My back-to-work morning train WFH reads:

• Don’t underestimate the American consumer: As we’ve discussed repeatedly, consumer finances have been in remarkably good shape despite what weak sentiment may suggest. And robust demand for labor continues to fuel job creation. All of this represents massive tailwinds powering spending, which has been bolstering economic growth for months. (TKer)

• Apple Is Reaching Deeper Into Your Pocket. Apple’s Next Version of the Wallet App Could Be Killer. Why PayPal and Other Fintechs Should Worry. (Barron’s) see also ChatGPT Now Has an iPhone App: Six months after OpenAI’s silver-tongued chatbot launched on the web and set off an AI arms race, you can put it in your pocket. (Wired)

• Investors Are Overlooking the Real Power of AI: Investments are not the most obvious target of image-generating AI, but, as WorldQuant’s Igor Tulchinsky writes, early-stage technologies like GPT-4 should be approached with radical openness. (Institutional Investor)

• NYC Skyscrapers Sit Vacant, Exposing Risk City Never Predicted: City says vacancy rate won’t dip below 19% before 2026 Office vacancies hit a record 22.7% this year amid remote work. (CityLab)

• Job Prospects for Black Workers Have Never Been Better—In Ways That Might: Last Tight market means better-paying, more-stable occupations that could provide resilience in potential recession. (Wall Street Journal)

• David Solomon Says Goldman Is Evolving: ‘Not Everybody Likes Change.’ The CEO sat down with Barron’s to discuss his critics’ complaints, the challenging climate for banking, his growth ambitions, and DJing side gig. (Barron’s)

• ESG Investing Goes Quiet After Blistering Republican Attacks: “Greenhushing” is the new greenwashing as asset managers in the US try to duck controversy over sustainable investing. (Businessweek)

• In Battle Over A.I., Meta Decides to Give Away Its Crown Jewels: The tech giant has publicly released its latest A.I. technology so people can build their own chatbots. Rivals like Google say that approach can be dangerous. (New York Times)

• The best way to deal with the debt ceiling: Ignore it: If all his options are unconstitutional, he should choose the least unconstitutional option. So which unconstitutional option — unilaterally raising taxes, disobeying spending laws or borrowing beyond the debt ceiling — is the least unconstitutional? The answer lies in the Constitution’s delicate balance of powers. (Los Angeles Times)

• What are the odds of a successful space launch? There’s a lot that can go wrong on a rocket launch. Over the decades, however, the failure rate has been surprisingly consistent. (BBC)

Be sure to check out our Masters in Business next week with Robyn Grew, Incoming CEO of Man Group, (and current President). Man Group is the largest publicly traded hedge fund in the world, whose history dates back 230 years to 1783. Previously, she held senior positions at Barclays Capital, Lehman Brothers, and LIFFE.

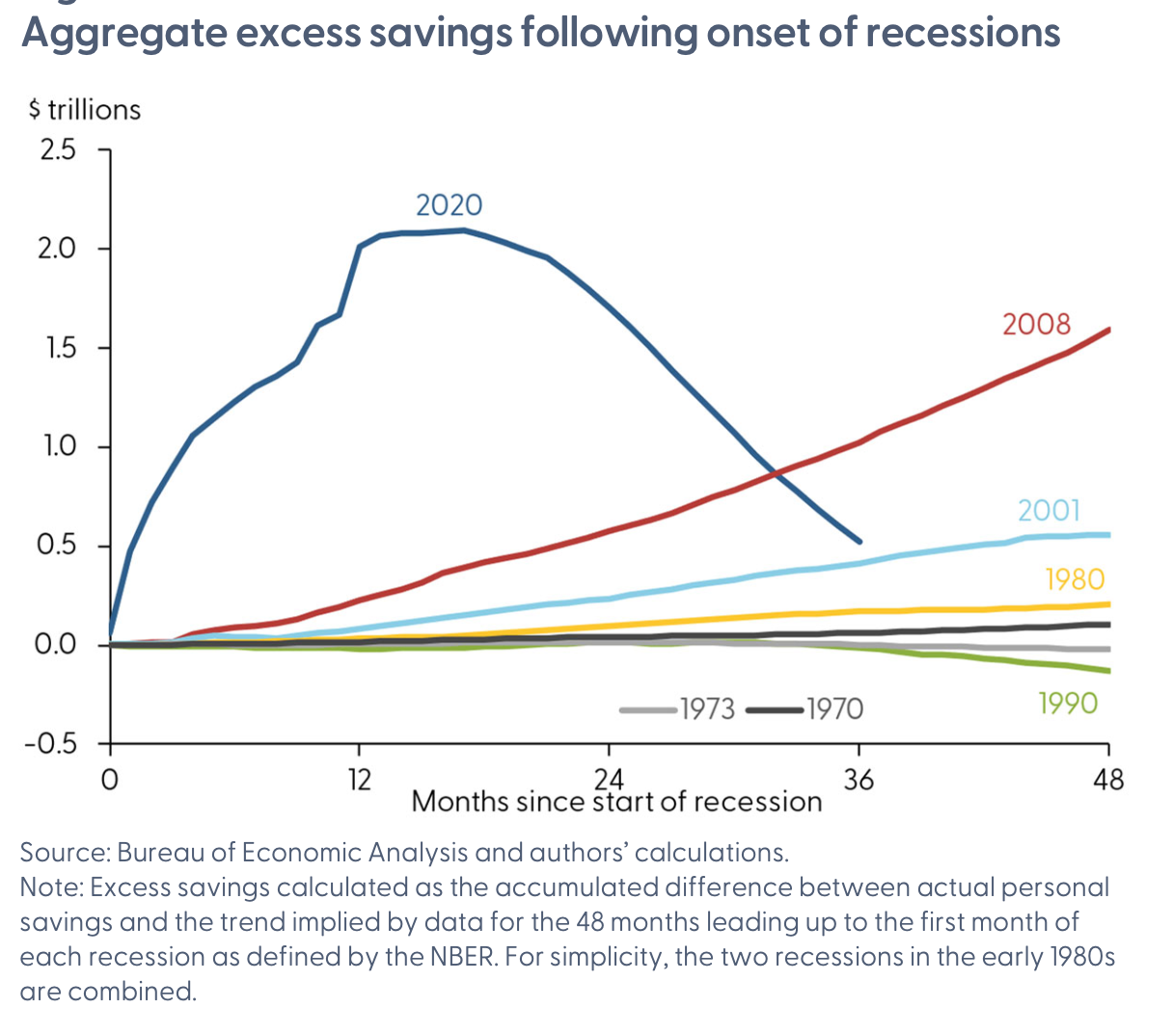

The Rise and Fall of Pandemic Excess Savings

Source: Federal Reserve Bank of San Francisco

Sign up for our reads-only mailing list here.