My end-of-week morning train WFH reads:

• RIP Goldman Sachs: When I started out at Goldman, it was the most feared firm on Wall Street. Those days are gone for good. (Business Insider)

• Inflation is the Lesser of Two Evils: But that’s not how this works. That’s not how any of this works. You don’t get to keep your higher wages while prices revert back to 2019 levels. Deflation might sound appealing regarding prices, but that also means lower wages, lower economic growth, and job loss. (A Wealth of Common Sense) see also Which is Worse: Inflation or Unemployment? Which is worse, higher inflation, or higher unemployment? The two components of the Misery Index were treated equally, but we should be asking: Should they be? It turns out we never really considered this question. Today, with only one of these two measures elevated, we should. (The Big Picture)

• Are Real Wages Rising? Yes, But Here’s Why That Question is Harder to Answer Than You Might Think. (Apricitas Economics)

• Nasdaq Leans Into Tech in Quest to Become More Than an Exchange: CEO Adena Friedman’s recent $10.5 billion Adenza deal underscores a strategic shift from simple stock market to fintech company. (Businessweek)

• Why businesses are pulling billions in profits from China: Foreign businesses have been pulling money out of China at a faster rate than they have been putting it in, official data shows. “Anxieties around geopolitical risk, domestic policy uncertainty and slower growth are pushing companies to think about alternative markets.” (BBC)

• Weak Companies’ Low-Yielding Bonds Set to Hit Maturity Wall: Risk grows as a raft of junk-rated issuers, paying modest interest, must refinance their debt at much higher rates. (Chief Investment Officer)

• The Trouble With America’s Ultra-Processed Diet: Concern is rising about ultra-processed foods in American diets, and their effects on our health. (Wall Street Journal)

• The Nazi case for Hamas. Do you attempt to draw a moral comparison between the bomber who drops bombs hoping that it will not kill children and yourself who shot children deliberately? Is that a fair moral comparison ? (Martin Kramer)

• An F1 racecar’s intimidating steering wheel, explained: Try keeping track of which button does what at 200 mph. (Washington Post)

• ‘Cary Grant’s whole life was a civil war’: the TV drama unmasking Hollywood’s permatanned icon: The mansion-dwelling megastar was born Archibald Leach and grew up in a squalid Bristol terrace believing his mother was dead. The stars and writer of Archie talk about his rise, shame and redemption. (The Guardian)

Be sure to check out our Masters in Business next week with Brad Gerstner, founder and CEO of Altimeter Capital. The tech-focused fund started in 2008 and invests in both public and private firms. Gerstner began as an entrepreneur and has had multiple exits, including travel startup NLG (to IAC). Openlist.com, (to Marchex) and Farecast (to MSFT). He also was an early investor in Zillow, Real Self, Nor 1, Instacart, Expedia, Silver Rail Tech and Room 77. After returning $7B in profits to its LPs, Altimeter manages currently manages $10B in assets.

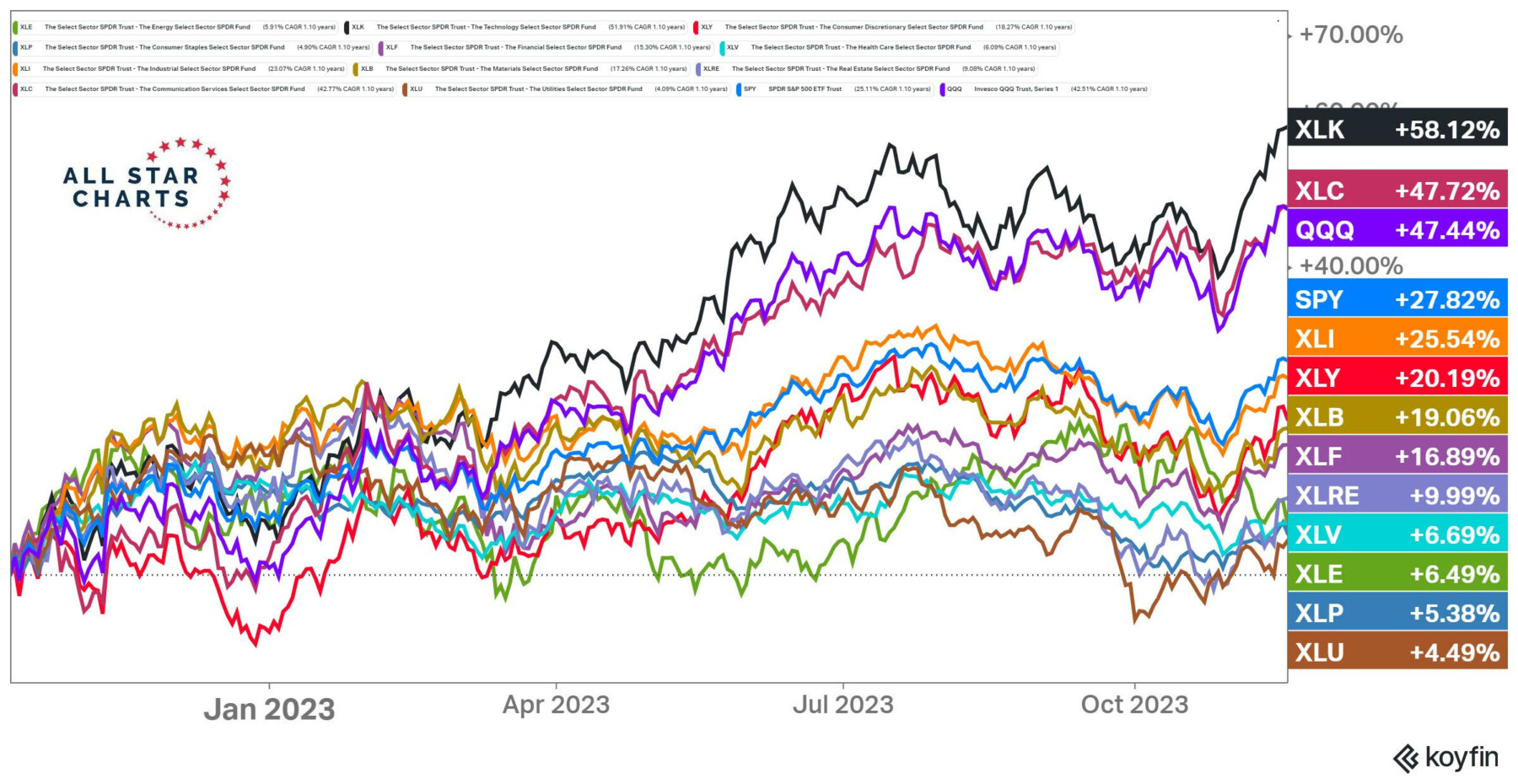

What Bear Market?

Source: @allstarcharts

Sign up for our reads-only mailing list here.