My back-to-work morning train WFH reads:

• 4 Charts That Explain the Stock Market: I view the stock market as a way to invest in innovation, profits, progress and people waking up in the morning looking to better their current situation. While I love the fact that this chart illustrates my long-term philosophy it’s a bit misleading. Yes, the stock market goes up over the long run but it can also get crushed in the short run. That can be difficult to see on a log chart with 200 years of data. The Great Depression, 1987 crash and Great Financial Crisis look like minor blips on this chart. And while every crash eventually turns into a blip on a long-term chart, they don’t feel like it in the moment. (A Wealth of Common Sense)

• Manhattan’s Trophy Apartments Are Gathering Dust: There just aren’t enough billionaires, and no one wants to live in Hudson Yards. (Curbed) but see also The N.Y.C. Neighborhood Where Families Are Filling Up Empty Offices: Five financial district buildings are being turned into housing, including the country’s largest such conversion. Will it work elsewhere in Manhattan? (New York Times)

• Power Laws in the Stock Market: Bessimbinder found just 86 stocks accounted for half of all wealth creation in the U.S. stock market going back to 1926. All of the wealth creation in that time came from just 4% of stocks. Nearly 60% of stocks failed to beat T-bill returns over their lives. Close to 40% of stocks barely beat T-bills. (A Wealth of Common Sense)

• What’s Behind the Market’s Wild Overreactions: There are deeper issues behind the rapid changes in the market story that are unlikely to be resolved soon. (Wall Street Journal)

• ‘Literally Impossible:’ Labcorp Workers Say Productivity Goals Are Pushing Them to the Brink: Ten Labcorp workers told 404 Media that Amazon-like productivity goals at the clinical lab giant are squeezing them for profits in a way that could put patients at risk. (404 Media)

• The Mirai Confessions: Three Young Hackers Who Built a Web-Killing Monster Finally Tell Their Story: Netflix, Spotify, Twitter, PayPal, Slack. All down for millions of people. How a group of teen friends plunged into an underworld of cybercrime and broke the internet—then went to work for the FBI. (Wired)

• Who chooses the world’s Color of the Year? From her desert office in a converted RV garage, Leatrice Eiseman has turned color into a celebrity for Pantone. (The Hustle)

• Inside the weird and delightful origins of the jungle gym, which just turned 100: This story starts in the fourth dimension. Or, more specifically, with a British mathematician who, in the late 1800s, was intrigued by the fourth dimension and how to teach disinterested children about it. (NPR)

• Hamas Mastermind Who Tricked Israel Is Top Target in Gaza Tunnels: Yahya Sinwar spent 22 years behind bars, plotting slowly Tricked Israelis into thinking Hamas had given up militarism. (Bloomberg)

• Coyote Vs. Acme Movie! Shelved?! Walt Disney once said (and the Disney company still oft repeats): “We don’t make movies to make money, we make money to make more movies.” Warner Brothers Discovery CEO David Zaslav is a vulture and a disgrace. His top priority should be putting good movies out into the world. (Kottke)

Be sure to check out our Masters in Business this week with Brad Gerstner, founder and CEO of Altimeter Capital. The tech-focused fund started in 2008 and invests in both public and private firms. Gerstner began as an entrepreneur and has had multiple exits, including travel startup NLG (to IAC). Openlist.com, (to Marchex) and Farecast (to MSFT). He also was an early investor in Zillow, Real Self, Nor 1, Instacart, Expedia, Silver Rail Tech and Room 77. After returning $7B in profits to its LPs, Altimeter currently manages $8B in assets.

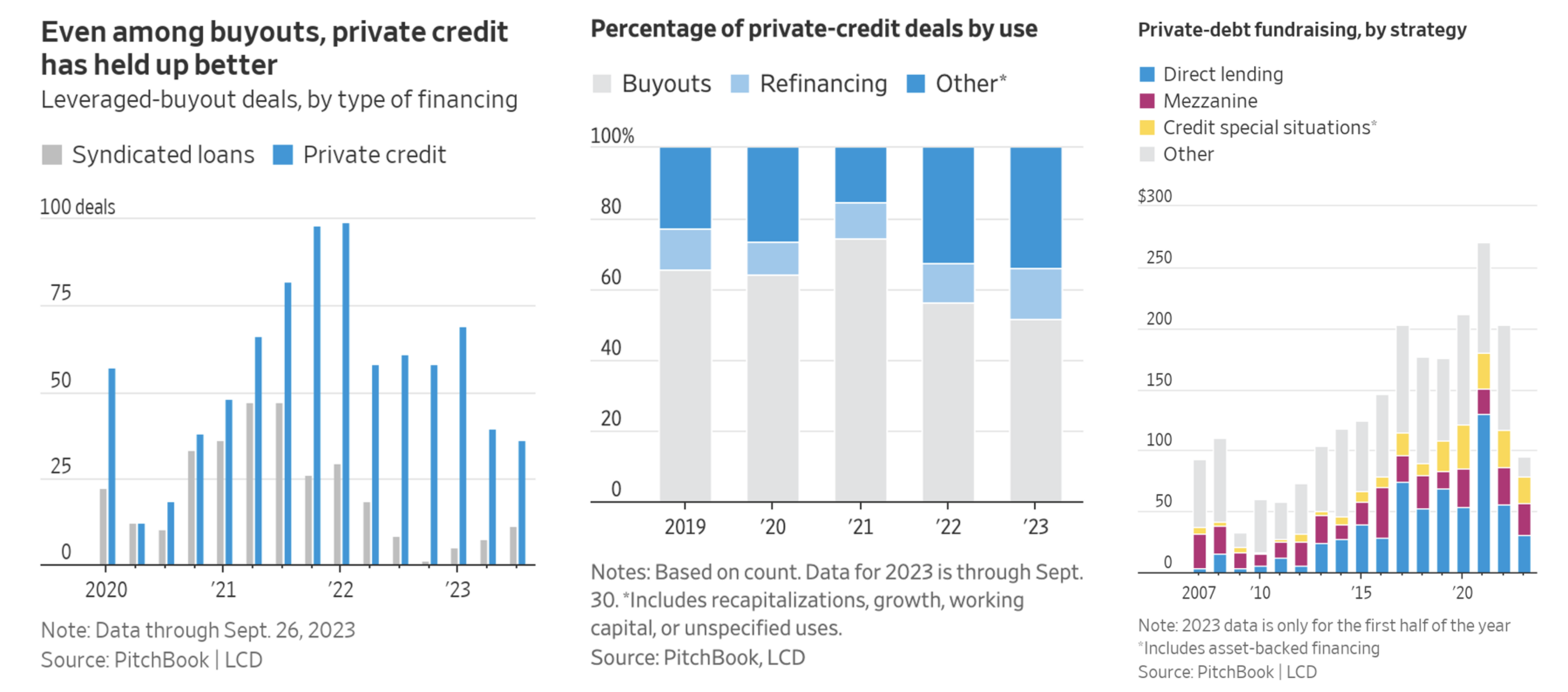

Private Debt Was Supposed to Collapse When Rates Rose. Instead It Is Everywhere.

Source: Wall Street Journal

Sign up for our reads-only mailing list here.