Welcome to August! Kick off the month with our Tuesday Two-fers morning reads:

• Everyday Investors Are Thriving in a World Awash in Yield: Cash-like investments are offering their highest rates since 2001, offsetting rising interest costs. (Wall Street Journal)

• Lots of US Homeowners Want to Move. They Just Have Nowhere to Go: Locked into cheaper borrowing costs and unable to find a new place that fits their budgets, countless people are opting to remain in their current homes, adding to an acute shortage of available properties. (Bloomberg) see also Rent is finally cooling. See how much prices have changed in your area. There’s good news for renters: Your too-high rent is finally not skyrocketing anymore.(Washington Post)

• As some consumer tailwinds fade, new ones emerge: For most of the past two years, measures of consumer sentiment have been in the dumps — largely due to inflation. Yet consumer spending growth has persisted. The explanation: Consumer finances have been in remarkably good shape thanks to a combination of excess savings and relatively low debt levels. Meanwhile, more consumers have been getting jobs, which means more consumers have been making money. If people have money, they’ll spend it. (TKer)

• Wall St. Pessimists Are Getting Used to Being Wrong: The S&P 500 is up about 20 percent this year, but some still warn that the future may not be as rosy as that implies. (New York Times) but see One Year Returns Don’t Matter: One of the hard parts about trying to focus on the long-term as an investor is the short-term toys with your emotions. In years like 2022 when everything is going down, you’ll always wish you would’ve taken less risk. In years like 2023 when everything is going up, you’ll always wish you would’ve taken more risk. (A Wealth of Common Sense)

• The great Rolex recession is here: The WatchCharts Overall Market Index – which tracks the prices of 60 timepieces from top brands including Rolex, Patek Philippe and Audemars Piguet – has plunged 32% from a March 2022 peak. A separate index for just Rolex models fell 27% over a similar period. (Business Insider)

• China’s war chest: how Beijing is using its currency to insulate against future sanctions. In the wake of sanctions on Russia, China has pushed to conduct more trade using the yuan in an effort to reduce its reliance on the dollar (The Guardian) see also While Everyone Else Fights Inflation, China’s Deflation Fears Deepen: Some economists see parallels between China and Japan, where growth stagnated and prices fell for years. (Wall Street Journal)

• What Landscapers Can Teach Landscape Architects: At Ohio State University’s Diggers Studio, a landscape architecture professor offers a hands-on lesson in bridging the divide between laborer and designer. (CityLab)

• The Norwegian Attack on Heavy Water That Deprived the Nazis of the Atomic Bomb: Operation Gunnerside: How a group of stealthy, skiing commandos took out a crucial Nazi facility. (Pocket) see also How the Soviets stole nuclear secrets and targeted Oppenheimer, the ‘father of the atomic bomb’ “Oppenheimer,” the epic new movie directed by Christopher Nolan, takes audiences into the mind and moral decisions of J. Robert Oppenheimer, leader of the team of brilliant scientists in Los Alamos, New Mexico, who built the world’s first atomic bomb. It’s not a documentary, but it gets the big historical moments and subjects right. The issues that Nolan depicts are not relics of a distant past. The new world that Oppenheimer helped to create, and the nuclear nightmare he feared, still exists today. (The Conversation)

• Why the Nation’s Gun Laws Are in Chaos: Judges clash over history a year after Supreme Court upended how courts decide Second Amendment cases—‘the whole thing puzzles me.’ (Wall Street Journal)

• What Jack Smith Knows: Donald Trump openly flatters foreign autocrats such as Vladimir V. Putin and Saudi Arabia’s Crown Prince Mohammed bin Salman, and in many ways Mr. Trump governed as authoritarians do around the globe: enriching himself, stoking ethnic hatreds, seeking personal control over the courts and the military, clinging to power at all costs. So it is especially fitting that he has been notified that he may soon be indicted on charges tied to alleged efforts to overturn the 2020 election by an American prosecutor who is deeply versed in investigating the world’s worst tyrants and war criminals. (New York Times)

Be sure to check out our Masters in Business this week with Liz Hoffman, Liz Hoffman, the Business and Finance Editor at Semafor. Previously, she was a senior reporter at Wall Street Journal covering finance, investment banking and M&A. Following a string of front-page articles on Goldman Sachs push into Main St, and the travails of the world’s largest VC, she moved to Semafor. Her new book is Crash Landing: The Inside Story of How the World’s Biggest Companies Survived an Economy on the Brink.

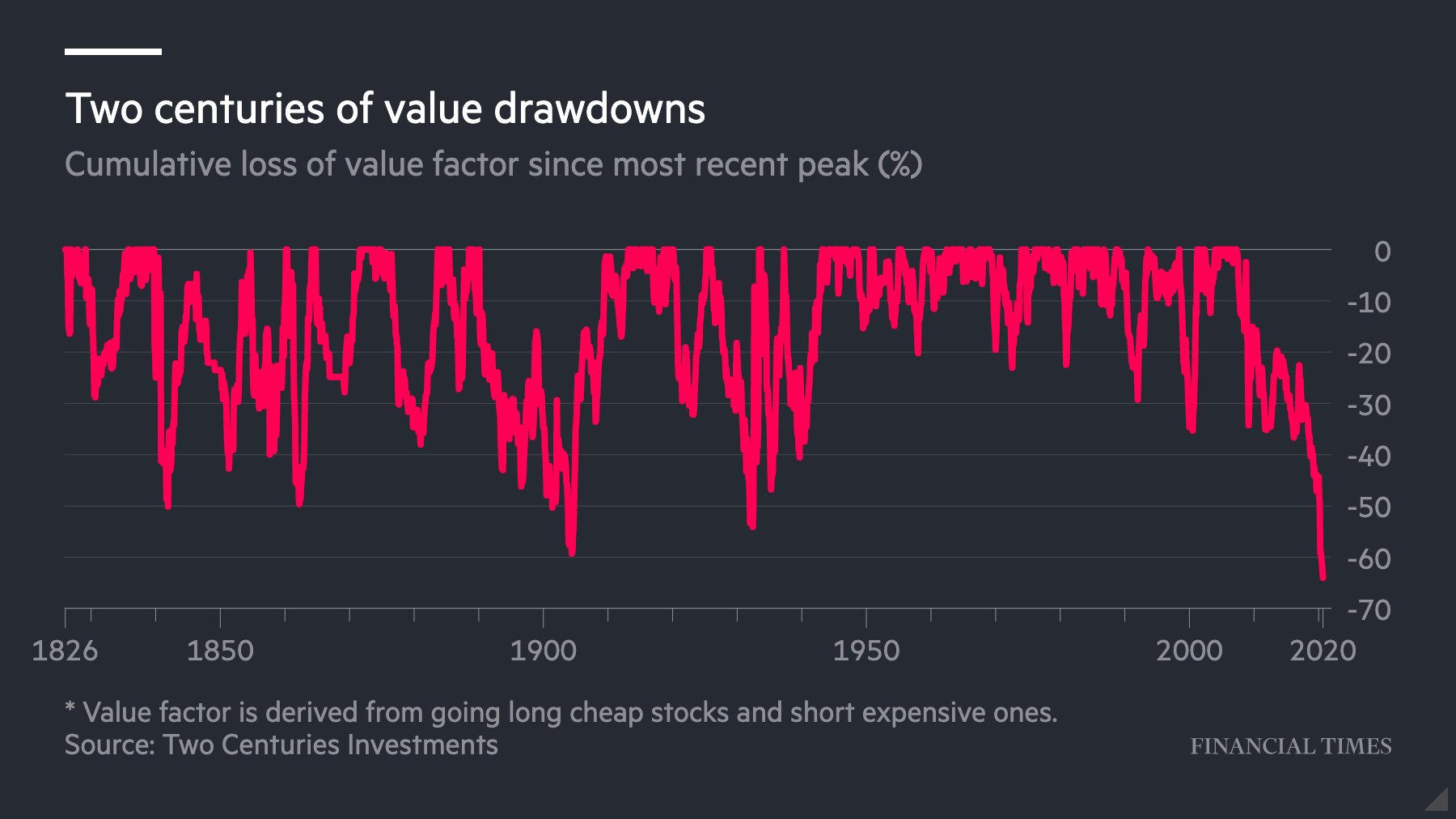

Covid condemns value investing to worst run in two centuries

Source: Financial Times

~~~

Note: Ritholtz Reads will be off the grid, traveling Thursday and Friday without access to internet; we will return this weekend…