My back from vacay morning reads:

• Pandemic Start-Ups Are Thriving, and Helping to Fuel the Economy: A record surge in new businesses has helped drive job growth, and could have longer-term benefits. (New York Times)

• Fidelity: Twitter is worth 80% less than 2 years ago when Elon Musk bought it. That’s according to estimates from investment giant Fidelity: As of the end of August, the firm is worth just $8 billion, according to a Sunday filing by Fidelity’s Blue Chip Growth Fund. That’s down from $44 billion in 2022. (CNN)

• Harvard’s Not-So-Smart Money: Two Decades of Poor Returns and Rich Pay. Its money managers underperformed after changing personnel and strategies at the worst times. (Bloomberg)

• This Will Be Your New Favorite Podcast. The Hosts Aren’t Human. With this Google tool, you can now listen to a show about any topic you could possibly imagine. You won’t believe your ears. (Wall Street Journal)

• This Video Game Controller Has Become the US Military’s Weapon of Choice: After decades of relying on buttons, switches, and toggles, the Pentagon has embraced simple, ergonomic video-game-style controllers already familiar to millions of potential recruits. (Wired)

• What Do US Vehicle Regulators Have Against Tiny Cars? Super-small urban vehicles have found a place in European and Asian cities. But in the US, federal and state rulemakers seem determined to keep minicars at bay. (CityLab)

• 5 Types Of People Who Spread Conspiracy Theories They Know Are Wrong: Some online conspiracy-spreaders don’t even believe the lies they’re spewing. (Talking Points Memo)

• An idea rooted in ‘twistronics’ yields an electrifying, ‘dizzying’ outcome: Researchers uncovered how twisting layers of a material can generate a mysterious electron-path-deflecting effect, unlocking new possibilities for controlling light and electrons in quantum materials. (Penn Today)

• Don’t ever hand your phone to the cops: Digital IDs make it tempting to leave your driver’s license at home — but that’s a dangerous risk. (The Verge)

• What Does College Football Have to Do With College? The question isn’t new. But seismic changes to college sports, embraced by Coach Deion Sanders and his University of Colorado Buffaloes, have made it more relevant than ever. (New York Times)

Be sure to check out our Masters in Business interview this weekend with Vincent Aita of Cutter Capital. The firm is a market- and factor-neutral, long/short hedge fund focused on health-care companies. Prior to launching Cutter, he focused on U.S. and European healthcare at Citadel and Millenium. Cutter has put-up impressive numbers since its 2022 launch, and now manages more than $500 million in institutional assets.

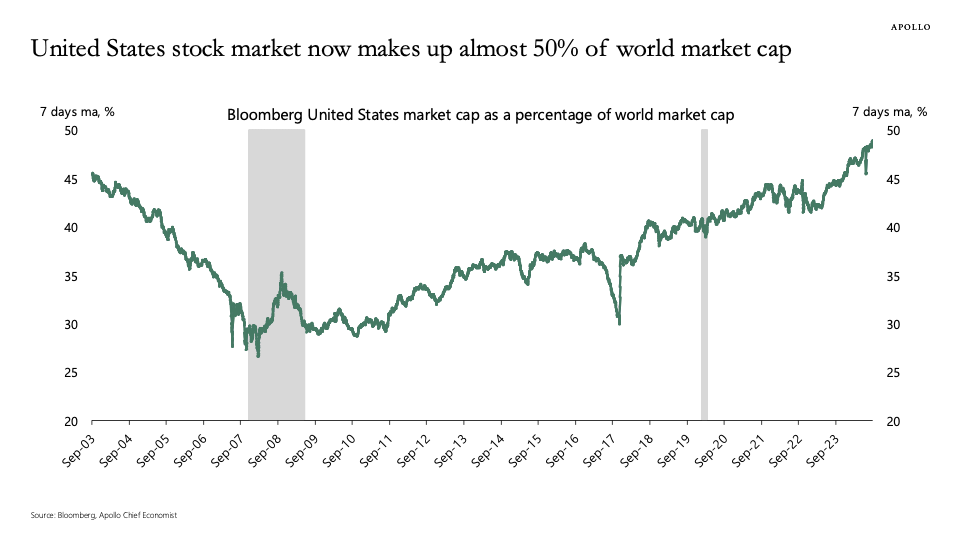

In 2009, the market cap of the US stock market was 30% of the global stock market cap. Today it is almost 50%, see chart below.

Source: Apollo

Sign up for our reads-only mailing list here.