My mid-week morning train reads:

• How inheritance data secretly explains U.S. inequality: A little over 1 in 5 U.S. households had received an inheritance at some point in their lives as of 2022, according to the Federal Reserve’s remarkable Survey of Consumer Finances. The inheritance rate jumps to 2 out of 5 if you look only at folks in their 70s, who have had more time for their parents and favorite aunts to meet a regrettable but timely demise. But even those folks are in the lucky minority. (Washington Post)

• Rebuild or retreat? Crypto faces tough choices after FTX: Following the trial of Sam Bankman-Fried, the industry must choose between becoming mainstream or retreating to the fringes. (Financial Times)

• Words of Wisdom: The Class of 2023 Knowledge Brokers draw on their collective decades of experience and offer actionable advice for success (investment and otherwise) in tumultuous times. (Chief Investment Officer)

• Clean-Energy Stocks Have Collapsed. What Comes Next: Stocks related to wind, solar and other forms of renewable energy have fallen by a third this year. Only a handful may be ready to rebound. (Barron’s)

• The Crash to Come: Insurance companies have responded to climate disasters by raising premiums and dropping customers. Now there’s a new housing bubble waiting to burst. (New York Review of Books) see also After the Flood: Perpetual crisis and recovery in Eastern Kentucky. (The Baffler)

• The Betting on the Presidential Election Has Begun: While two leading prediction markets are fighting regulatory restrictions in court, wagers on politics and economics are still being made. (New York Times)

• Whither philosophy? The discipline today finds itself precariously balanced between incomprehensible specialisation and cheap self-help.(Aeon)

• Your phone is the key to your digital life. Make sure you know what to do if you lose it. Preparing yourself for the worst is easier than you might think — and it’s never been more important. (Vox)

• A lot of Americans embrace Trump’s authoritarianism: Given all of this, given Trump’s increasingly explicit rhetoric about shifting the chief executive position toward authoritarianism, it seems difficult to understand how he’s still running even with President Biden in early polling — or, in some cases, leading him. (Washington Post)

• Albert Brooks Everlasting: A conversation with the legendary comedian and filmmaker about what annoys him, how you know when something is funny, and his theory about John Lennon (The Atlantic)

Be sure to check out our Masters in Business this week with Linda Gibson, CEO of PGIM‘s Quantitative Solutions, which manages $119 billion via quantitative and multi-asset solutions. PGIM is one of the world’s largest asset managers, running $1.27 trillion in client assets.

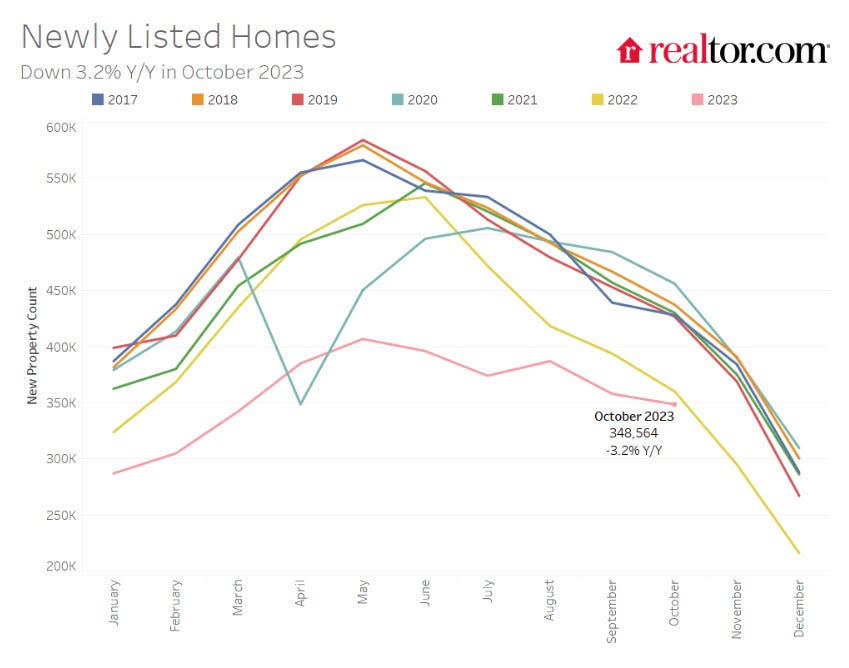

Blame the Fed: Year-over-year Decline in New Listings

Source: Calculated Risk

Sign up for our reads-only mailing list here.