My mid-week morning train WFH reads:

• The Super Rich Are Worried. Should You Be? We human beings act irrationally, which makes for bursts of creativity in the arts and, yes, even on Wall Street, but inevitably precipitates overexuberance in capital markets and bank runs. It also means that there is probably some limit on the marginal utility of incremental units of regulation, I suppose. But does that mean we can never tame these spirits? (Barron’s)

• There is No Index Fund For the Housing Market: While stock market ownership during the Great Depression was a rounding error of the total population, plenty of people owned houses. Real estate got obliterated just like everything else in the economy back then but the homeownership rate still only got as low as 44% following the Great Depression. (A Wealth of Common Sense) see also No Sellers, No Buyers: Like every other market in the world, real estate has a large psychological component. But unlike liquid markets where Animal Spirits can dominate, primary residences are more governed by arithmetic than almost anything else. The prices are what they are, and you can either pay for the mortgage or you cannot. (Irrelevant Investor)

• Here’s Where Market Timing Works: Factor timing has its champions and skeptics — so academics set out to find an answer to the controversial practice. (Institutional Investor)

• The inside story of Credit Suisse’s collapse, by Credit Suisse: Dispatches from the room where nothing was happening. (Financial Times)

• Hospital ‘Black Boxes’ Put Surgical Practices Under the Microscope: Hospitals have begun to use the technology to help reduce medical errors and improve patient safety. (Wall Street Journal)

• Elon Musk: Owning Twitter has been “quite painful” and “a rollercoaster”: The multi-billionaire entrepreneur said he would sell the company if the right person came along. Musk, who also runs car maker Tesla and rocket firm SpaceX, bought Twitter for $44bn in October. The interview at the firm’s HQ in San Francisco also covered the mass lay-offs, misinformation and his work habits. (BBC) see also Twitter Isn’t a Company Anymore: It’s been merged into a new entity called X Corp. Here’s what that could mean. (Slate)

• Abortion was a 50/50 issue. Now, it’s Republican quicksand. Six in 10 voters support legal abortion in most cases. Just over a third want it to be entirely or mostly illegal. (Politico)

• China May Not Need Western Technology Much Longer: The latest ranking of global spending on research and development has US tech companies on top and Chinese rivals on the rise. (Bloomberg)

• How Russia’s Offensive Ran Aground: After months of pouring soldiers into eastern Ukraine, Russia’s progress essentially adds up to this: three small settlements and part of the city of Bakhmut, a high-profile battlefield with limited strategic value. (New York Times)

• ‘Secret Invasion’ Revealed: Inside Samuel L. Jackson’s Eye-Opening New Marvel Series. Why he has no eyepatch, where you’ve seen Emilia Clarke’s mystery character before, and 10 new images from the shape-shifting alien saga. (Vanity Fair)

Be sure to check out our Masters in Business next week with Aswath Damodaran, Professor of Finance at New York University’s Stern School of Business. Known as the Dean of Valuation, he teaches Corporate Finance and Valuation to the MBA students at Stern where he has been voted “Professor of the Year” by the graduating M.B.A. class nine times. His textbook “Investment Valuation” is the standard in the field. His next book comes out in December, and is titled The Corporate Lifecycle: Business, Investment, and Management Implications.

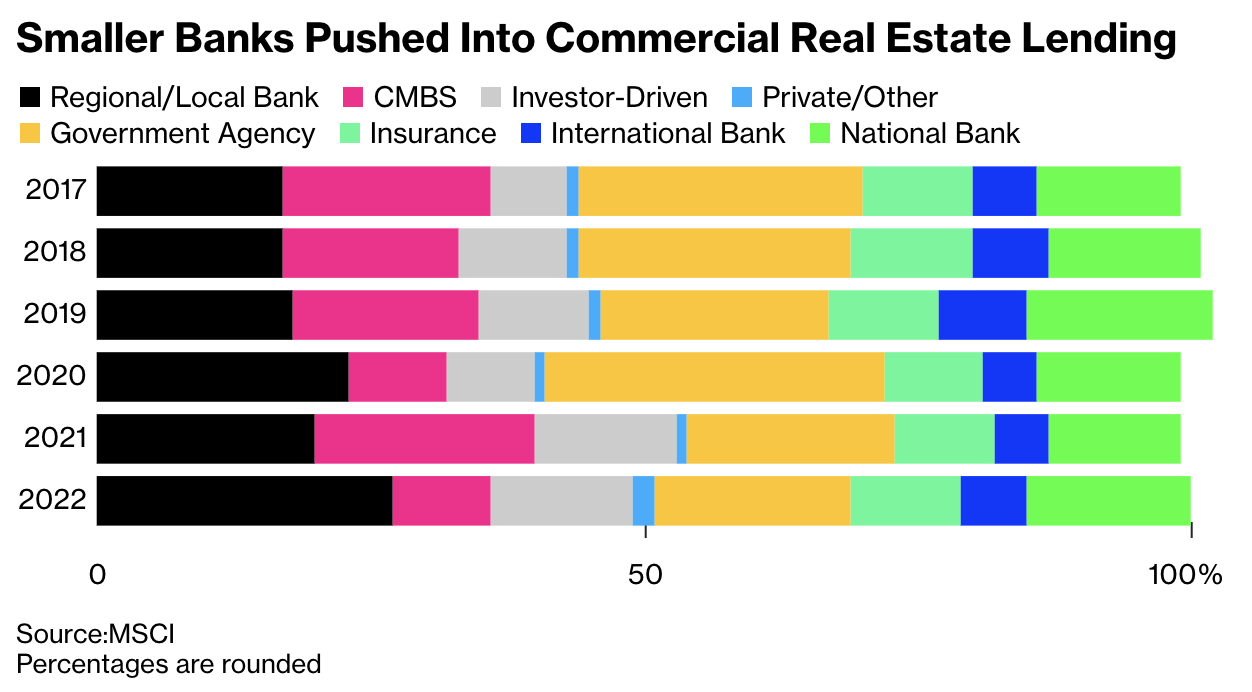

A $1.5 Trillion Wall of Debt Is Looming for US Commercial Properties

Source: Bloomberg

Sign up for our reads-only mailing list here.