Avert your eyes! My Sunday morning look at incompetency, corruption and policy failures:

• Why Interest Rate Cuts Won’t Fix a Global Housing Affordability Crisis: Central bankers are lowering borrowing costs, but that won’t be a cure-all for a widespread lack of affordable housing. (New York Times)

• Three Events That Speak to Greedflation: The Mars-Kellanova merger, the Kroger-Albertsons court case, and the monopolization lawsuit against RealPage all bolster her case against price-fixing. (American Prospect)

• When Interest Rates Go Down, the Hucksters Spring Up: An investment-advisory firm was promoting ‘guaranteed’ annual yields of up to 17.1%—until our columnist started asking questions. (Wall Street Journal)

• Sunk cost: The rise and fall of NFTs made and unmade OpenSea — the largest marketplace for the crypto asset. But insider accounts of the company reveal a chaotic work environment, ever-shifting priorities, and troubles with the SEC. (The Verge)

• Boeing’s No Good, Never-Ending Tailspin Might Take NASA With It: This is a fiasco. And not just because of the strain it puts on the astronauts and their families. Boeing’s engineering woes extend beyond Starliner; they threaten NASA’s bigger goals of going back to the moon through its Artemis program, for which Boeing has become an essential partner. I was told that a number of retired astronauts are increasingly troubled by Boeing’s performance. This loss in confidence helps put the entire Artemis program into a new state of uncertainty. (New York Times)

• Private Equity Is Coming for Youth Sports: Kids’ sports have become an expensive, high-pressure affair. An industry famous for squeezing out value claims it will make the experience better. (Businessweek)

• F-35: $2T in ‘generational wealth’ the military had no right to spend: F-35: $2T in ‘generational wealth’ the military had no right to spend The Joint Strike Fighter had a $200B price tag in 2001, now babies born that year are out of college and the plane is still not ready for prime time. (Responsible Statecraft)

• Residential real estate was confronting a racist past. Then came the commission lawsuits: One of the biggest challenges for Black and other minority buyers is that many are not just first-time buyers, but the first among their generation in their families to purchase property. Just 45.3% of Black Americans are homeowners, compared to 74.4% for whites. (USA Today)

• Why I Left the Network: America is in the midst of a mental health crisis. But finding a therapist who takes insurance can feel impossible. Insurers say that’s because there aren’t enough therapists. That’s not entirely true. (ProPublica)

• The Conservatives Who Sold Their Souls for Trump: The rage and shame of the anti-anti-Trumpers is getting worse. (The Atlantic)/ see also In a test of character, Trump shows his true grift: In his disorientation, the GOP nominee and former president retreats to his instincts. (Washington Post)

Be sure to check out our Masters in Business this week with Heather Brilliant, CEO since 2019 of publicly traded Diamond Hill (DHIL). The firm manages $26B in client assets via a bottoms-up stock selection. Previously, she was CEO at First State Investments.

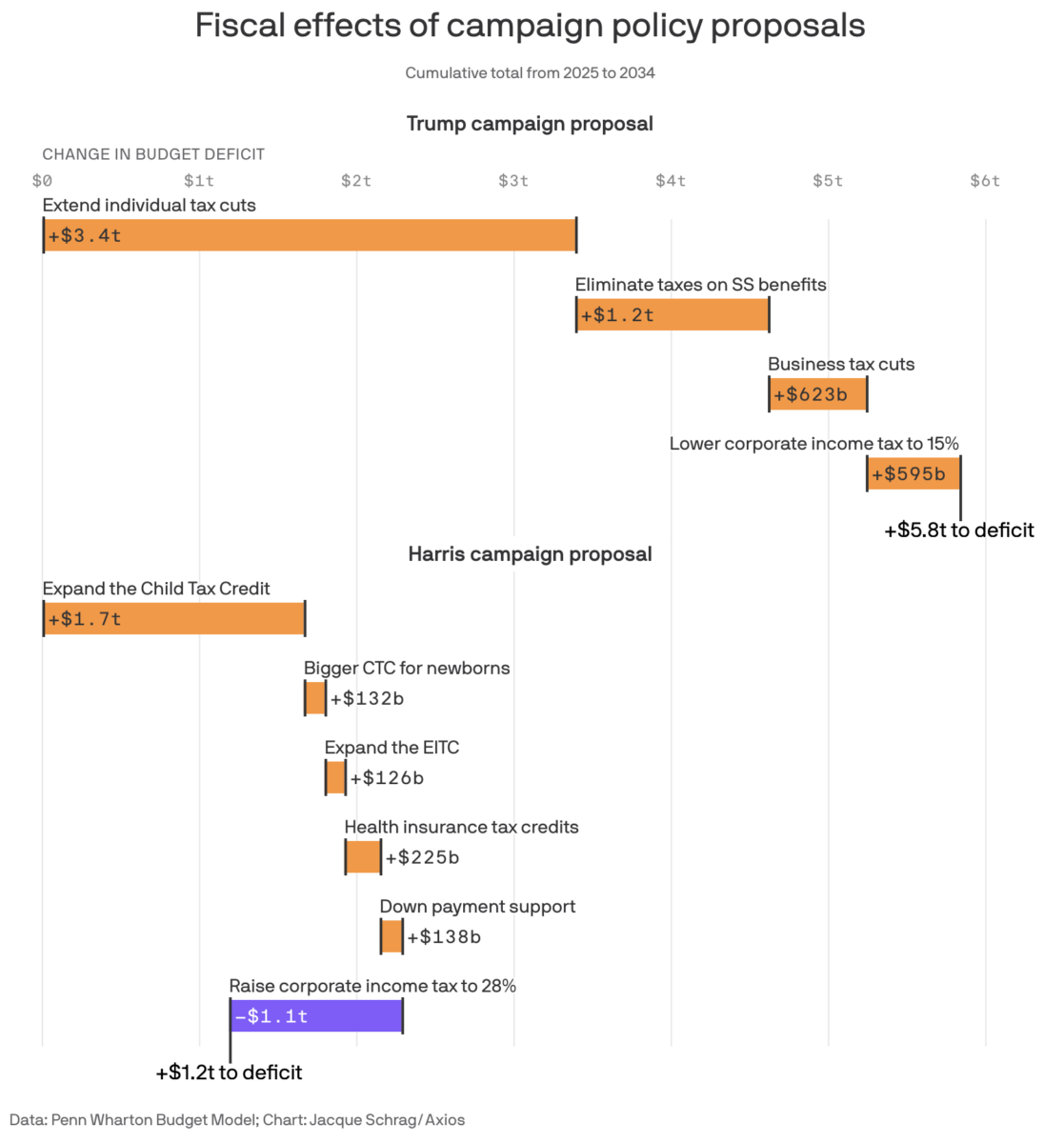

Trump plans would add $5.8 trillion to national debt

Source: Axios

Sign up for our reads-only mailing list here.

~~~

To learn how these reads are assembled each day, please see this.