My Two-for-Tuesday morning train reads:

• Higher Contribution Limits Are Coming for 401(k) Retirement Plans: But, financial advisers note, most people cannot afford to set aside the maximum amount. “This is a system geared for high earners,” one expert said. (New York Times) see also The U.S. Gets a C+ in Retirement: Social Security and 401(k) plans leave Americans less secure than retirees in much of the world, a new ranking finds (Wall Street Journal)

• Will Market Volatility Continue in 2024 and Beyond? Class of 2023 Knowledge Brokers anticipate what successful investing in turbulent times will look like. (Chief Investment Officer)

• Investors shake up VC market by raising money to buy out start-ups: Aim is to take advantage of economic headwinds to acquire promising businesses at a discount. (Financial Times) see also The Clearest Sign Yet That Commercial Real Estate Is in Trouble: Lenders are issuing a record number of foreclosure notices related to risky property loans. (Wall Street Journal)

• Goldman Sachs: Everything Is Awesome: Goldman Sachs’s macro analysts have been notably more optimistic than almost everyone else on the street throughout 2023, and, as a result, basically nailed it. (Financial Times)

• How Work From Home Has Reshaped What Americans Buy: The shift back toward spending on services has largely ended, which leaves Americans devoting a bigger share of their spending to goods than before pandemic. (Wall Street Journal) see also The Post Lock-Down Economy: The inflation surge began in the Spring of 2021, as everyone came out of their lockdowns, armed with CARES Act cash in their bank accounts, bored out of their minds and ready to party. Eventually, after all the pent-up demand caused by 18 months of cabin fever broke, things began to normalize.(The Big Picture)

• Do gravitational waves exhibit wave-particle duality? All matter particles can act as waves, and massless light waves show particle-like behavior. Can gravitational waves also be particle-like? (Big Think)

• Americans are confused, frustrated by new tipping culture, study finds: Americans are divided and confused over when to leave gratuities and how much to tip for all kinds of services, according to the Pew Research Center — and many don’t like recent trends such as added service fees and suggested tipping amounts. (Washington Post) see also POS Tip Demands Are Driving Inflation Higher: I have a new thesis I have been noodling around with: All of those Square credit card processing machines you use to pay for coffee or sandwiches or small retail purchases are driving inflation higher. Demands for worker tips in non-tipping industries are having a meaningful impact on prices and CPI. (The Big Picture)

• Get to Know the Influential Conservative Intellectuals Who Help Explain G.O.P. Extremism: We shouldn’t grow complacent about just how dangerous it all is — and how much more dangerous it could become. The efforts to overturn the 2020 election failed. (New York Times)

• MAGA-dominated state Republican parties plagued by infighting, money woes: National Republicans fear the cash crunch could hamper field operations in key swing states come 2024. (Washington Post) see also Biden shouldn’t run. The Democratic field is stronger than you think. A Biden 2024 campaign isn’t worth the added difficulty that comes from his deep unpopularity. The Democratic Party should strongly consider embracing another candidate — or at least a truly open primary. (Washington Post)

• How To Kill a Superhero: Hollywood embraces a desperate strategy—canceling franchise films before they’re released. (The Honest Broker)

Be sure to check out our Masters in Business this week with Linda Gibson, CEO of PGIM‘s Quantitative Solutions, which manages $119 billion via quantitative and multi-asset solutions. PGIM is one of the world’s largest asset managers, running $1.27 trillion in client assets.

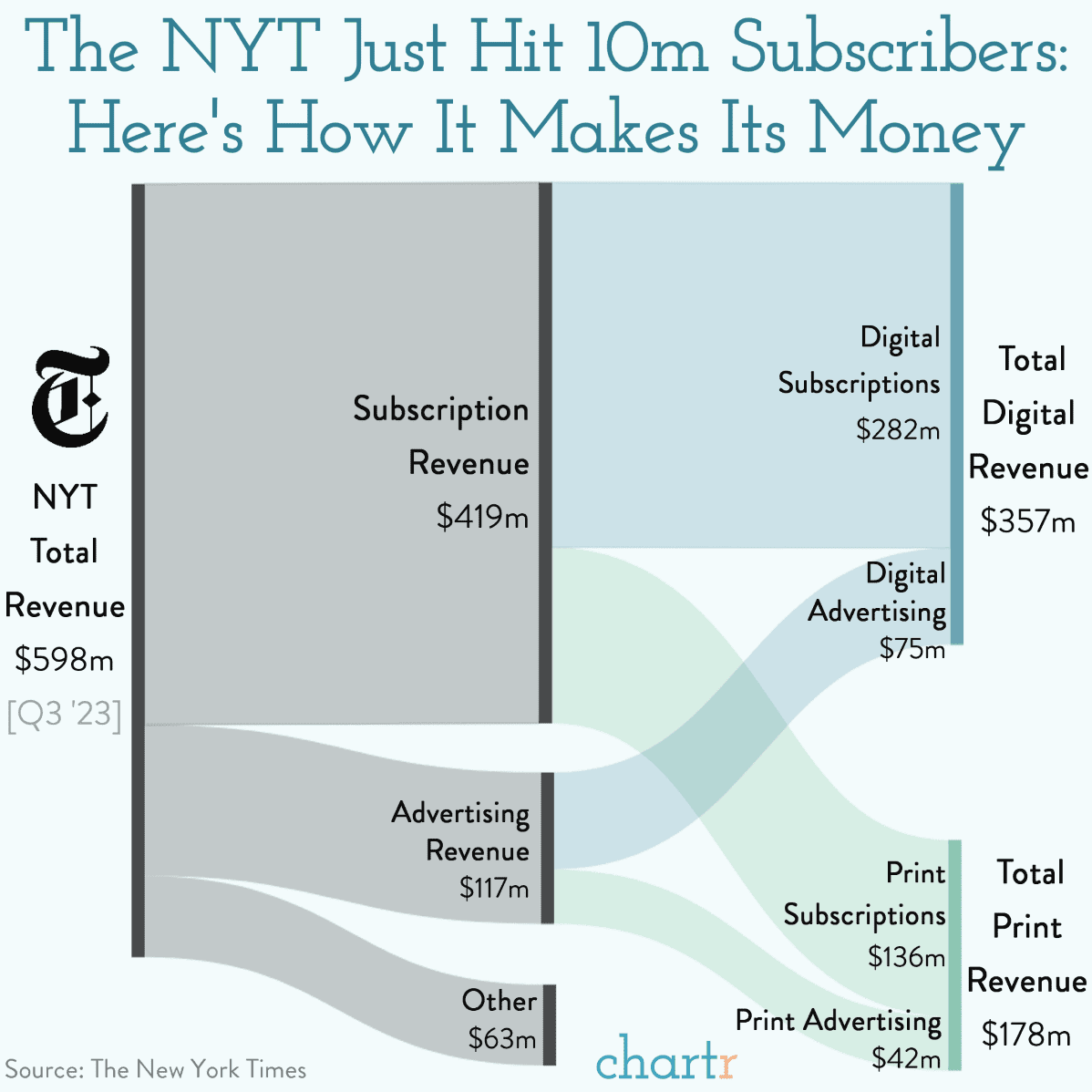

Unprecedented Times: The NYT just hit a major milestone

Source: Chartr