My morning Summer train reads:

• The Art of Short Selling: Among all the activities in finance, short-selling remains one of the most misunderstood. To many, the practice of selling something you don’t own with the intention of buying it back later at a cheaper price appears…abstract. Few baulk at the idea of buying low and selling high, but reverse the chronology and it sows confusion. (Net Interest)

• A Bull or a Bear Market? It Doesn’t Matter. Stocks still haven’t returned to their last peak, and our columnist is in the camp that says this isn’t a bull market yet. But he’s buying stock anyway. (New York Times)

• U.S. Allocators Grapple With the Risks of Investing in China: “While a tail event is remote, it’s more likely than it was five years ago,” says Scott Taylor, CIO of the Andrew W. Mellon Foundation. (Institutional Investor)

• Forget the Fed, and Focus on the Economy: What matters for long-run returns is getting the direction right, and the Fed’s fine-tuning misses the point. (Wall Street Journal)

• Don’t Forget Who Loses in Fed’s Quest to Soften Labor Market: Lower-income workers are the ones who have come off the sidelines to fill many recent openings, and will likely be the first to suffer when jobs disappear. (Bloomberg)

• 9 things to know about buying a car in this terrible market: With high interest rates, limited options, skyrocketing prices and scarce discounts, it’s a tough time to be in the market for a car. But if you want or need one now, there are ways to navigate the marketplace and find a vehicle that meets your needs, even if it means adjusting your expectations. (Washington Post) see also EV Makers Confront the ‘Nickel Pickle’ Large amounts of the mineral are needed for electric car batteries, but getting it out of the ground and refining it often requires clearing rainforests and generating large amounts of carbon. (Wall Street Journal)

• The Risks of Storing Money in Apps Like Venmo and Cash App: The Consumer Financial Protection Bureau is warning that the funds may be at risk if the app’s parent company runs into trouble. (New York Times)

• Parrots Are Taking Over the World: Smart, adaptable and loud, parrots are thriving in cities far outside their native ranges (Scientific American)

• Tax Cuts Are Primarily Responsible for the Increasing Debt Ratio: Without the Bush and Trump tax cuts, debt as a percentage of the economy would be declining permanently. (Center For American Progress)

• In an Age of Power, Luis Arraez Is Hitting Singles—and Batting .400: Baseball’s analytics movement has often downplayed the simple act of hitting a single to get on base. The Marlins’ Arraez is challenging the new thinking in an old-fashioned way. (Wall Street Journal)

Be sure to check out our Masters in Business next week with Peter Borish, founding partner at Tudor Investments, where he was Director of Research for 10 years working directly with Paul Tudor Jones. He has also been Chairman and CEO of Computer Trading Corp, and Chief Strategist for quant fund at Quad Group. Borish is also a founding trustee of the Robin Hood Foundation, formed with Paul Tudor Jones in 1988.

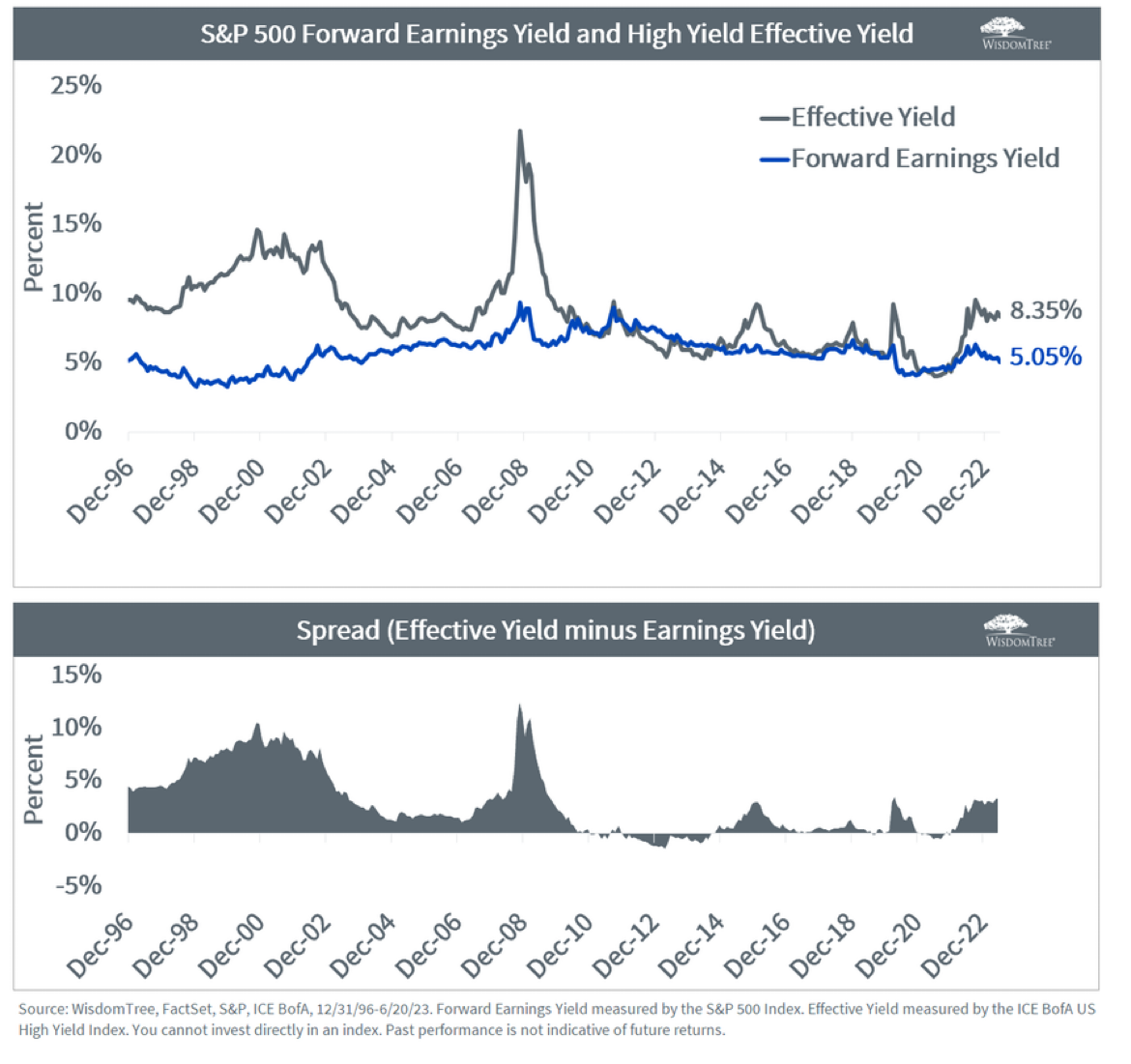

Comparing High Yield levels vs Earnings Yields on the S&P 500; Median spread over nearly 3 decades is 170 bps

Source: @JeremyDSchwartz

Sign up for our reads-only mailing list here.