My end-of-week morning train WFH reads:

• A Textbook Non-Recessionary Bear Market: I don’t think the bear market was an overreaction either considering the changes we saw to inflation and interest rates. Plus we had such a large run-up in prices in 2020 and 2021 that it was good for knocking down the speculation that was running rampant. And now that this one is over everyone can go back to worrying about what’s going to cause the next bear market. (A Wealth of Common Sense)

• Family Offices Are Patiently Watching These Asset Classes for Opportunities: Real estate and private debt are among the investments these asset owners are eyeing. (Institutional Investor)

• Property Owners Ignore Climate Risk Amid Insurance Meltdown :As major underwriters abandon vulnerable states, people keep moving into danger zones. (Businessweek)

• A Winning Bet for Pension Funds Goes Cold: After years of outperforming public markets, some alternative assets are reporting losses. (WSJ)

• Psychopathic Tendencies Help Some People Succeed in Business: Traits in psychopaths may be present to some extent in all of us. New research is reframing this often maligned set of attributes and finding some positive twists. (Scientific American)

• What Happened to Japan? These days the focus of anxiety about global competition has shifted from Japan to China, which is a bona fide economic superpower: Adjusted for purchasing power, its economy is already bigger than ours. But China has seemed to be faltering lately, and some have been asking whether China’s future path might resemble that of Japan. (New York Times) see also Maximum Canada is happening: Canada has a nation-building population strategy. Does America? (Noahpinion)

• Has Texas lost its pro-business mojo? The state has dropped out of the top five in a ranking of the best states for business. Is it politics? (The Week)

• AI and the automation of work: ChatGPT and generative AI will change how we work, but how different is this to all the other waves of automation of the last 200 years? What does it mean for employment? Disruption? Coal consumption? (Benedict Evans)

• Want to quickly spot idiots? Here are five foolproof red flags: Announces they are a proud non-reader of books; says every book should be a blog post; links wealth to intelligence; Drops “AI” or “ChatGPT” constantly; obsess about their IQs; and strongest of all, “look for the person who is cruel.” (The Guardian)

• The one baseball’s been waiting for: So far, the two-way sensation is living up to Ruthian expectations. But how will he possibly keep this up? We trace his journey back to Japan in search of the surprising answer. (ESPN)

Be sure to check out our Masters in Business next week with Liz Hoffman, Liz Hoffman, the Business and Finance Editor at Semafor. Previously, she was a senior reporter at Wall Street Journal covering finance, investment banking and M&A. Following a string of front-page articles on Goldman Sachs push into Main St, and the travails of the world’s largest VC, she moved to Semafor. Her new book is Crash Landing: The Inside Story of How the World’s Biggest Companies Survived an Economy on the Brink.

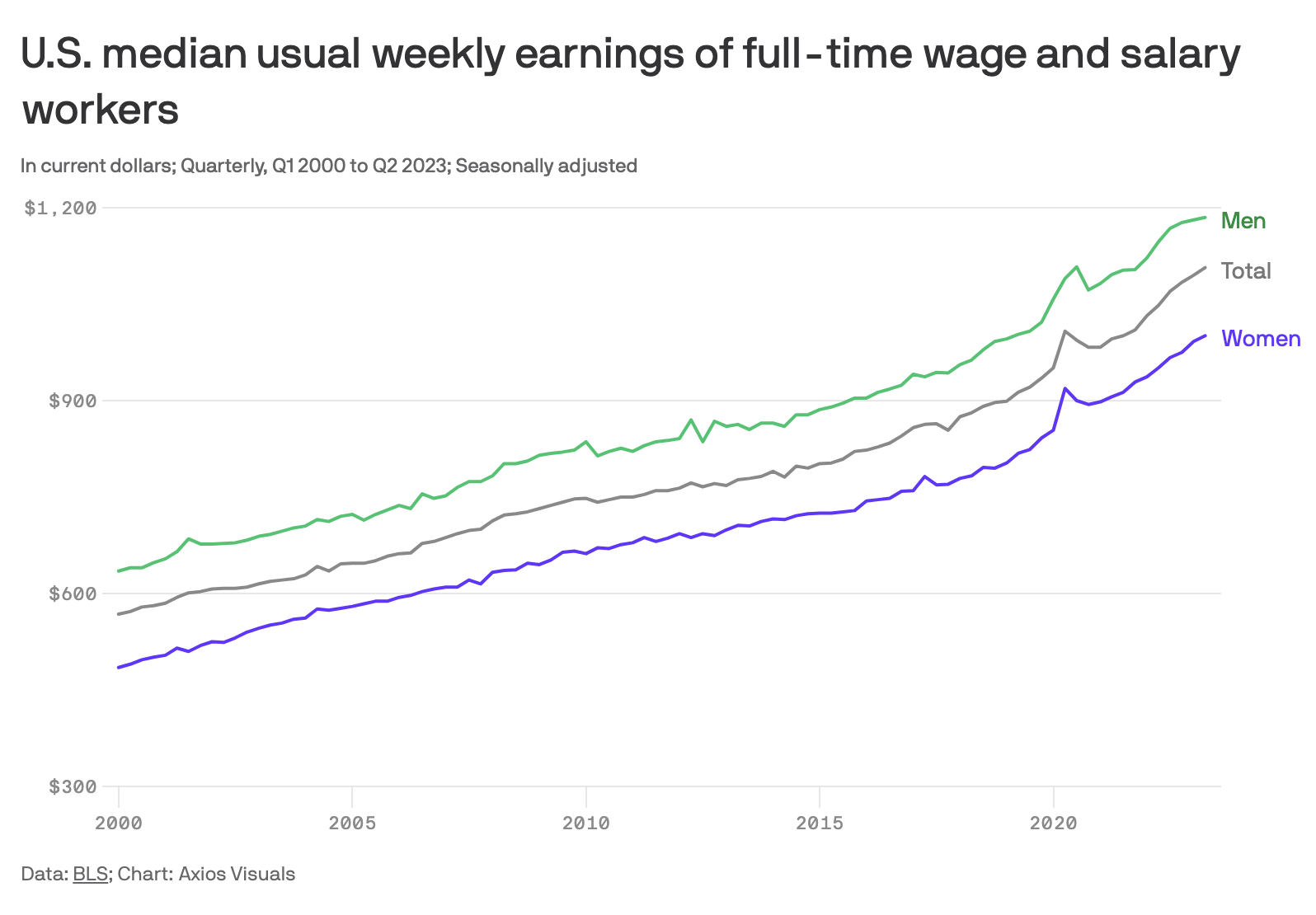

Median weekly earnings for full-time workers in the U.S. reached $1,107 in the Q2 — up 5.6% year over year

Source: Axios

Sign up for our reads-only mailing list here.