My end-of-week morning train WFH reads:

• The Great and Awful Thing About These Interest Rates: If you’re depending on income to fund your retirement, 5% rates are a blessing. But if you’re in need of credit, current rates are a curse. (Irrelevant Investor)

• In a Hot Job Market, the Minimum Wage Becomes an Afterthought: The federal wage floor of $7.25 is increasingly irrelevant when even most teenagers are earning twice that. But what happens when the economy cools? (New York Times) see also Businesses Want Remote Work, Just Not as Much. The enormous increase in remote work that occurred during the pandemic was a response to a temporary public health crisis. Now that the pandemic has passed, just how much remote work will persist and how much are businesses comfortable with? Results from our August regional business surveys. (Liberty Street Economics)

• Generative AI applications: an investing framework: The generative AI venture landscape has blossomed rapidly, from applications to infrastructure and tools. In this post, we focus on the application layer – where we have historically been most active. It seems inevitable that generative AI will be embedded in most applications we touch, enabling entirely new experiences as well as large-scale automation. Less certain is the pace of this change, and its second-order effects. It’s one thing to tinker with ChatGPT; it’s quite another to adopt a product that structurally reinvents a long-held human task. (Mosaic)

• Huawei Is Building a Secret Network for Chips, Trade Group Warns: Tech giant is reportedly getting $30 billion in state support Biden administration monitoring and ready to take action. (Bloomberg)

• What Stone-Carving Robots Tell Us About the Architecture of the Future: Architects are exploring new creations with old materials, using robots to carve stone? (Slate)

• Does The Ocean Floor Hold The Key To The Green Energy Transition? Abundant minerals at the bottom of the ocean could be vital for renewable energy infrastructure. But what harm will be caused by mining them? (NOEMA)

• Meditation is more than either stress relief or enlightenment: Exploring the wider range of meditation is no longer reserved for the monasteries. The new science of meditation is just getting started. (Vox)

• Heat, Floods, Fire: Was Summer 2023 the New Normal? Climate scientists say a warming planet is contributing to, and worsening, extreme weather events (Wall Street Journal) see also 47 Days in Extreme Heat, and You Begin to Notice Things: You notice things in sustained heat. Paying attention is a strategy for survival. The red rock landscape I love and have lived in for a quarter of a century is a blistering terrain. The heat bears down on our shoulders with the weight of a burning world. (New York Times)

• Tape Heads: The Mellotron, an electronic keyboard of recorded samples, heralded the digital age, and its use in “Strawberry Fields Forever” changed pop music history. (JSTOR Daily)

• Andy Roddick’s Open Era: Twenty years after winning the U.S. Open, Andy Roddick has thrown away his trophies and moved on with his life. But in a rare interview, the last American man to win a grand slam reflects on that historic triumph—and all the pressure, fame, failure, love, and loss that came after. (GQ)

Be sure to check out our Masters in Business interview this weekend with Greg Davis, Chief Investment Officer of the Vanguard Group. Davis is responsible for the oversight of approximately $7 trillion managed by Vanguard fixed income, equity index, and quantitative equity groups. He also serves as a member of the Treasury Borrowing Advisory Committee of the US Treasury Department.

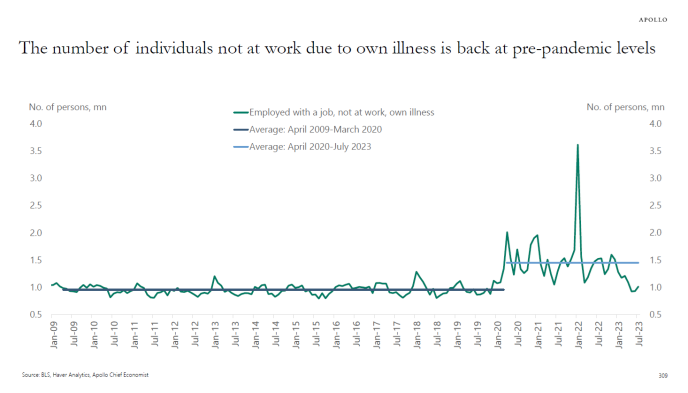

Covid no longer holding back labor supply

Source: Torsten Slok, Apollo Global

Sign up for our reads-only mailing list here.