap-weighted indices be improved? What if we no longer chase soaring winners and abandon tumbling losers, and instead choose stocks based on a more stable metric, namely, the size of the underlying business? (Financial Times Alphaville)

• Think of language models like ChatGPT as a “calculator for words.” This is reflected in their name: a “language model” implies that they are tools for working with language. That’s what they’ve been trained to do, and it’s language manipulation where they truly excel. Want them to work with specific facts? Paste those into the language model as part of your original prompt! (Simon Willison)

• A frenzy of deregulation killed Silicon Valley Bank: Late in 2018, two Trump-appointed banking regulators, Federal Reserve Vice Chair Randal Quarles and FDIC Chair Jelena McWilliams, went on a nationwide tour to meet with regional bank examiners. If you’re looking for the roots of the banking crisis that took down Silicon Valley Bank and has rattled the entire financial sector for weeks, that’s as good a place to start as any. The officials’ message to the examiners was: Back off. (LA Times) see also How a Trump-Era Rollback Mattered for Silicon Valley Bank’s Demise: An under-the-radar change to the way regional banks are supervised may have helped the bank’s rapidly growing risks to go unresolved. (New York Times)

• A philosophical question about the Fed’s ‘mistake.’ Assuming the Fed hit the brakes on the economy when inflation started heating up in 2021, where would we be today? If such a move worked and inflation eased quickly, it’s likely the economy would be much weaker today. Tightening monetary policy is about cooling demand — and that means the labor market probably wouldn’t be as robust as it is today. Would everyone be OK with that? (TKer)

• The Electron Is Having a (Magnetic) Moment. It’s a Big Deal: A new experiment pulled off the most precise measurement of an electron’s self-generated magnetic field—and the universe’s subatomic model is at stake. (Wired) see also What Lights the Universe’s Standard Candles? Type Ia supernovas are astronomers’ best tools for measuring cosmic distances. In a first, researchers have managed to re-create one on a supercomputer, giving a boost to a leading hypothesis for how they form (Quanta Magazine)

• Would Life Be Better if You Worked Less? From part-time hours to four-day workweeks, Americans experiment with living more (Wall Street Journal)

• Why Are Public Restrooms Still So Rare? Cities in the U.S. and elsewhere have made strides, but challenges remain.(New York Times) see also To All Manhattan Bathrooms I’ve Loved Before: How to find great public restrooms in the Big Apple. (meltedcheeseonwhitefish)

• ‘Hot Ones’ Was a Slow Burn All Along: This YouTube talk show’s premise is simple: Disarm celebrities with deep-cut questions and scorchingly spicy wings. Nearly 300 episodes later, the recipe still works. (New York Times)

• What’s it like to approach the edge of the Universe? With a finite 13.8 billion years having passed since the Big Bang, there’s an edge to what we can see: the cosmic horizon. What’s it like? (Big Think) see also What Lit the Lamps That Let Humanity Measure the Universe? Type Ia supernovas are astronomers’ best tools for measuring cosmic distances. In a first, researchers recreated one on a supercomputer to learn how they form. (Wired)

Be sure to check out our Masters in Business interview this weekend with Ken Kencel, founder and CEO of Churchill Asset Management. The private credit firm manages $46 billion in private capital and is an affiliate of Nuveen, the $1.1 trillion asset manager of TIAA. Churchill was the top U.S. private equity lender in 2022 and was “Lender of the Year” according to M&A Advisor. Kencel was named one of private credit’s 20 power players.

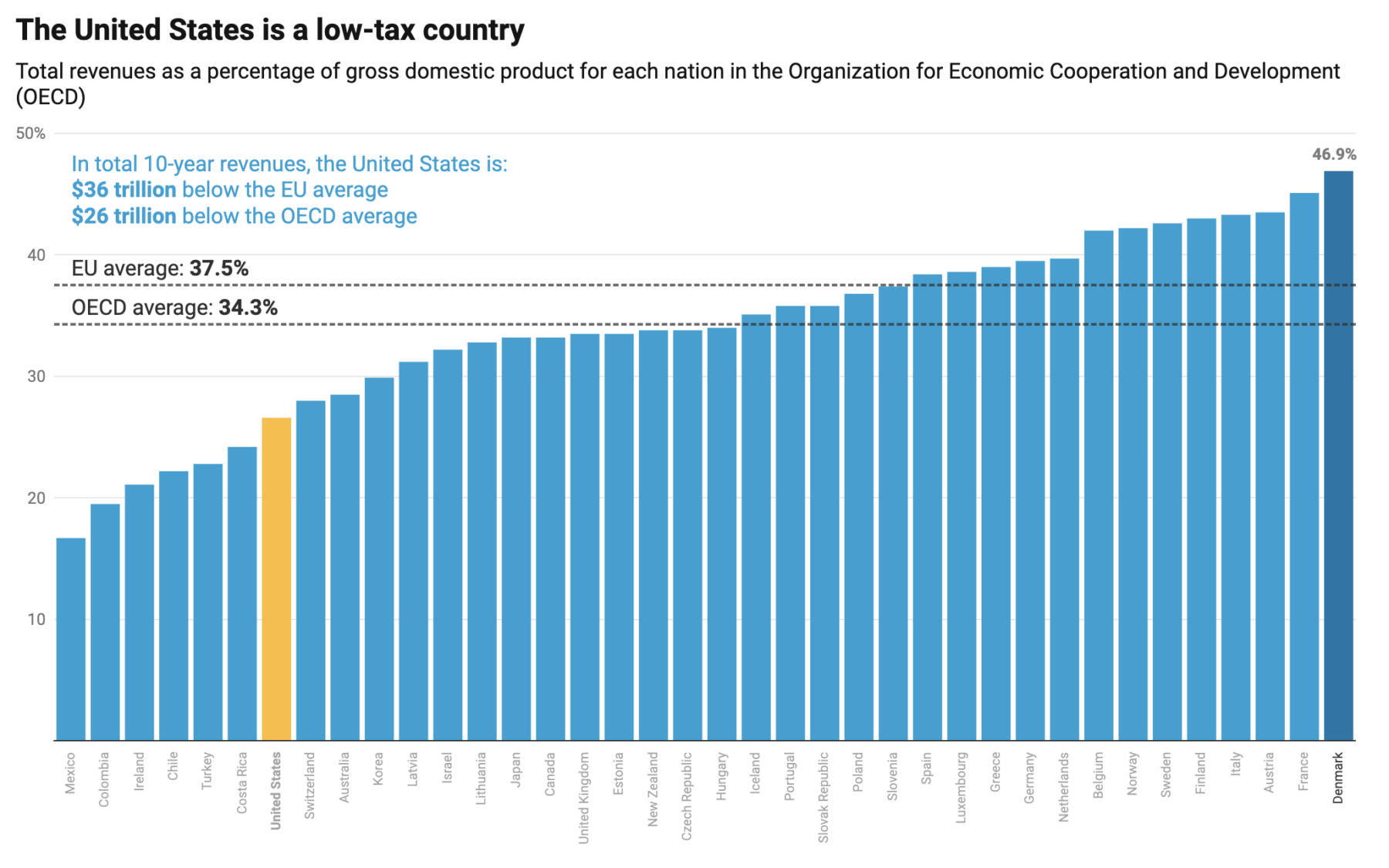

Tax Cuts Are Primarily Responsible for the Increasing Debt Ratio

Source: Center For American Progress