My morning train WFH reads:

• Larry Summers Was Wrong About Inflation: His call for austerity was premised on the notion that only a sharp increase in unemployment could prevent a ruinous wage-price spiral. In reality, both wage and price growth have been slowing for months, even as unemployment has remained near historic lows. Summers’s failure to anticipate this outcome should lead us to reconsider just how prescient his analysis of the post-COVID economy ever was. (New York Magazine)

• Business Is Slowing, So Companies Are Juicing Profits. Reallocate costs. Unwind charges. Delay depreciation. Companies are using nontraditional ways to boost the bottom line. (Wall Street Journal) but see Why the U.S. Remains Far From Recession: The pandemic’s aftereffects fuel economic resilience despite rising interest rates. (Wall Street Journal)

• Consumer Sentiment Is Low—That’s a Good Sign for Stocks: When the public is gloomy, equities usually thrive. (Morningstar)

• Due Diligence: Using ESG as a Risk Mitigator: Although seldom apparent in financial statements, environmental, social and governance deficiencies can come out of nowhere and slam investors. (Chief Investment Officer)

• Don’t Ask Us to Come to the Office More — Or We Will Quit, Investors Say: One in two financial professionals said they would change jobs if asked to come into the office more often. (CityLab)

• Compounding Optimism: Ideas compound. Inventions compound. Education compounds. A trivial thing can grow into a massive thing, and faster than most people realize. (Collab Fund)

• America’s Long, Tortured Journey to Build EV Batteries: The fall of startup A123 still haunts the US decades later—and reveals everything that’s wrong with this country’s approach to innovation. (Businessweek) see also Volkswagen Bets an Old SUV Can Help It Win Over Americans: Scout chief Scott Keogh is banking on pure Americana for VW to finally break through in the key market (Wall Street Journal)

• NASA’s newest X-plane wants to save the planet: The space agency has a plan to “skip a generation” of passenger aircraft design to fight climate change. (Vox)

• The Center Triumphant: Two Not-Great Men and one Nobel Prize Winner: If you love liberalism—not social programs, necessarily, but an open, inquiring attitude and a skepticism that breeds humility—this was a very good week. Two less-than-great men, President Biden and House Speaker Kevin McCarthy, agreed to a deal to reduce federal spending and permit more federal borrowing. (Intrinsic Value)

• How the Lionel Messi Deal Stymied Saudi Arabia: A complex arrangement, involving Apple, to bring the soccer star to Miami shows how to trump the free-spending kingdom — and how hard that may be to duplicate. (Dealbook)

Be sure to check out our Masters in Business interview this weekend with NBC News and former WSJ reporter Gretchen Morgenson. The Pulitizer price winning investigative journalist is the author of a new book, These Are the Plunderers: How Private Equity Runs―and Wrecks―America.

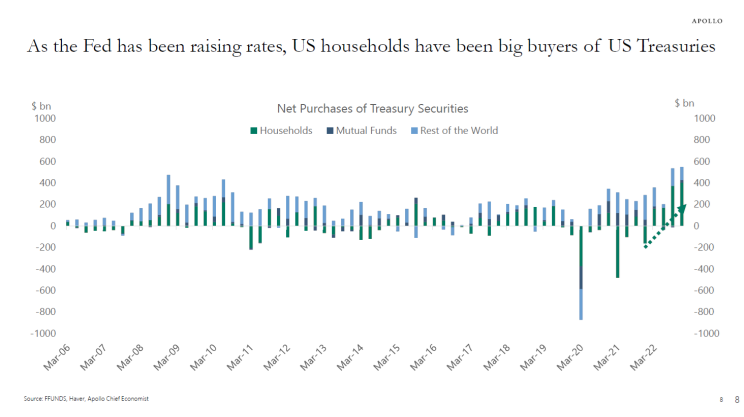

Demand for Treasuries

Source: Torsten Slok, Apollo

Sign up for our reads-only mailing list here.