My end-of-week morning train WFH reads:

• Inflation undershoot? Narrative shifts again. But as impressive U.S. disinflation sweeps through 2023, without a cratering of employment or the wider economy so far, the narrative is shifting again – and encouraging hopes that bruising central bank tightening may be short-lived too. With a ‘soft landing’ now majority thinking again, phrases like ‘immaculate disinflation’ abound and raise questions about whether underlying price dynamics have changed very much after all – even if geopolitical and supply chain maps are redrawn. (Reuters)

• This Statistic Could Be Distorting How We Think About Inflation: The apparent causal link between unit labor costs and inflation is far weaker once you understand how the statistical sausage is made. It’s honest but crude. One of the two inputs into the calculation is inflation itself. So if inflation rises and nothing else changes, the unit labor cost will go up. By definition (New York Times) see also Unit Labor Costs are Literally Constructed Using Prices: Some big-name economists have also unfortunately similarly cited high unit labor costs as a contributor to inflation in the US, arguing that growth in hourly compensation is too high relative to the growth in labor productivity in order to see inflation return to low levels. However, when one takes a closer look at how this statistic is constructed, one finds that “unit labor costs” are simply the product of the labor share and a price index. The notion that this “explains” inflation is therefore a near-tautology; multiplying the CPI by a relatively stable measure—my average resting heart rate, for example—would perform similarly. (Employ America)

• She Was the Oppenheimer of Barbie. Her Invention Blew Up. Mattel co-founder Ruth Handler engineered a new way of selling toys. Then she created the most popular doll in history. (Wall Street Journal)

• Market Resilience or Investors In Denial? A Mid-year Assessment for 2023! I am not a market prognosticator for a simple reason. I am just not good at it, and the first six months of 2023 illustrate why market timing is often the impossible dream, something that every investor aspires to be successful at, but very few succeed on a consistent basis. At the start of the year, the consensus of market experts was that this would be a difficult year for markets, given the macro worries about inflation and an impending recession, and adding in the fear of the Fed raising rates to this mix made bullishness a rare commodity on Wall Street. Markets, as is their wont, live to surprise, and the first six months of 2023 has wrong-footed the experts (again). (Musings on Markets)

• Masters of Their Own Realities: Taylor Swift isn’t the only one rerecording classics. A wide range of musicians are heading back to the studio to retrace the past and reclaim ownership of their work. (The Ringer)

• How AI is bringing film stars back from the dead: Celebrities such as James Dean can be brought back to life as digital clones thanks to the power of artificial intelligence, but it is raising troubling questions about what rights any of us have after we die. (BBC)

• Where Did Our Belief in Abundance Come From? History shows that we don’t have to be satisfied with the economic and intellectual limits of the age in which we live (Discourse)

• The Best Way to Save American Lives on the Road: France, unlike America, but like almost every other rich country on earth, has worked out how to make its roads safer. They have reduced the speed limits on minor roads, and installed thousands of speed cameras to ensure people stick to them. But they have also literally rebuilt the roads to make it harder to crash. And one of the ways they have done so is by installing roundabouts. (Time) see also The Safety Dance: Autonomous vehicle companies claim that “humans are terrible drivers” and their tech is needed to save lives. Don’t buy it. (Slate)

• Extreme Heat Is Deadlier Than Hurricanes, Floods and Tornadoes Combined: When dangerous heat waves hit cities, better risk communication could save lives. (Scientific American)

• It’s the Summer of the Status Concert: Forget the latest ‘it’ bag: A snap from Taylor Swift’s Eras Tour or Beyoncé’s Renaissance Tour is guaranteed to make your friends jealous as they scroll your social media feed. (Town & Country)

Be sure to check out our Masters in Business interview this weekend with Jawad Mian, CFA and Chartered Market Technician, who runs the independent global macro research and trading advisory firm Stray Reflections. The firm’s focus is on major investment themes, and its clients include many of the world’s largest hedge funds and alternative asset managers.

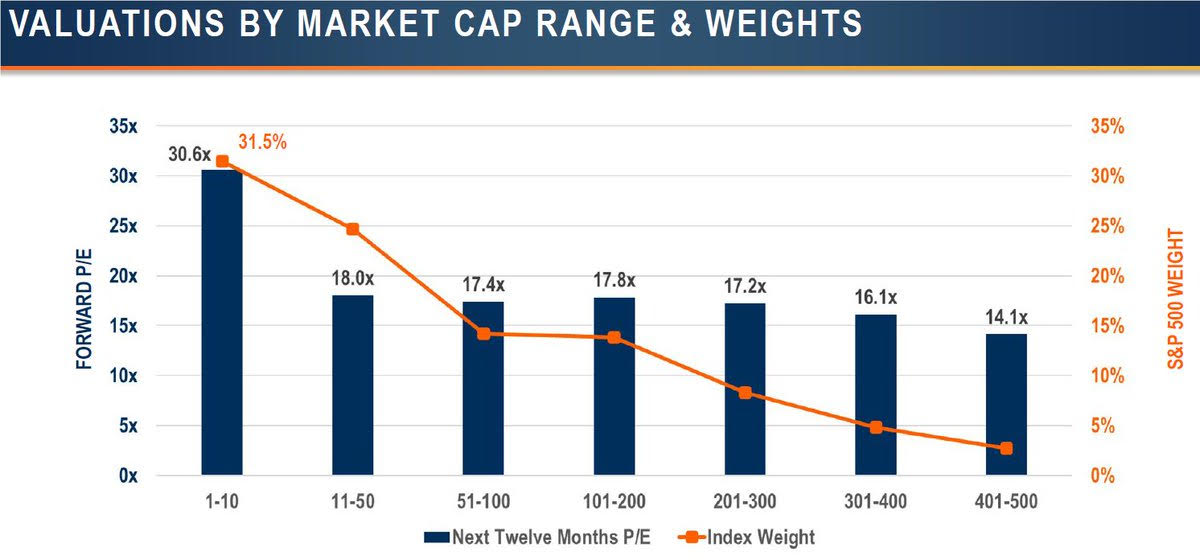

Valuations by Market Cap Range

Source: @nategeraci

Sign up for our reads-only mailing list here.