My morning train WFH reads:

• You’ve Heard About Behavioral Finance. But What About Physical Finance? Research suggests a fascinating link between the physical world and how investors price stocks. (Institutional Investor)

• The real reason Mexico suddenly dominates global beer exports: Today, Mexico ships out more than twice as much beer as any other country and single-handedly accounts for 30 percent of the world’s entire export-beer market, according to Geneva-based trade statistics provider Trade Data Monitor. That puts Mexico far above the Netherlands (14%), Belgium (13%) and even Oktoberfest progenitor Germany (9%). (Washington Post)

• How Interest Rates & Inflation Impact Stock Market Valuations: You would assume, all else equal, that much higher interest rates and price levels would have had a far greater impact on the stock market. Don’t get me wrong — we’ve had a nice little bear market. And this kind of snapshot approach to looking at market indicators can be misleading. But if you were to tell investors two years ago that we were about to enter one of the most aggressive Fed hiking cycles in history combined with inflation reaching 9%, most would have assumed things would be a lot worse. (A Wealth of Common Sense)

• Don’t Bother Investing in China Unless You’re Chinese: Only a local can properly circumvent the country’s infamous firewall. Even asset managers in Hong Kong no longer have a clear picture of the mainland. (Bloomberg)

• Why was Labor Productivity Growth So High during the COVID-19 Pandemic? The Role of Labor Composition: In the first few weeks of the COVID-19 recession, around 20 million people lost their jobs, with half of those losses occurring in the last two weeks of March 2020. On the tail of these unprecedented job losses, labor productivity grew at an annualized rate of 11.2 percent in 2020q2 and the average hourly wage increased sharply. (Bureau of Labor Statistics)

• How YIMBYs Won Montana: A wave of legislation designed to reform local zoning rules and boost housing is sweeping this GOP-led state, thanks to an unusual left-right coalition of supporters. (CityLab)

• The State of Global Gender Equity: Despite efforts to advance gender equity, women still lag behind men in home ownership, labor force participation, board representation and many more areas. Here’s why. (J.P. Morgan Research)

• The Counteroffensive: The future of the democratic world will be determined by whether the Ukrainian military can break a stalemate with Russia and drive the country backwards—perhaps even out of Crimea for good. (The Atlantic)

• What Real Meteorologists Wish You Knew About Your Weather App: The realization you are seeing is one possible outcome of a model that gets run every six hours. But weather is more complex. It’s a broader envelope of outcomes, which you’re probably not seeing in your app. (Slate)

• 5 Minutes That Will Make You Love Herbie Hancock We asked musicians and experts, including Thundercat, Patrice Rushen and Nicole Sweeney, which Hancock song they would play for a friend. (NYT)

Be sure to check out our Masters in Business interview this weekend with Julian Salisbury, Chief Investment Officer of Goldman Sachs Asset & Wealth Management, with $737 billion in assets under management. He is a member of the Management Committee and Co-Chair of the Asset Management Investment Committees, (private equity, infrastructure, growth equity, credit, and real estate).

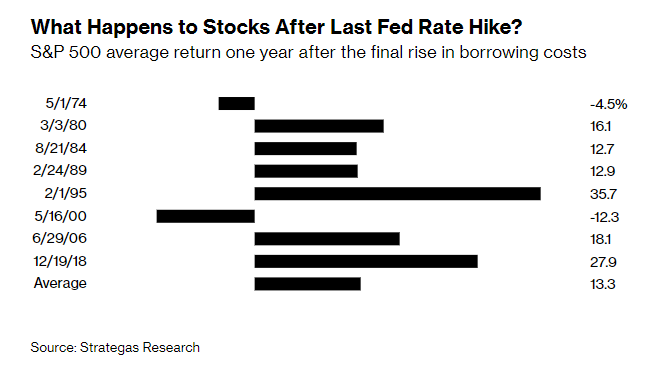

A Historical Look at S&P 500 $SPX returns after the Last Federal Reserve Rate Hike

Source: Strategas via @Barchart

Sign up for our reads-only mailing list here.