My Two-for-Tuesday morning train reads:

• Trading Stocks Loses Its Thrill: ‘I Would Get Burned’ Individual investors are dialing back on risks across markets. (Wall Street Journal) see also How Hard is it to Become the Michael Jordan of Trading? For newbie traders, a better analogy than a casino is the possibility becoming a professional athlete. Trading and athletics have many parallels. Both require a combination of natural skills, discipline, and very hard work. Both require an ability to deal with elements of randomness that is challenging in a competitive environment. (The Big Picture)

• Corporate America Is Ignoring Jay Powell and Bingeing on Debt: The recent spike in bond yields may have briefly cooled the market, but the pace of borrowing has been blistering. (Bloomberg)

• Bonds Have Been Awful. It’s a Good Time to Buy. As interest rates rose over the past few years, bond prices plummeted, making high-quality bonds more attractive, our columnist says. (New York Times) but see Dreams of Big Bond Gains Backfire With $10 Billion ETF Loss: Record sums of cash flowing to TLT despite an epic drawdown Rare chance for double-digit returns at long end: McDonough. (Bloomberg)

• Gas Prices Fueled Summer Inflation. That Is About to Change. Prices at the pump are tumbling, even as war rages in the Middle East. (Wall Street Journal)

• Social Internet Is Dead. Get Over It. I was reminded of something I have known for a while, though I had not synthesized it succinctly enough: the internet, as we have known it, has evolved from a quaint, quirky place to a social utopia, and then to an algorithmic reality. In this reality, the primary task of these platforms is not about idealism or even entertainment — it is about extracting as much revenue as possible from human vanity, avarice, and narcissism. (Om )see also Tools that Want to Be Our Masters: Though Twitter and other social media platforms have their uses, fundamentally, they are tools that want to be our masters. They will take as much time as they can from you and leave you somehow miserable yet ravenous for more. If you can’t avoid these platforms completely, I’d suggest trying out a tool like News Feed Eradicator, which strips out a major source of noise. (Irrelevant Investor)

• The Coronavirus (Still) Doesn’t Care About Your Feelings:The Covid-19 pandemic is not a state of mind—and telling us not to panic isn’t healthcare. (The Nation)

• What Iran gains from the conflict in Israel. US government says its intelligence agencies have yet to find proof that Iran planned these attacks. Still, Joel Rayburn, who used to be in charge of Iran policy on the US National Security Council, isn’t buying the denials. Iran was the author of the attacks, he told me. Hamas was not an independent actor. (The Spectator) see also Israel’s Challenge in Responding to a Brutal Surprise Attack: Hamas staged a shockingly successful operation against the Jewish state, but history shows that wars are seldom won by such tactics. (Wall Street Journal)

• If you’re stuck in traffic this $100,000 Mercedes will drive for you: This is the first time any major automaker has offered a system for sale to the public that will literally drive the car for you. Sure, there are others that may, in purely practical terms, be “driving the car” in terms of basic steering and using the brakes but you, the human driver, must constantly be alert to what’s happening and monitor everything. With Drive Pilot, you get permission to fully check out while you’re behind the wheel, even if it’s just at low speeds. (CNN)

• House Republicans collapse into anarchy: But there is one eternal truth, one unwavering constant to steady us when all else is in flux: Every time the House Republican majority tries to govern, it’s guaranteed to turn into a goat rodeo. (Washington Post) but see also The Kamala Harris Problem: Few people seem to think she’s ready to be president. Why? (The Atlantic)

• ‘The Daily Show’ still doesn’t have a host. Why not? A comedy show that once helped steer the national conversation is at a crossroads. The next host could determine its future.(Washington Post)

Be sure to check out our Masters in Business next week with Graeme Forster, a director at Orbis Holdings Ltd., which has $34 billion in assets under management. Orbis deploys a unique fee arrangement, where they are only paid a fee when they outperform their benchmark and refund fees to clients when they underperform. The Orbis Global Equity is their flagship fund, accounting for 67% of their assets, and has compounded at 11% annually, outperforming its benchmark since its 1990 inception.

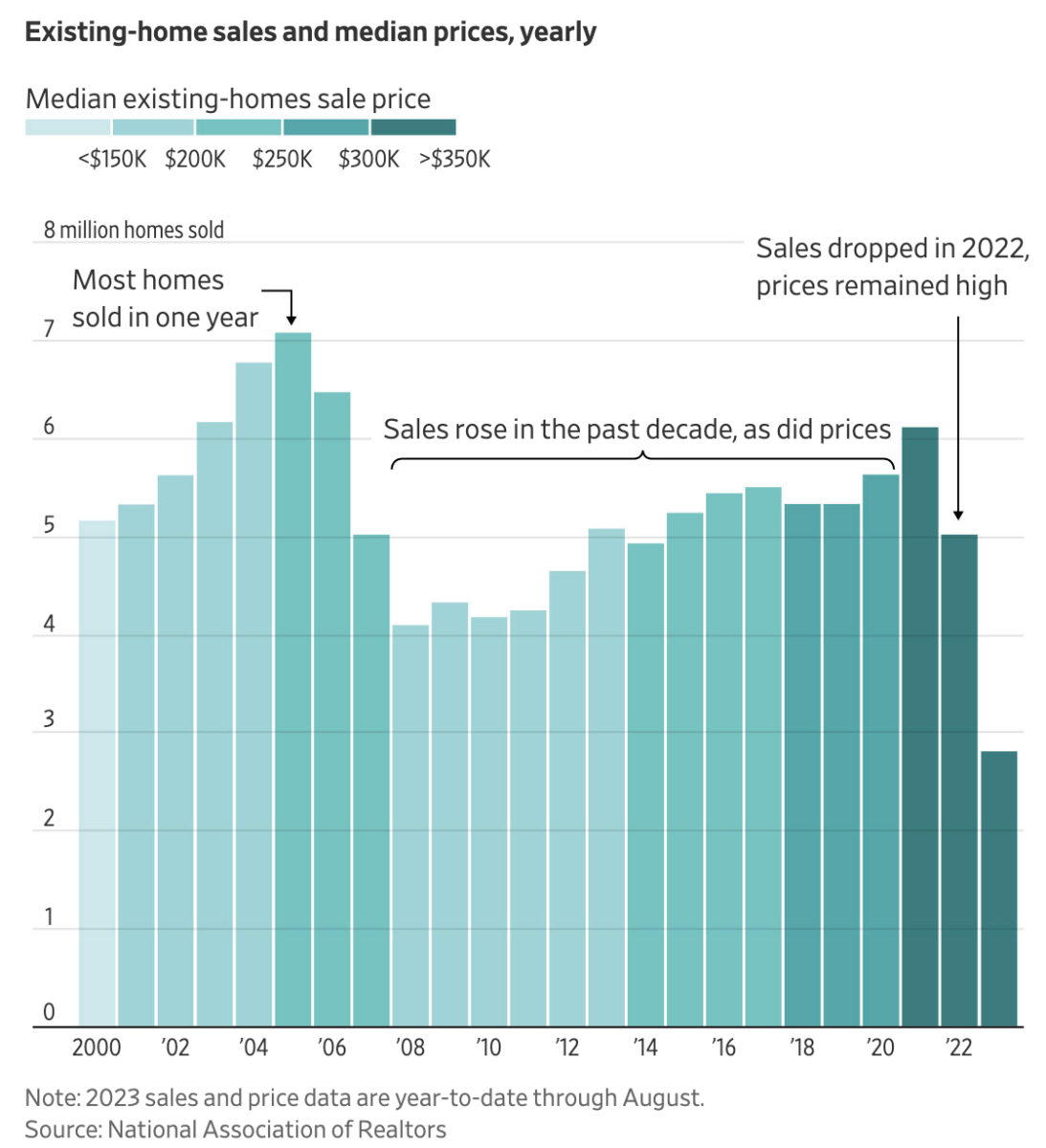

Home Sales on Track for Slowest Year Since Housing Bust

Source: Wall Street Journal