My back-to-work morning train WFH reads:

• How Sam Bankman-Fried Peddled a Story Everyone Wanted to Believe: In an excerpt from his upcoming book, Axios’s Brady Dale explores “what we think we know” about Sam Bankman-Fried, FTX, and the crypto industry. (Institutional Investor)

• Where to Invest in Real Estate Now: Four experts offer timely ideas on where — and whether — to invest in this messy market. (Bloomberg)

• 2023 World Changing Ideas Awards: Fast Company’s annual World Changing Ideas Awards honor the businesses and organizations that are developing creative solutions to the most pressing issues of our time. (Fast Company)

• It’s Not Just Bud Light. How Companies Are Fighting Back Against the War Over ‘Woke.’ Bud Light is the latest casualty in a battle over whether companies are embracing too many progressive goals on everything from gender identity to climate change. What’s at stake as companies fight back. (Barron’s)

• Steve Jobs, Rick Rubin and “taste”: The Apple co-founder and the super-producer share similar ideas regarding taste and creativity. (Trung Phan)

• Why Disinformation and Misinformation Are More Dangerous Than Malware: Combatting misinformation and disinformation online is no easy task, but the cybersecurity community needs to fight it anyway, experts argue at RSAC 2023. (PC Mag)

• BuzzFeed’s Jonah Peretti and Gawker’s Nick Denton on why the 2010s digital media boom went bust: A conversation with two media pioneers — plus Ben Smith, whose new book chronicles their rise and fall. (Vox)

• The Quest for Longevity Is Already Over: Studying people who live well beyond the age of 100 could reveal the secret to living longer, healthier lives. But the statistics tell another story. (Wired)

• Why is it so hard for American drivers to reach Formula One? There have been just four U.S.-born drivers in F1 in the past 30 years. (Washington Post)

• ‘God, life is so strange’: Diane Keaton on dogs, doors, wine and why she’s ‘really fancy’ The Oscar-winning actor is back for the Book Club sequel. But what she really wants to talk about is big cars, her love for Woody Allen – and her unexpected passion (The Guardian)

Be sure to check out our Masters in Business interview this weekend with Julian Salisbury, Chief Investment Officer of Goldman Sachs Asset & Wealth Management, with $737 billion in assets under management. He is a member of the Management Committee and Co-Chair of the Asset Management Investment Committees, (private equity, infrastructure, growth equity, credit, and real estate).

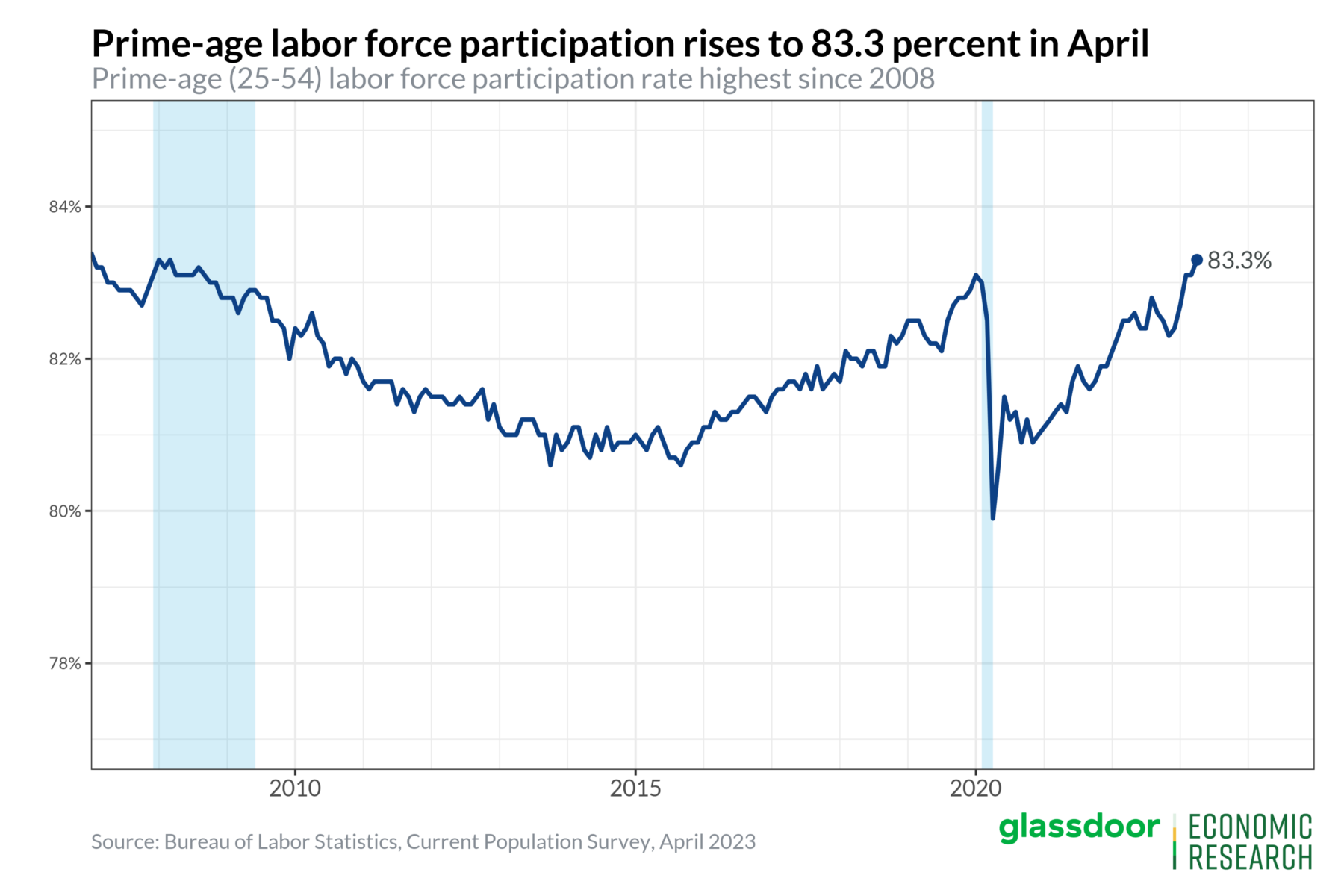

The prime-age employment population ratio rose to the highest level since 2001

Source: @danielbzhao

Sign up for our reads-only mailing list here.