My Two-for-Tuesday morning train reads:

• Into Perspective: The US Auto Labor Dispute and Recession Worries: Partial work stoppages can impact local economies, but the national effect should be minimal. (FI) but see Whatever the UAW Strike Outcome, Elon Musk Has Already Won: The Detroit automakers entered labor talks at a cost disadvantage to Tesla. (Wall Street Journal)

• Lessons from a century of inflation shocks: Inflation will take longer to tame than most people think, but taming it doesn’t necessarily mean much higher unemployment, and premature loosening of monetary policy could be dangerous. Those are the main conclusions from a new IMF working paper published on Friday, which examined lessons from over 100 separate inflation shocks on 56 countries since the 1970s. (Financial Times)

• Why Are Consumers Still So Gloomy? Blame Covid. Many explanations have been given for why sentiment has failed to rebound to pre-pandemic levels despite the strong economy, but only one is plausible. (Bloomberg) see also Is Partisanship Driving Consumer Sentiment? Does it make sense that current sentiment readings are worse than:1987 Crash, the 9/11 Terrorist Attacks, the Dotcom implosion, the Great Financial Crisis and the 2020 Pandemic? No. (TBP)

• TikTok Shop Is a Real E-Commerce Threat: For a glimpse of what the social media platform is capable of, take a look at Indonesia. (BusinessWeek).

• The Market Is Stuck Until the Fed Is Done: Stocks are mired in a holding pattern. The big question, our columnist says, is when will the Federal Reserve start to cut interest rates? (New York Times) see also The Tech Trade Is Showing Cracks. Higher Rates for Longer Spell More Trouble. Investors are looking with renewed skepticism at valuations commanded by market leaders. (Wall Street Journal)

• Proxymity, a Startup Solving Proxy Voting Headaches, Launches in the U.S. The company, backed by the biggest custody banks, has been processing shareholder votes in real-time in Europe, Australia and other markets. (Institutional Investor)

• Confirmed: The iPhone 15 is the most affordable iPhone since 2007: Here’s the full chart of every iPhone’s retail price in 2023 dollars, grouped similar models (Pro, Pro Max, Mini, ect.) together for easier comparison. The initial retail price is for an unlocked, unsubsidized phone with the lowest memory configuration. (PerfectRec) but see I just bought the $1,199 iPhone 15 Pro Max — here’s why: This upgrade means I get other, slightly older, features I’ve admired from a distance. Those include a smoother display (which debuted with the iPhone 13 Pro’s ProMotion tech) and the iPhone 14 Pro’s Always-On screen. The latter is key to making the most of iOS 17’s Standby Mode, which turns an iPhone into a smart display when it’s horizontal and charging. (CNN)

• Kristen Welker’s ‘Meet the Press’ Trump interview was a gross dereliction of journalistic duty: The NBC News publicity machine immediately built up Todd’s successor, Kristen Welker, as a tough, whip-smart journalist, “dogged” and a master of “sharp questioning of lawmakers.” That whole PR edifice came crashing down Sunday, when Welker got steamrollered by Donald Trump on national television. (L.A. Times)

• Is Long Covid a new name for an old syndrome? It is virtually indistinguishable from the condition long known in the medical lexicon as post-infectious syndrome or myalgic encephalomyelitis/chronic fatigue syndrome (ME/CFS). Although some have recognized and studied their similarities, it seems no one has made the simplifying observation that they are essentially the same condition. (Stat News) see also Neanderthal Genes Are Linked to Severe Covid Risk: Study in Italy’s worst pandemic hot spot sheds light on why some people fell seriously ill and others didn’t. (Wall Street Journal)

• The Plight of the N.F.L. Running Back: A combination of factors has devalued one of the marquee positions in all of American sports. (New York Times)

Be sure to check out our Masters in Business interview with Elizabeth Burton, Managing Director and Client Investment Strategist at Goldman Sachs Asset Management. Previously, she was Chief Investment Officer of Hawaii’s Employees’ Retirement System (“HIERS”). She was named to Chief Investment Officer Magazines’ 40-Under-40, as well as winning the 2017 Industry Innovation Award, and a Power 100 member in 2019.

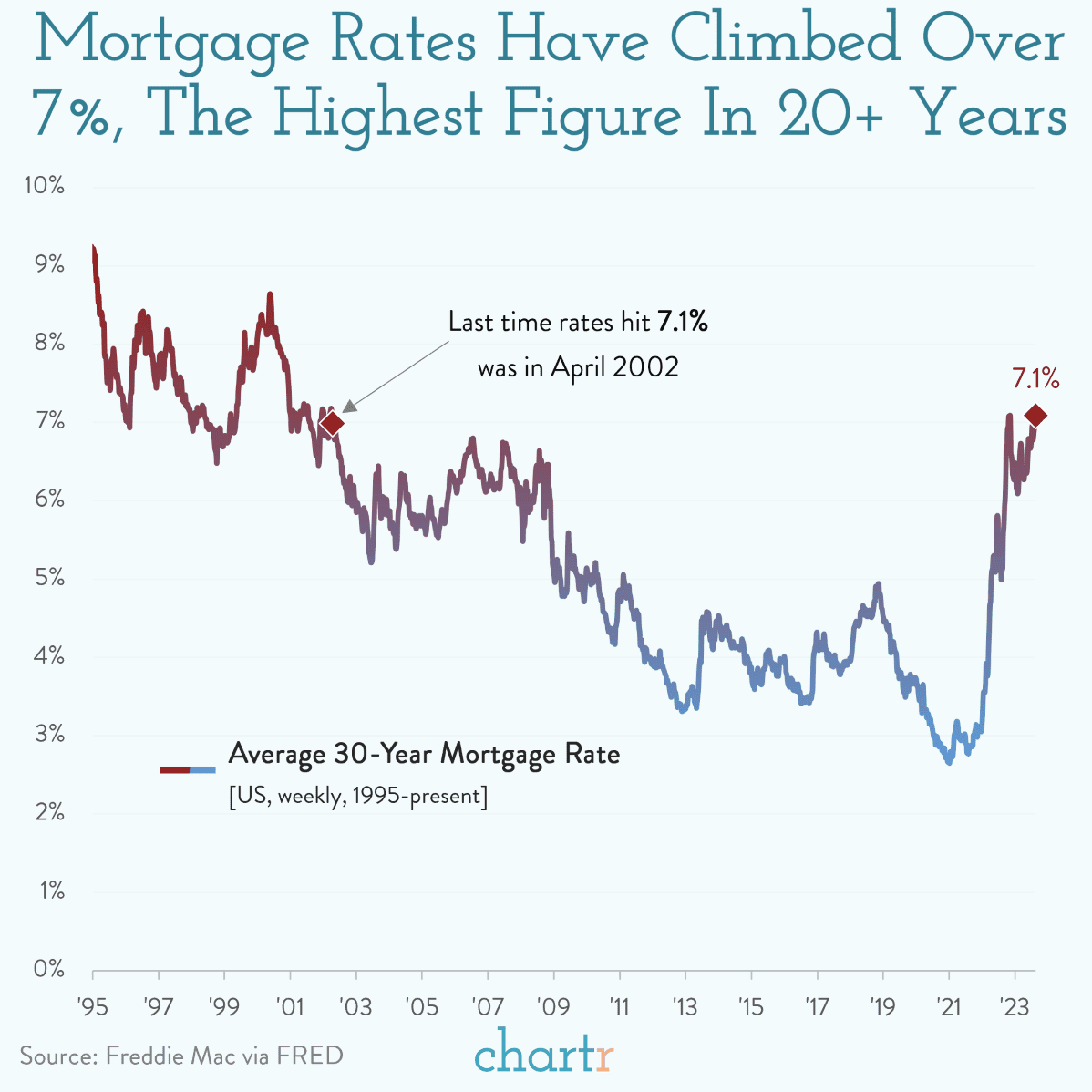

Mortgage rates for would-be borrowers are hitting 20-year highs

Source: Chartr