My mid-week morning train WFH reads:

• Are You Rich? Billionaires know they are. Low-wage workers are very well aware that they aren’t. But vast swaths of America’s “regular rich” don’t feel that way, and it’s keeping everybody down. You know them. They’re lawyers in New York, doctors in Phoenix, dentists in Memphis. They own construction companies in your hometown, burger franchises off the highway, homes in the resort villages your parents want to retire in. They’re young, old, Democrats and Republicans. They have two things in common: They’re rich. But they don’t feel that way. (Bloomberg)

• Examining Gold’s ‘Store of Value’ Reputation: The many riffs on the store of value theme seem to harken back to gold’s longstanding role in human history and culture. But one shouldn’t conflate this notion with actual stability in purchasing power on a nominal or inflation-adjusted basis: It is an asset more volatile than stocks with lower returns. (Fisher)

• Surprise Stock-Market Rally Bulldozes Bearish Hedge Funds: Short covering reaches highest cumulative dollar amount in years. (Wall Street Journal)

• Why Are NYC Rents So High? It’s Complicated: COVID spurred many tenants to vacate city apartments, but changing rent laws and rising interest rates are among factors now encouraging people to stay put — with few new apartments available. (The City)

• The private lending explosion: Private credit has gone from essentially non-existent in the 1970s, to a gigantic $1.3 trillion market today. But are the risks rising along with the returns? (Alts.co) see also A big credit rating agency just downgraded the U.S. Should you worry? What struck many observers as especially bizarre was not so much Fitch’s action, but its timing. “I could see a case for downgrading the US … after the Trump tax cuts were passed in 2017, after January 6 and before Congress suspended the debt ceiling (but not after).” The prices of long-dated U.S. bonds, which would have been likeliest to respond to a downgrade, actually point to continued strong investor demand. (Los Angeles Times)

• The State of Russia’s Wartime Economy: Russia’s Economy is Recovering From Western Sanctions—But the Cost of the War Itself is Growing (Apricitas Economics)

• What if Generative AI turned out to be a Dud? Some possible economic and geopolitical implications (The Road to AI We Can Trust)

• The Clean Energy Future Is Roiling Both Friends and Foes: Resistance to wind and solar projects, even from some environmentalists, is among an array of impediments to widespread conversion to renewables. (New York Times)

• San Franciscans Are Having Sex in Robotaxis, and Nobody Is Talking About It: As autonomous vehicles become increasingly popular in San Francisco, some riders are wondering just how far they can push the vehicles’ limits—especially with no front-seat driver or chaperone to discourage them from questionable behavior. (San Francisco Standard)

• Why Did Scouts Whiff on Luis Arraez, MLB’s Base-Hit King? And will the unexpected success of baseball’s batting average leader pave the way for other unconventional prospects? (The Ringer)

Be sure to check out our latest Masters in Business interview with Ted Seides, founder of Capital Allocators, an advisory platform to managers and allocators. Previously, he worked under David Swensen at the Yale Investments Office, where he invested directly with three of Yale’s managers. We discuss his famous bet with Warren Buffett about whether a selection of hedge funds could beat the S&P 500 over a decade. (Buffett won).

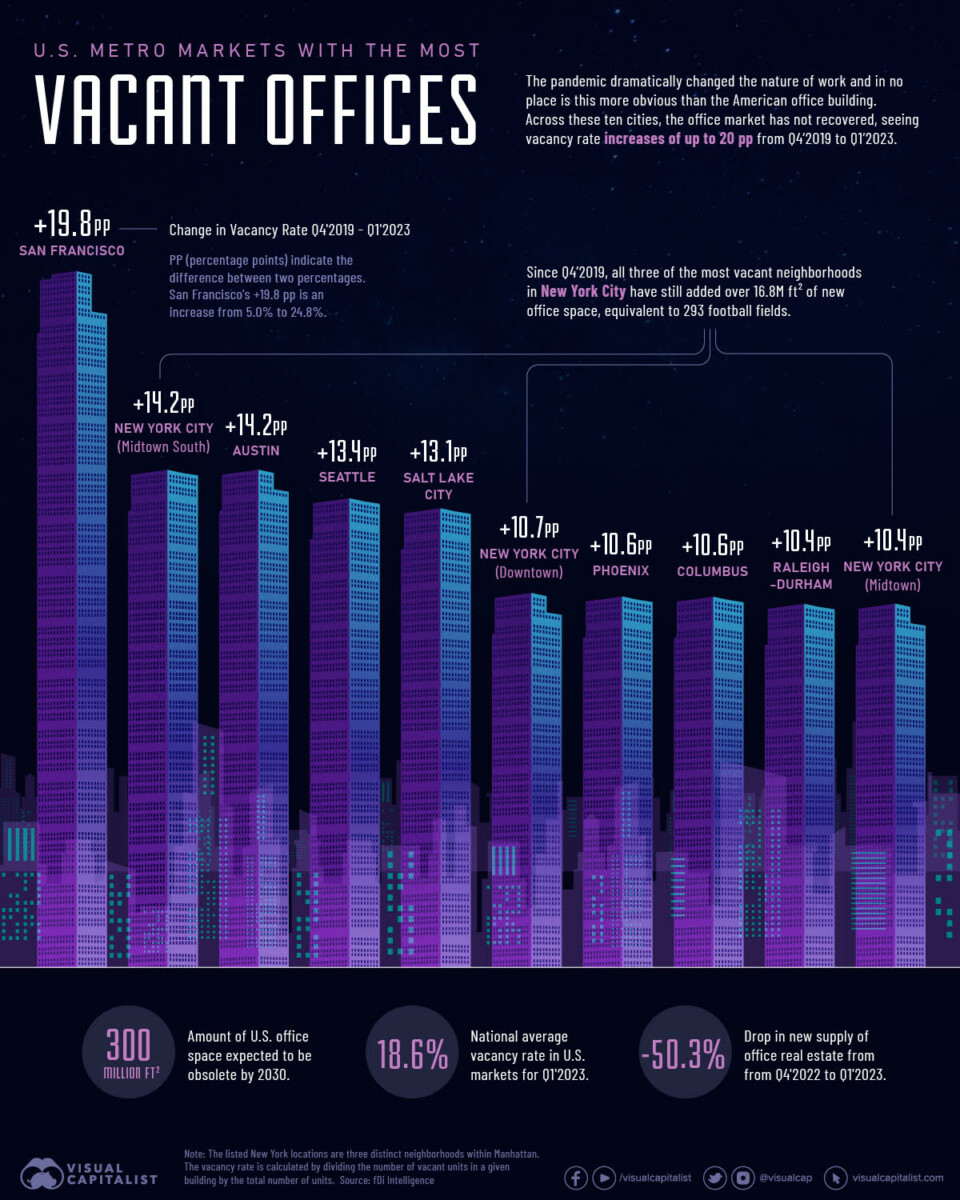

Ranked: The U.S. Cities with the Most Vacant Offices

Source: Visual Capitalist

Sign up for our reads-only mailing list here.