My back-to-work morning train WFH reads:

• The Economy (Taylor’s Version): See how much money Taylor Swift’s Eras Tour actually made. (Washington Post)

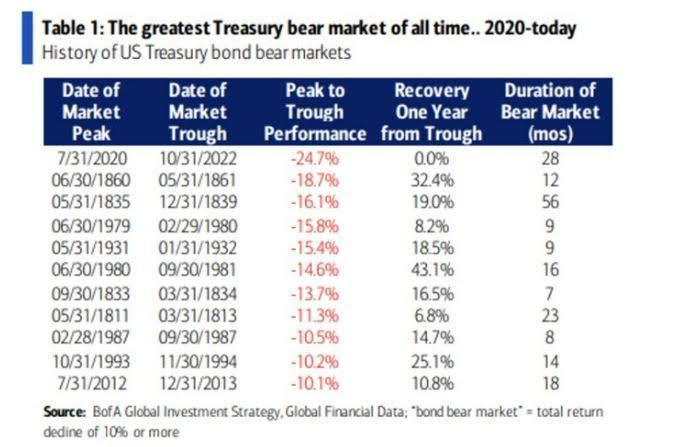

• The Worst Bond Bear Market in History: The bond bear market of the 1950s through the early-1980s was more of a death-by-a-thousand cuts. And the source of those cuts was inflation. Sure, annual nominal returns were positive at a little more than 2% per year but inflation was in the 4-5% range over that period. (A Wealth of Common Sense) see also The 5% Bond Market Means Pain Is Heading Everyone’s Way: The impact will be felt in everything from shoppers’ pockets to company balance sheets. (Bloomberg)

• How a Maneuver in Puerto Rico Led to a $29 Billion Tax Bill for Microsoft: In the largest audit in U.S. history, the IRS rejected Microsoft’s attempts to channel profits to a small factory in Puerto Rico that burned Windows software onto CDs (ProPublica)

• A ‘Shadow’ Lending Market in the U.S., Funded by Insurance Premiums: Apollo was the first to use annuities to build a major financing business. Others followed, driving the growth of the private lending market and worrying regulators. (New York Times)

• Actually, neuroscience suggests “the self” is real: If the “self” is not real, then we are slaves to a billiard ball universe, trapped in a nihilistic nightmare in which we cannot change our fate. (Big Think)

• Bots Are Joining Your Meetings and They Think You Talk Too Much: New AI technologies count speaking time and interruptions; saying ‘absolutely’ eight times is too much. (Wall Street Journal)

• How the attacks in Israel are changing Threads: Three months into its existence, the app’s purpose may be coming into focus — if Meta will embrace it. (Platformer)

• Golden Years: Some vets think golden retrievers are dying younger than they used to. The answer could change how we think about dogs for good. (Slate)

• The NFL’s Viral Sensation: ‘Roof Cam’ Highlights Meet the Atlanta Falcons auteur behind these motion-tracking videos making fans and insiders gush. (Wall Street Journal)

• What Madonna Knows: The artist is always one step ahead—and has a unique power to scandalize each generation anew. (The Atlantic)

Be sure to check out our Masters in Business next week with Graeme Forster, a director at Orbis Holdings Ltd., which has $34 billion in assets under management. Orbis deploys a unique fee arrangement, where they are only paid a fee when they outperform their benchmark and refund fees to clients when they underperform. The Orbis Global Equity is their flagship fund, accounting for 67% of their assets, and has compounded at 11% annually, outperforming its benchmark since its 1990 inception.

The Worst Bond Bear Market in History

Source: A Wealth of Common Sense

Sign up for our reads-only mailing list here.