My Two-for-Tuesday morning train WFH reads:

• Stock Pickers Failed to Take Part in First-Quarter Rally: Bearish positioning, less exposure to big tech stocks hurt active fund managers. (Wall Street Journal) see also Take ‘Potential Winners’ With a Grain of Salt: Investment fads are nothing new, as the Salton Sea’s mid-century boom-turned-bust shows—a timeless lesson. (Fisher Investments)

• Bond Market Is Overplaying the Risk of a Deep Recession: Trading in other major markets suggests a painful economic downturn isn’t as set in stone as Treasury investors think. (Bloomberg)

• Meet the Return-to-Office Whisperers: A niche group of consultants is trying to get you back to the office. It’s not going too well. (New York Times) but see also Of Course WFH is “Really Working” The pandemic revealed what a colossal waste of time commuting in America is. Our mass transit is shite; we live too far from our jobs because of the cost of housing. Compare the American experience (60% RTO) with that of Europe (90+% back in the office). (TBP)

• Jamie Dimon: Dear Fellow Shareholders: We are champions of banking’s essential role in a community — its potential for bringing people together, for enabling companies and individuals to attain their goals, and for being a source of strength in difficult times. We help people and institutions finance and achieve their aspirations, lifting up individuals, homeowners, small businesses, larger corporations, schools, hospitals, cities and countries in all regions of the world. (JP Morgan Chase)

• The real reason trucks have taken over U.S. roadways: In 1989, the trucks claimed their first state, Alaska. A trickle of trucky states in the Mountain West and Northern Plains followed, but most states didn’t turn truck until after the Great Recession, when crossover utilities conquered the suburbs (Washington Post) see also When Will Cars Be Fully Self-Driving? The technology isn’t anywhere near where it needs to be to replace human drivers. Three experts weigh in on what the future holds for autonomous vehicles. (Wall Street Journal)

• Patek Philippe’s Thierry Stern on What Comes After the Nautilus: In a candid sit-down, the boss reveals his plans for succession at the Swiss watchmaking giant, how he hunts through the secondary market to find flippers, and why he won’t sell the company. (Bloomberg)

• The Corrupted Federal Judiciary: There are few better examples of the right-wing corruption of the federal judiciary than what happened yesterday down in Amarillo, Texas, when federal trial court “stayed” FDA approval of the abortion drug mifepristone. Mifepristone was approved for use in the U.S. 20 years ago. There’s no serious or substantial question whether mifepristone is safe and effective for the purpose of inducing an abortion. (Talking Points Memo) see also In a divided nation, dueling decisions on abortion pill: Conflicting rulings set up extraordinary legal clash and could reshape abortion access. (Washington Post)

• Paxlovid May Reduce Long Covid Risk, but Access Is About to Get Worse: If you’re eligible for the drug, you should try to get it, says the author of a new study. (Slate)

• The Knicks’ Long Search for a Championship Is Ongoing. The Search for a Point Guard Is Over. Jalen Brunson says he’s not the savior of New York basketball. Fifty years after their team last won a title, Knicks fans might disagree. (Wall Street Journal) see also Wait, the New York Knicks Are Good? I Think I Need to Sit Down (Wall Street Journal)

• They thought a painting in their TV room was a fake. It sold for $850K. The owners broke the bad news: The painting had long been regarded as a knockoff by the family. Their forebears had purchased it in the late 1800s, and it spent the next century bouncing to different houses as younger generations inherited the work. Over the years, the painting had turned into a punchline. (Washington Post)

Be sure to check out our Masters in Business next week with Aswath Damodaran, Professor of Finance at New York University’s Stern School of Business. Known as the Dean of Valuation, he teaches Corporate Finance and Valuation to the MBA students at Stern where he has been voted “Professor of the Year” by the graduating M.B.A. class nine times. His textbook “Investment Valuation” is the standard in the field. His next book comes out in December, and is titled The Corporate Lifecycle: Business, Investment, and Management Implications.

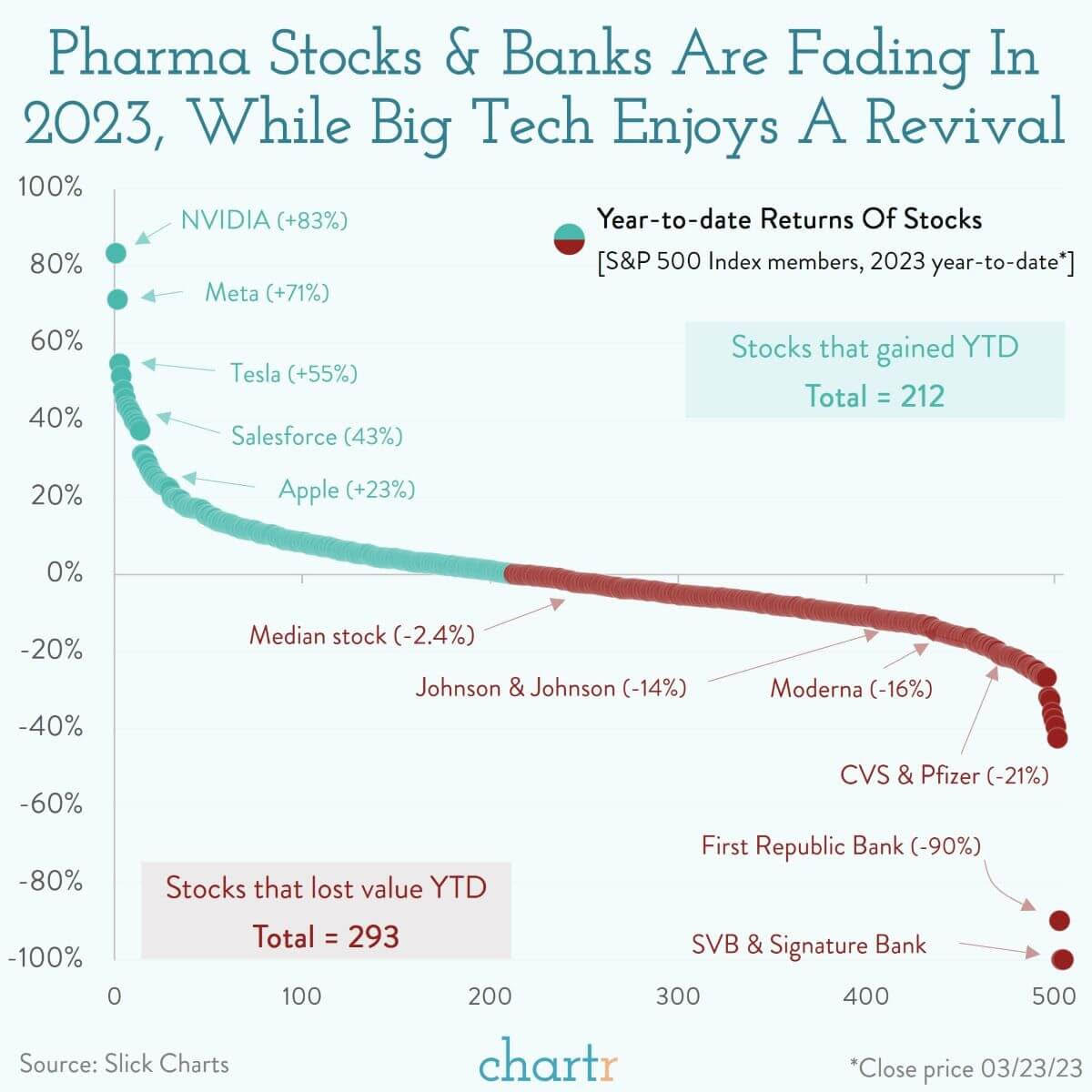

How the S&P 500 is faring so far

Source: Chartr