My back-to-work morning train WFH reads:

• What exactly is your problem with stock index concentration? Ever since artificial intelligence was invented eight months ago, people have been writing about the rising concentration of stock indices. The usual way to start is with an observation that the trillion-dollar IT club makes up approximately a quarter of the S&P 500 index by weight — because of AI hype, or possibly, the result of a rotation by investors after the same stocks sold off a year earlier. Everyone says this much concentration is bad, because obviously. But there’s not much agreement as to the specific reasons for that badness. (Financial Times)

• The New 1970s: The U.S. is a confused, unsettled nation. But green shoots are quietly sprouting. (Noahpinion)

• Three Maintenance Philosophies Fought for Control of the Auto Industry: A fundamental question that will keep coming up is this: What are the best ways to design for maintenance? At the very beginning of the auto industry, no less than three radically different design-for-maintenance philosophies fought it out. One lost, but not because of maintenance issues. The other two won big by rejecting each other’s approach to maintenance. (Works in Progress)

• As Greedflation Starts to Fade, Wageflation Creeps In: Softer demand, more supply and rising labor costs all take the air out of profit margins. (Wall Street Journal)

• Q and A with Robert McCauley on Manias, Panics, and Crashes: A History of Financial Crises: In 1978 Charles Kindleberger published what was to become the classic text on financial bubbles, Manias, Panics, and Crashes: A History of Financial Crises. Though Kindleberger died in 2003, his work has never seemed more relevant. Economists have described recent economic conditions as the “Everything Bubble,” where the prices of all asset classes are simultaneously overvalued. (London School of Economics)

• Meta’s New Threads App Is Terrible. It Just Might Bury Twitter. It has one killer feature that’s a nightmare for Elon Musk. after less than a day, a new warrior has taken the clear lead in the Twitter wars. It’s Threads, the Twitter copycat from Meta. The app rolled out on Wednesday, and within seven hours, Mark Zuckerberg said it had cleared 10 million users. By Thursday morning, it was north of 30 million. (Zuckerberg and Meta are a bit more constrained than Musk in their ability to lie about the success of their initiatives because Meta is a public company and Musk’s Twitter is not.) (Slate)

• As Downtowns Struggle, Businesses Learn to Love Bike Lanes: From Manhattan to San Francisco, the need to rethink the urban core is encouraging business improvement districts to change their tune on prioritizing cars. (CityLab)

• Bitter rivals. Beloved friends. Survivors. After 50 years, Chris Evert and Martina Navratilova understand each other like no one else can. When cancer came, they knew where to turn. (Washington Post)

• Spider-Man’s Pavitr Prabhakar, Based on Peter Parker, Drives India Wild: The world’s most movie-crazed country is ecstatic over what’s considered to be the first Indian superhero in an American blockbuster. (Wall Street Journal)

• The point of Shania Twain is to let her be Shania Twain: Even if her current concert tour isn’t exactly what anyone might expect, the country-pop legend has defied odds for decades by doing exactly what she wants. (Washington Post)

Be sure to check out our Masters in Business this weekend with Franklin Templeton CEO Jenny Johnson, which manages $1.5 trillion dollar in client assets. She has worked at FT since 1988, and held leadership roles in investment management, distribution, technology, operations, and high-net-worth clients. Franklin Templeton oversees more than 9000 employees and 1300 investment professionals. Johnson is on the list of most powerful women (Barron’s, Forbes, American Banker, and more). She has been CEO February 2020.

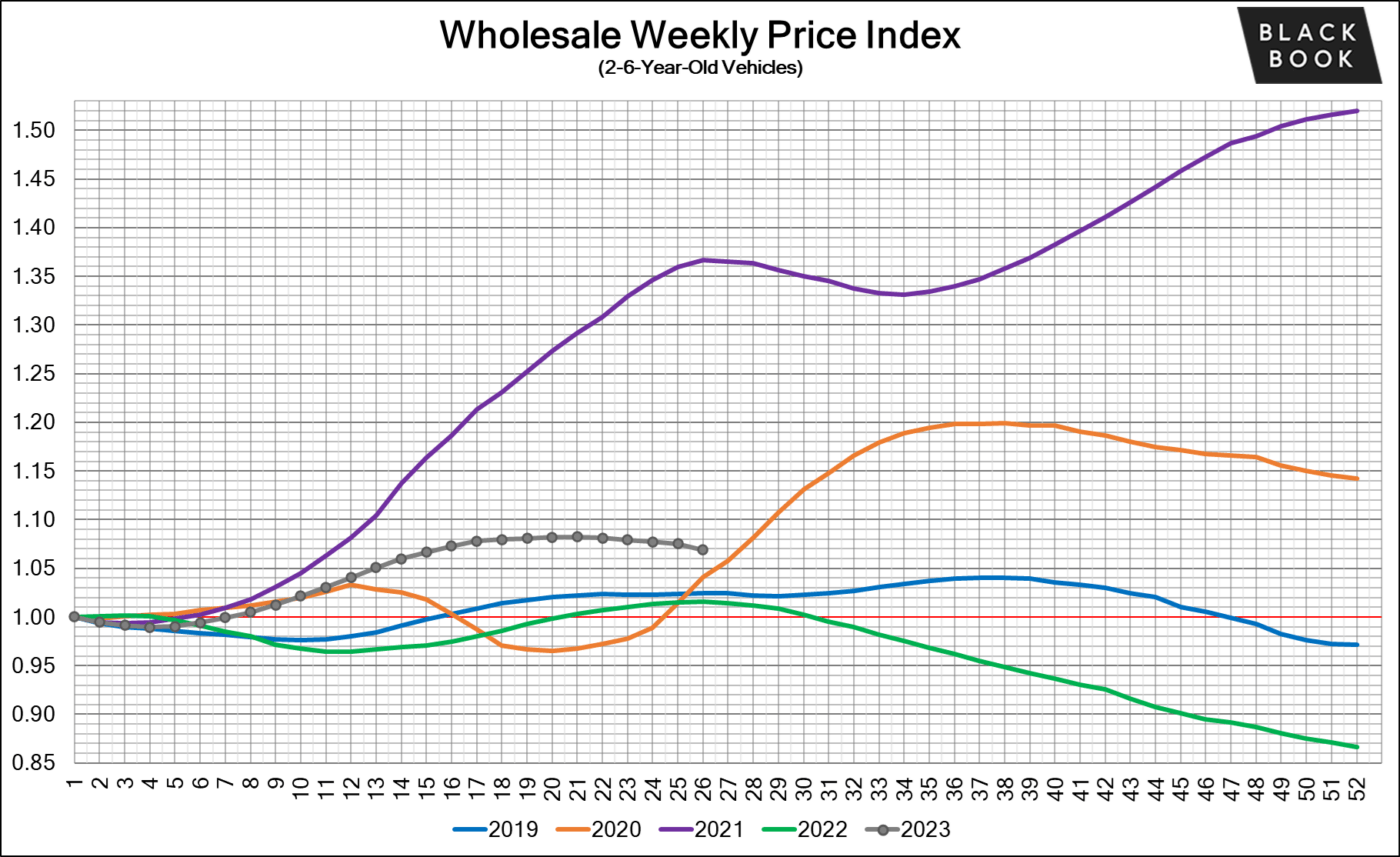

Used vehicles (2-6 years old), Weekly Wholesale + Retail Price Indexes

Source: Black Book

Sign up for our reads-only mailing list here.