My Two-for-Tuesday morning train reads:

• Large-Cap Stocks Outperform as Investors Seek Stability: The gap between large- and small-cap stocks has widened since the banking crisis, according to FTSE Russell. (Institutional Investor) see also Fed Rate Increases Hit Small Businesses the Hardest: Companies with smaller payrolls and valuations are facing higher funding costs. (Wall Street Journal)

• The Stock Market Usually Goes Up (But Sometimes it Goes Down): There have been just 13 bear markets since World War II (including the current iteration). That’s one out of every 6 years or so, on average. During that same time frame, the stock market has fallen by 30% or worse 4 times. That’s one out of every 13 years on average. A crash of 50% or worse has occurred just 3 times. That’s one out of every 26 years on average. (A Wealth of Common Sense)

• Office Workers Don’t Hate the Office. They Hate the Commute. Let’s address why folks aren’t coming back — and why they probably won’t unless we fix a big problem with office work that few C.E.O.s seem to mention: Getting to and getting home from the office. Survey after survey bears this out. If we want people to go to the office more often, we have to do something about a ritual of American life that’s time-consuming, emotionally taxing, environmentally toxic and expensive: the daily commute. (NYT) see also WFH vs RTO: It won’t be easy; it’s going to require a wholesale change to the infrastructure of your region, from where people live and work, to how walking and bike-friendly those areas are, to how we can deemphasize the car culture with which I grew up in and have come to love so much. (The Big Picture)

• How America’s Largest Restaurant Franchisee Decides When to Raise Prices: Flynn Restaurant Group, owner of eateries including Applebee’s, Taco Bell and Pizza Hut, is at the vanguard of menu strategy. (Wall Street Journal)

• Once a fringe theory, “greedflation” gets its due: Once dismissed as a fringe theory, the idea that corporate thirst for profits drives up inflation, aka “greedflation,” is now being taken more seriously by economists, policymakers and the business press. (Axios) see also What’s Driving Inflation: Labor or Capital? I was correct in identifying inflation during the mid-2000s; during the post-crash 2010s I remained appropriately skeptical about rising prices. “Transitory” turned out to be too optimistic, and I was wrong in my expectations for a faster decline in the delta of prices. I was also wrong about “Greedflation…” (The Big Picture)

• Gen Z just wants a stable job: Young people are suddenly interested in working for the military industrial complex. (Vox)

• Where’s my self-driving car? EVs may seem closer to reality than AVs, but our view of both is distorted by our rigid understanding of transportation. (Fast Company) see also Why most car dealers still don’t have any electric vehicles: A new survey finds two-thirds of car dealers didn’t have a single electric vehicle for sale. (Vox)

• Why Suicide Rates Are Dropping Around the World: Over the past couple of decades, global suicide prevention efforts have reduced deaths by a third—but some countries are falling behind. (Wired)

• Fox News’s ‘vitriolic lies’ present clear threat to US democracy, says woman suing rightwing network: disinformation expert Nina Jankowicz, who is suing over campaign of falsehoods, says ‘if Fox isn’t brought to account, it will not stop.’ (The Guardian) see also Negotiating with post-Trump Republicans is like dealing with a toddler’s tantrum: While one side is happy to defecate on the floor, the other side has no choice but to clean up the mess. (The Guardian)

• The 40 Best TV Finales of the 21st Century, Ranked: It’s hard to say goodbye. But if there’s a silver lining, it’s that we often get a tremendous hour of television. In honor of ‘Succession’ and ‘Barry’ ending this week, we’re ranking the best series wrap-ups since 2000. (The Ringer)

Be sure to check out our Masters in Business next week with Robyn Grew, Incoming CEO of Man Group, (and current President). Man Group is the largest publicly traded hedge fund in the world, whose history dates back 230 years to 1783. Previously, she held senior positions at Barclays Capital, Lehman Brothers, and LIFFE.

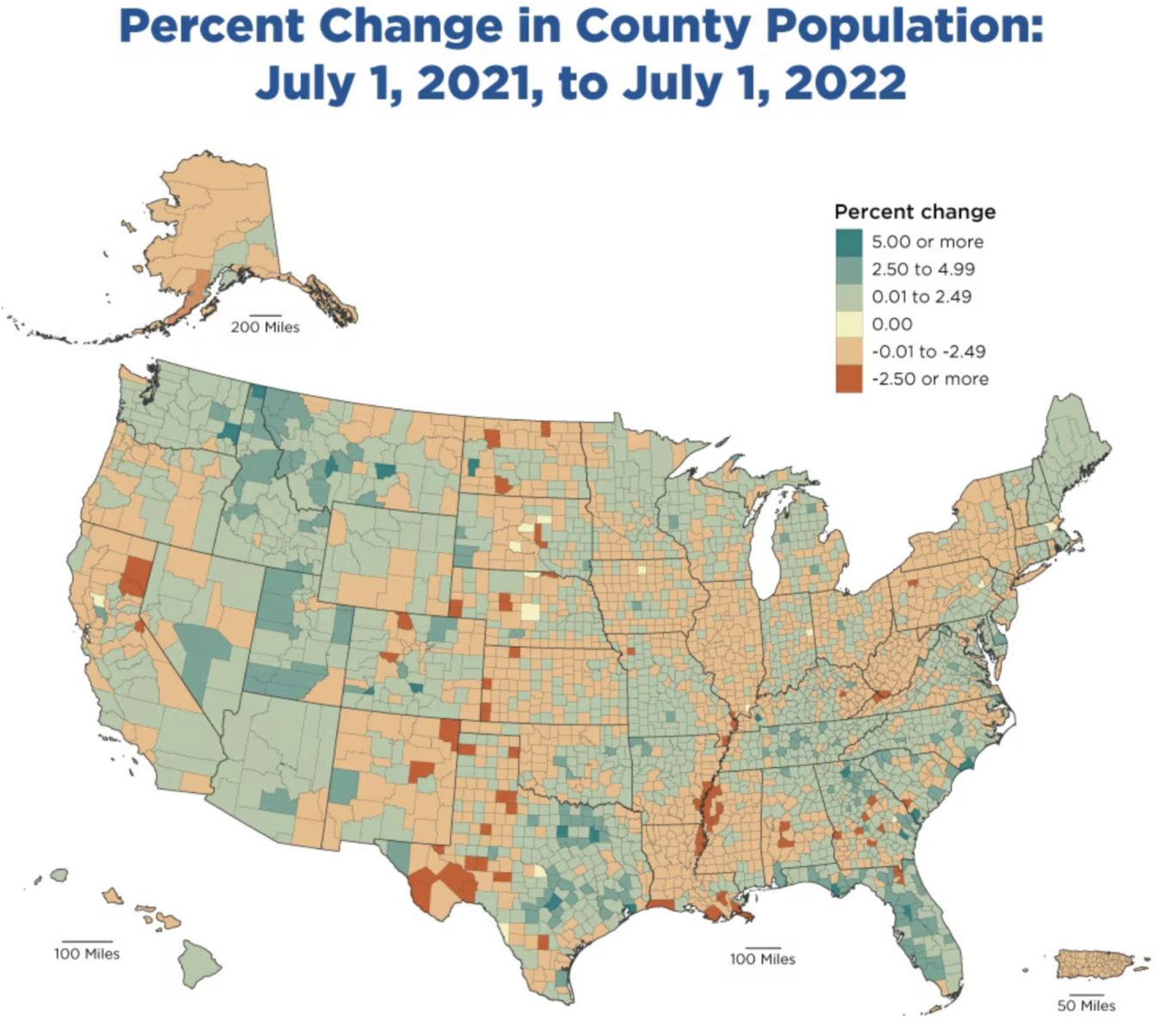

Almost half of American counties have shrinking population

Source: Slow Boring